Fixed Income Research & Macro Strategy (FIRMS) – 15 March 2019

- There is no formal definition of what constitutes a safe haven currency. However, it will normally exhibit a number of related characteristics, including i) high trading volume and liquid financial markets, ii) reserve currency status, iii) a low yield and iv) low volatility.

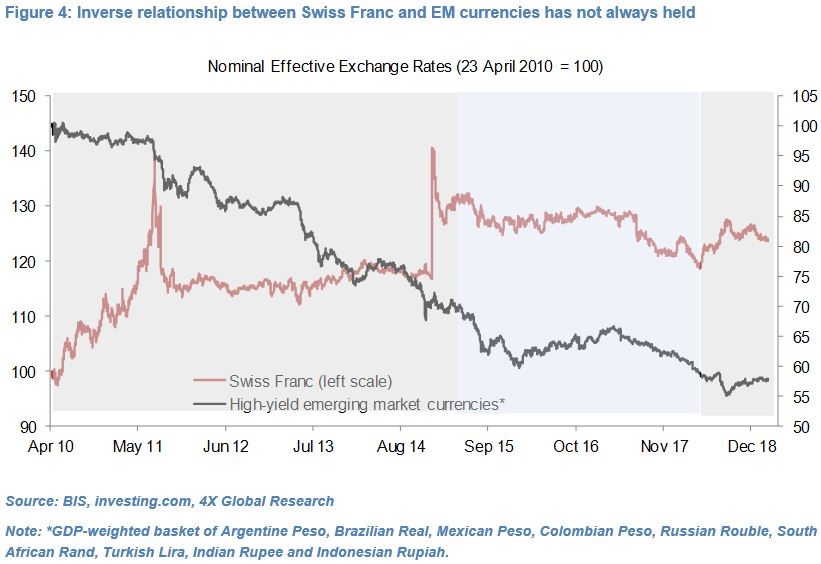

- Importantly, a safe haven currency will tend to be inversely correlated to assets with a higher risk profile such as high-yield (HY) emerging market (EM) currencies because it is used to fund short positions in such currencies or held as a hedge, a store of value with an underlying aim of capital preservation rather than capital appreciation.

- Moreover, safe haven currencies are typically associated with mature democracies and developed economies which boast stable political and judicial institutions, an independent central bank with significant FX reserves and a current account surplus.

- The Swiss Franc ticks most of these boxes. It is the seventh most traded currency while Switzerland is one of the wealthiest countries in the world and has consistently run sizeable current account surpluses. The independent Swiss National Bank has substantial FX reserves equivalent to over 100% of GDP.

- In the past three years the low-yielding Swiss Franc has been amongst the least volatile currencies in the world. Moreover, the Swiss Franc has in the past ten months moved broadly in the opposite direction to a basket of HY EM currencies, as well as in 2010-2015.

- However, Swiss Franc volatility spiked in early September 2011 (after the SNB pegged it to the Euro) and again in January 2015 (when it was revalued).

- Furthermore, between April 2015 and May 2018 – a period of reasonably elevated global risk appetite – the Swiss Franc weakened alongside HY EM currencies, due largely to the material appreciation of the Dollar, Yen and in particular Euro. The Swiss Franc has thus tended to outperform when global risk aversion was acute and financial market volatility elevated, such as in the years following the great financial crisis in 2008 and last summer.

- The Swiss Franc’s (very modest) depreciation in the past two months is largely related to the relative and absolute weakness of Swiss economic growth and inflation, in our view.

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022