Fixed Income Research & Macro Strategy (FIRMS) from 4x Global Research – 4 January 2019

- Price action in markets deprived of tier-one macro data over the Christmas and New Year period has centred on acute volatility in US and global equities, with sizeable intra-day swings including a temporary flash crash in the USD/JPY cross below 105 on 3rd January.

- The US government shutdown, ongoing concerns about the US-China trade war, the slowdown in global economic growth, uncertainty over Federal Reserve policy, the global increase in central bank policy rates and increased regulation of the technology sector all seemingly contributed to major equity indices posting losses in December.

- Global stocks closed the year down more than 11%, their worst performance since 2008 and a sharp reversal from a 21.6% gain in 2017, and have had a soft start to the year.

- The macro data calendar was, as expected, very light between 24th December and 1st January. However, data published in the past ten days, including US consumer confidence and pending home sales, US and Chinese manufacturing PMIs and German CPI-inflation point to an ongoing slowdown in global economic activity, in our view.

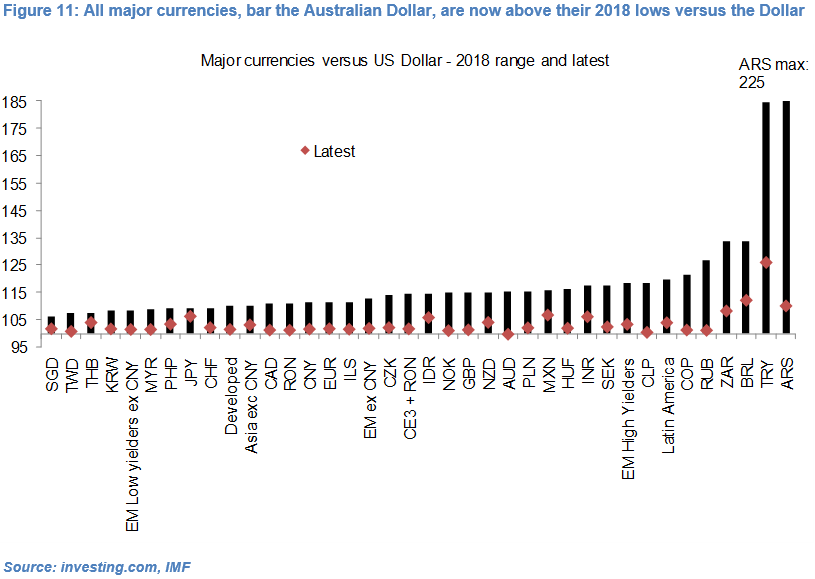

- This roller-coaster in equity markets has so far only partly fed through to major currencies, with most having moved 2% or less versus the US Dollar since 21st December.

- However, the Brazilian Real and Japanese Yen (the best performing currency in 2018) have appreciated 4% and 3%, respectively, while the Turkish Lira has weakened about 2.7% and the AUD/USD cross remains near a three-year low.

- The Dollar NEER, which appreciated 5% in 2018, is down about 1.3% since its multi-year peak on 27th November, with markets having seemingly interpreted recent US macro data as the US glass being half empty. We maintain our view, first expressed over three months ago, that “as markets head into 2019 the Dollar could become more vulnerable” (see Crunch time for currencies ahead of pivotal Q4 (24 September 2018).

- Sterling was a mid-table performer in 2018 but its key challenge still lies ahead. We expect the House of Commons to vote (in the second half of January) against the draft EU deal and a second referendum remains our core scenario.

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022