Time to gear up for the Bank of Canada decision

The easy bit first. Expectations for any action today are very low. What might be surprising is that the odds for a hike are zero, yet the odds for a cut stand between 11-15% (between RTRS and BBG models). This is indicative of the markets view of central bank policy at the moment, and that it’s taken a dovish stance for rate expectations. In fact, the market pricing doesn;t see a rate hike at all in 2019. That can all change on a word or phrase though.

All being well, and there’s no surprises in the rate decision, it will fall to the presser to get Poloz latest views of the economy and the rate picture. He’s been a bit more neutral of late and the data hasn’t done much to change that picture. We’ve seen a drop in inflation in both the headline and core rates, GDP has softened on a quarterly and annual basis and the jobs market hasn’t really given us any fresh clue,s though permanent hourly wages have been falling y/y.

Taking things as a whole, there doesn’t look to be any reasons why Poloz should be hawkish today, and while he’s likely to highlight downside risks (as all central bankers do) it will be the strength of that highlighting that gives the market something to trade. I personally don’t think he’ll be dovish either but we still have people thinking that not being hawkish amounts to being dovish, rather than neutral. There is no reason for him to be dovish either but the market might see things differently.

I see the price risk pretty balanced today. CAD could be just as volatile in either direction. There’s been some discussion in our trading room regarding why CAD has been so strong of late, as K-Man has just explained in his post. I also concur with him on which way the sentiment is lying (CAD strength) and so fading CAD selling could be the better trade (depending on what we’re given).

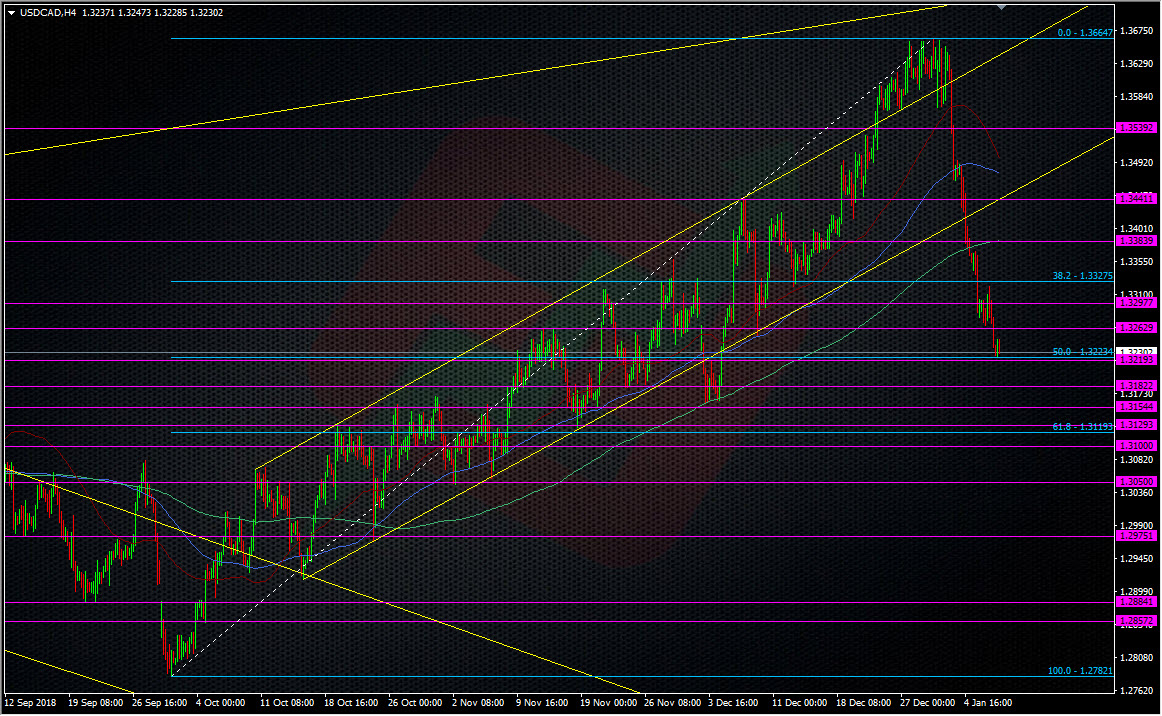

Here are the levels in play today;

Up

- 1.3440 – Dec S&R. Underside of Oct channel

- 1.33390/1.3400 – big fig

- 1.3380/85 – Long-time old S&R level. 200 H4 MA

- 1.3320/30 – Recent resistance

- 1.3300 – Normal big fig resistance. 55 DMA at 1.3296

- 1.3260/65 – Too close for the announcement but might have a say if we move away and come back.

Down

- 1.3220/25 – 50 fib of the Oct swing

- 1.3200 – Big fig

- 1.3180/85 – Additional S&R to 1.3200 that actually looks stronger than the big fig

- 1.3155/65 – S&R. 100 DMA

- 1.3120/30 – S&R. 61.8 fib of Oct swing

- 1.3100 – S&R. Further support into 1.3080/85

- 1.3073 200 DMA

Usual rules apply. These are levels where the price might do something. I tend to focus on the wider areas where the price may become stretched. With CAD, it has a habit of halting at a level, then getting a seond wind and pushing on for a while after. Very rarely to we get a single touch and retrace. If Poloz changes tack from last time, the market will go that way for a while. In that instance, I’d watch a first test of any level but only look to enter on a second test and hold, while still keeping a tight stop if it does keep going. CAD is not a currency you want to get stuck in the wrong way. Don’t give it the chance to do that. I would rather get out for a small loss if I feel it’s going to carry on than sit in and hope it comes back. We don’t do “hope” here at ForexFlow.

Lastly, while some of these levels may not stand up in the initial moves, we should still keep an eye on them if the price moves back after. Levels don’t just trade one way. What has been support can become resistance, and vice versa. This can be a very volatile currency so you need to have a lot of control over your trades. If in doubt, stay out until the picture is clearer.

As usual, we’re beavering away in the trading room for the best BOC trading plans, so if you want to be part of it, you can join us here.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022