Fixed Income Research & Macro Strategy (FIRMS) – 08 March 2019

- The House of Commons (HoC), the lower house of parliament, will on 12th March hold a legally-binding vote on whether to approve Prime Minister May’s draft Brexit deal – the Withdrawal Agreement and Political Declaration on the UK’s future EU relationship.

- We expect the outcome of this critical vote to be closer than on 15th January when an all-time high majority of 230 Members of Parliament (MPs) voted against the deal. However, our core scenario is that a majority of the 634 voting MPs will again vote against the deal.

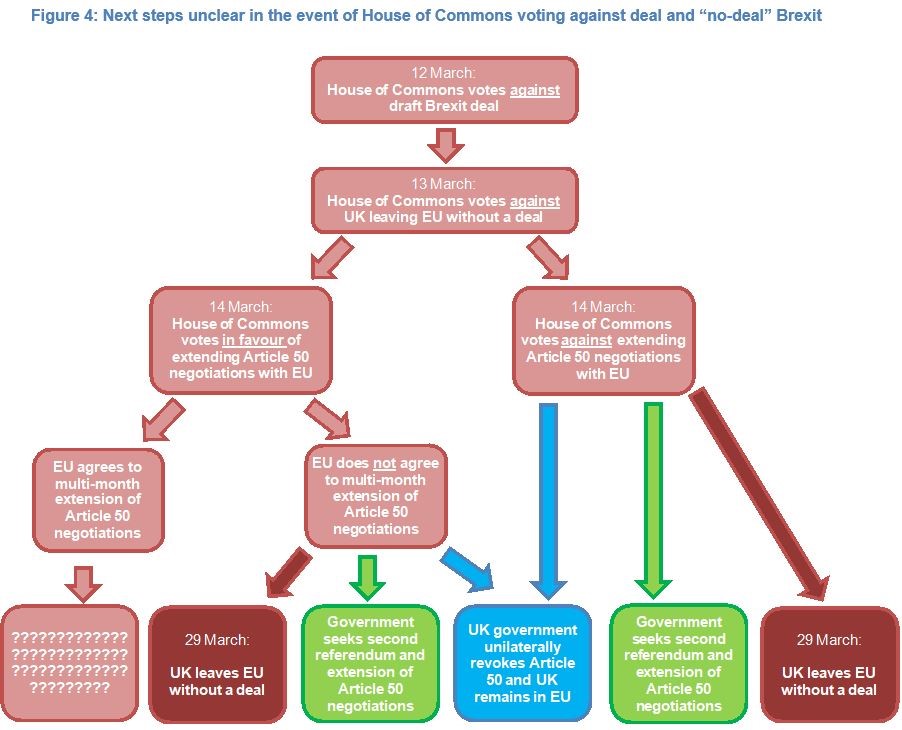

- Importantly, Prime Minister May has promised that should the HoC vote against her draft Brexit deal, it would vote on 13th March on whether the UK should leave the EU without a deal and if it voted against a “no-deal” Brexit” it would vote on 14th March on whether or not to seek an extension of negotiations under Article 50 beyond the 29th March – the date on which the UK is currently legislated to formally cease being an EU member.

- Prime Minister May could opt to “cancel” the non-legally binding votes on 13th and 14th March and schedule a third HoC vote on her draft Brexit deal before 29th March. However, we do not expect her to perform what would undoubtedly be a politically damaging u-turn and to respect the outcome of votes which carry significant political weight.

- We have consistently argued in the past six months that there is little political (or popular) support for a “no-deal” Brexit and we have seen little evidence to change our view.

- In the event of the HoC voting against a “no-deal” Brexit next week, MPs would ultimately have little choice but to vote in favour of seeking a time-extension which the European Council would then approve, in our view.

- What would happen next remains unclear but we still think the most likely outcome would be parliament holding a vote on whether the government should call a second referendum.

- Sterling, which has appreciated 4% in the past three months, is likely to continue beating to the Brexit drum for the foreseeable future, with Sterling volatility remaining elevated relative to other major currencies. However, our core scenario leads us to remain bullish Sterling, including versus the Dollar

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022