Fixed Income Research & Macro Strategy (FIRMS) – 14 November 2018

- 873 days after the referendum on 23rd June 2016, the British government announced yesterday that UK and EU negotiators had reached a draft agreement on the terms and conditions of i) the UK’s exit from the EU and ii) the outline of the UK’s future relationship with the EU beyond 29th March 2019.

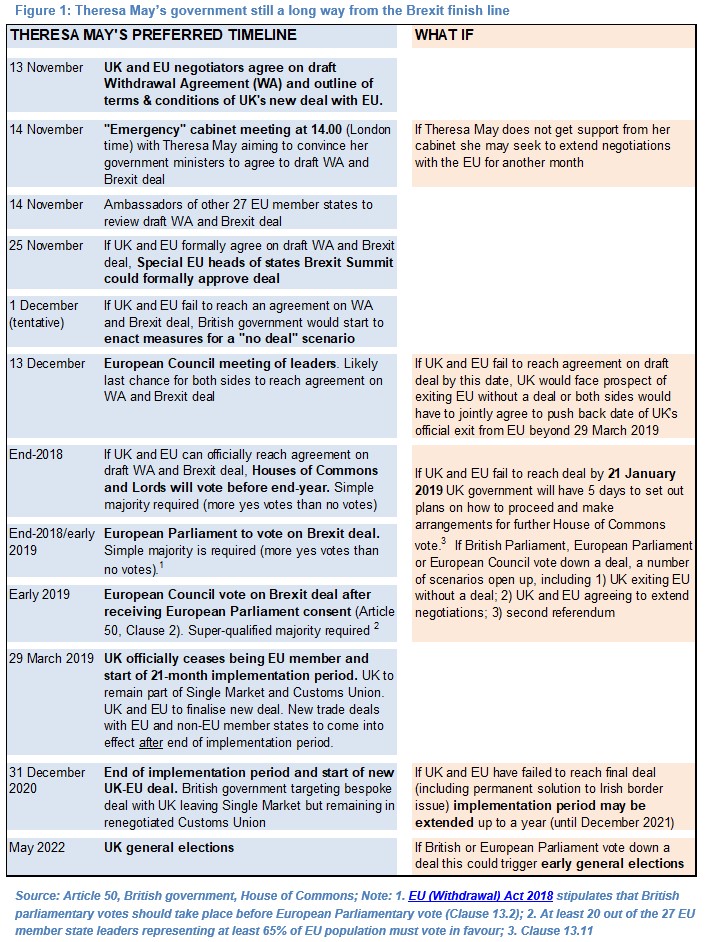

- The first hurdle which Prime Minister May faces is to convince her divided cabinet to sign off on this draft deal at a ministerial meeting scheduled for 14.00 (London time) today.

- Theresa May will want to get a broad consensus from senior cabinet members for the draft agreement to improve the odds of the British Parliament voting in favour of the deal.

- She already faces an uphill battle to convince a simple majority of the 650 members of the House of Commons to vote in favour of any draft deal, as we argued in Final Twist in Brexit Plot (14 September 2018).

- While parliamentary arithmetics are complex, a majority of House of Commons members could realistically vote against such a deal, in our view.

- In the event of the House of Commons voting against the deal, a number of possible scenarios would open up, including the government seeking a second popular referendum in which the British electorate would be asked to vote on whether to accept the deal, remain in the EU or leave the UK without a deal.

- We argued in Final Twist in Brexit Plot (14 September 2018) that the odds of a second referendum had increased materially over the summer. If anything, those odds have increased further in the past two months, in our view.

- Should the cabinet today approve the draft deal we would expect Sterling to extend its recent gains. However, the uncertainty of whether Parliament would vote in favour of such a deal, not to mention the underlying weakness of the UK economy and a “neutral” Bank of England monetary policy stance, would likely cap any Sterling upside, in our view.

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022