Fixed Income Research & Macro Strategy (FIRMS) – 05 March 2019

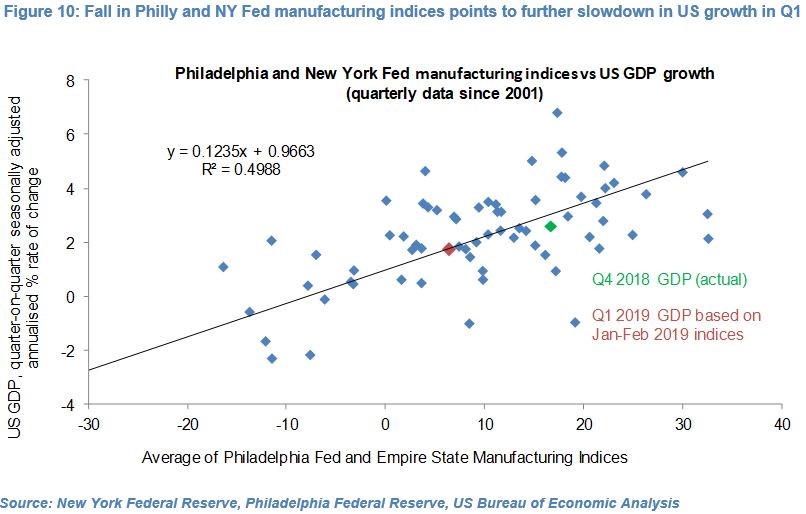

- In line with our forecasts, the 60bp of central bank rate hikes in 2018 is contributing to the ongoing slowdown in global GDP growth, which we estimate will fall below 3% yoy in Q1 2019 for the first time since Q3 2016.

- The broad-based moderation in global economic growth, along with the fall in crude oil prices, has pushed global headline CPI-inflation sharply back down to 2% yoy. Core CPI-inflation in emerging markets, which hit an 81-month high of 3.3% yoy year in November, moderated to 3.0% yoy in January 2019.

- Perhaps unsurprisingly, no major central bank has hiked its policy rate year-to-date, with the exception of Banco Central de Chile, and both the Federal Reserve and the European Central Bank have flagged possible measures to boost domestic liquidity.

- The stasis in central bank policy rates in recent months has contributed to muted FX market volatility with government-centric and geopolitical events generating most of the price action.

- The PBoC has allowed the Renminbi to appreciate over 3% in the past three months, in line with our constructive Renminbi view, but it is not immune to the albeit gradual slowdown in Chinese economic growth.

- The breakdown in talks between US President Trump and North Korean leader Kim Jong-un and escalation in tensions between India and Pakistan have seen high-yielding EM currencies underperform but the safe-haven Swiss Franc has treaded water in the face of a slew of weak domestic macro data.

- Mounting expectations that the UK will not leave the EU without a deal – our core scenario for the past six months – has seen the Sterling NEER appreciate 4.5% in the past two months. While there is still a great deal of uncertainty ahead, we maintain our long-held view that Theresa May’s government will ultimately be backed into calling a second referendum and we remain bullish Sterling, including versus the Dollar

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022