Reality comes home to roost in GBP

GBP woke up today and realised that Brexit wasn’t just a bad dream but a real thing, and here we are some 80 pips lighter than after Powell. The usual Brexit crap is one thing to weigh but there was also news today of a collapsed £2.8bn M&A deal for some UK shopping centres, which was blamed on “economic uncertainties and market volatility”. That’s reinforced the Brexit rhetoric further of a sign of investors unease at putting their money into the UK.

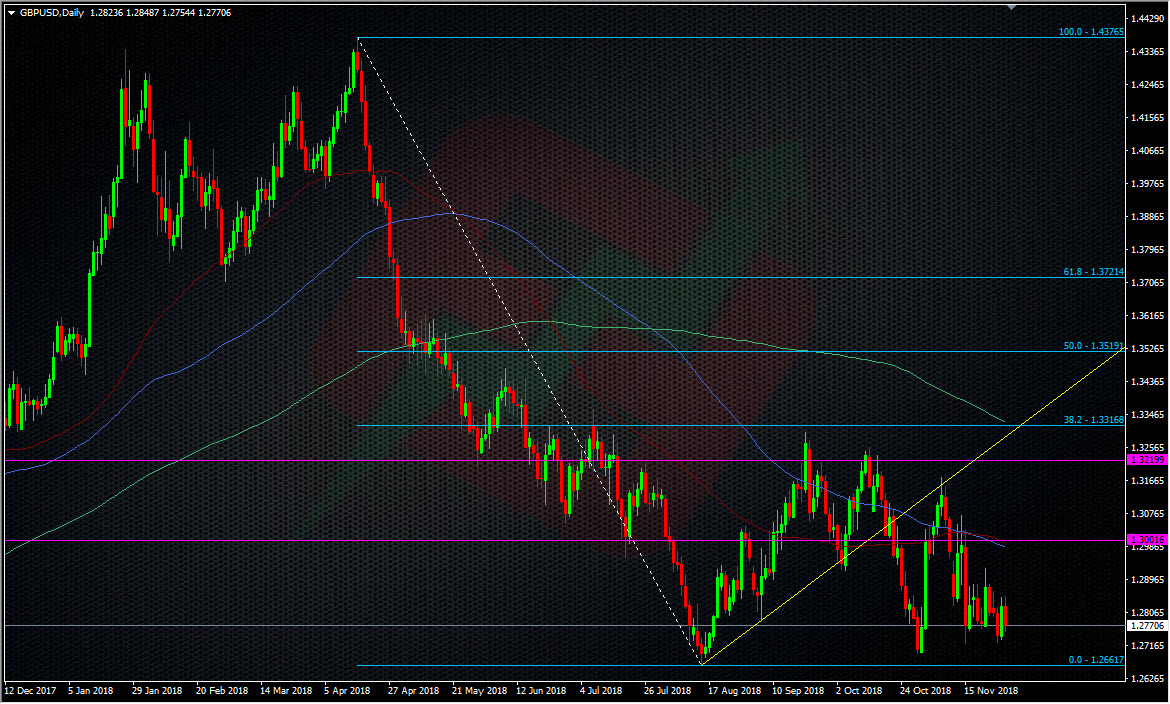

We’re pretty much back to square one from yesterday with GBPUSD hovering around 1.2760/80, and technically, we’re still in danger of pushing further south while we remain below 1.2800.

Now we’ve got some Brexit dates in the diary, we could well find ourselves in a period of consolidation but we’ll still have the headline risk hanging over us. We’d have to get definitive news (on something like expected Brexit no-vote numbers) to bring a big move, otherwise we can expect to sit in a range. 1.2700 has good reason to be the bottom of that range, while 1.29-1.30 could mark the top.

Yesterday was a reminder that there’s always two sides to a currency pair and if there’s big news on the other side, it can overtake the sentiment on the other.

I’m more inclined to sell rallies right now than buy dips, unless it’s at strong support areas. In the intraday picture, 1.2780 & 1.2800 are the nearby resistance levels, and 1.2760/40/20 are the supports.

As always, trade the levels as you wish but be aware of the higher volatility that’s in GBP right now and keep your trade sizes and risk under control.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

well wouldn’t u know it!? i closed my GJ and GU shorts too early it seems. or did i??? infuriating not being able to know whether a retrace will turn into continuation or reversal. there’s got to be some magic crystal ball somewhere…

Keep searching Grassy 😉