Fixed Income Research & Macro Strategy (FIRMS) – 18 January 2019

- In the UK the House of Commons voted against the draft Brexit deal by a crushing majority of 230 – in line with our forecast (Tuesday 11th December: Brexit D-Day, 4 December 2018).

- With the UK due to exit the EU in only 70 days, the British government is fast running out of time and options and Sterling volatility is likely to remain elevated.

- Prime Minister Theresa May has to announce her “Plan B” no later than 21st January, which could be an altogether different deal (e.g. EFTA membership) with MPs due to debate and vote on “Plan B” on 29th January. However, we are sticking to our core scenario that ultimately the government will be pushed into calling a “second” referendum.

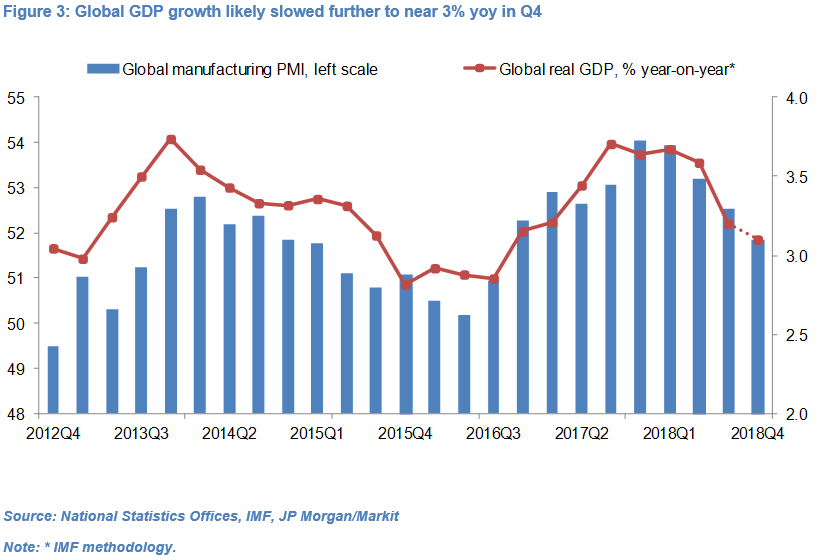

- Most agree that global GDP growth is slowing. We estimate that it hit a seven-quarter low of about 3.1% yoy in Q4 and expect growth to gradually slow further in coming quarters.

- If our forecasts of lower global growth and CPI-inflation in 2019 prove correct, we would expect most central banks (including the Fed) to slow , pause or delay their rate hiking cycles (Global central bank rate hikes: Part solution, part problem, 21 December 2018).

- Slowing US growth and a far less hawkish Fed have contributed to gradual Dollar depreciation, in line with our view that “as markets head into 2019 the Dollar could become more vulnerable” (Crunch time for currencies ahead of pivotal Q4, 24 September 2018).

- We see the risk to the Dollar tilted to the downside, particularly as our analysis of historical seasonal patterns points to Dollar weakness in February-April.

- The far more acute slowdown in Eurozone growth has dragged the Euro to a 7-month low, and the risk in our view is biased towards the ECB delaying its planned start to the rate-hiking cycle. In this scenario markets are likely to heap further pressure on the Euro.

- Analysts forecast Chinese GDP growth to have slowed to 6.3% yoy in Q4 but recent monthly data and policy-makers’ strong response point to a sharper slowdown in underlying economic growth, in our view (Q4 data are due for release on Monday).

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022