It’s FOMC time and the market is going to be on the hunt for clues from Fed’s Powell

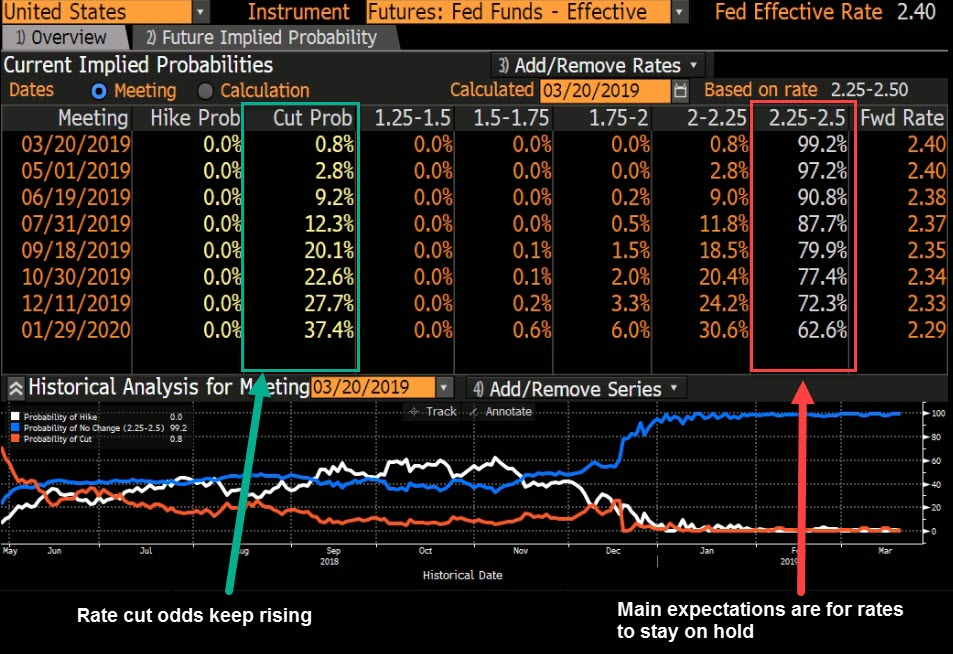

All the previews in the world that come and go over these events can usually all be summed up in one metric. For the Fed, the FFR rate probabilities is one of the best.

The market is on the dovish path and that can be seen in the latest interest rate odds. The pricing continues to write out a hike at all this year and the odds of a cut keep increasing.

Putting it plain and simply, the market is leaning one way and it will need to know that view is correct. That will only come from the FOMC and Powell. Anything from the Fed that doesn’t conform to the market’s thinking will cause a reaction in prices. For tonight, the market is leaning dovish so the biggest price risk is if the Fed isn’t (or isn’t as much as the market wants). That’s the main aspect I’m looking to take advantage of, given the opportunity.

There’s really only two key points to consider tonight.

- Will the dot plot change meaningfully?

- What will Powell say about the economy?

I seem to preach it every FOMC meeting but the fact remains that even under this gloomy global cloud on growth and trade worries, the US economy has been doing fine. The labour market is strong, the consumer is still spending and inflation is holding up (Core vs headline). Yes, there have been wobbles (see retail sales and 20k NFP) but that’s to be expected and there are no real downward trends in most of the data. There is still no reason for the Fed to get overly dovish and certainly not to the point of talking about rate cuts. So the divergence between what the market thinks and what the Fed thinks could grow, and that’s where we get out best trading opportunities.

The dots are probably the most important aspect tonight as that will define the markets view on rate hikes from the Fed members. The updated forecasts will be important too as any real drop in the forecasts will embolden the market’s view. However, how Powell explains any changes in forecast away will be key to the market’s moves. Keep an ear out for any balance sheet chatter too. The market is waiting to see if the Fed drops some finer details on their plans, be it carrying on or when they might stop the run-off. This is much like the ECB continuing to reinvest so any signs of stopping or slowing will add to the markets easing bias for the Fed.

How do we trade it?

I will be looking to counter any extreme moves. I see no value in taking a position into it, and outside of my GBPUSD position, I have nothing else on in USD to manage. The likelihood is that we don’t get much anyway and any moves are limited in size and we’re none the wiser after it all.

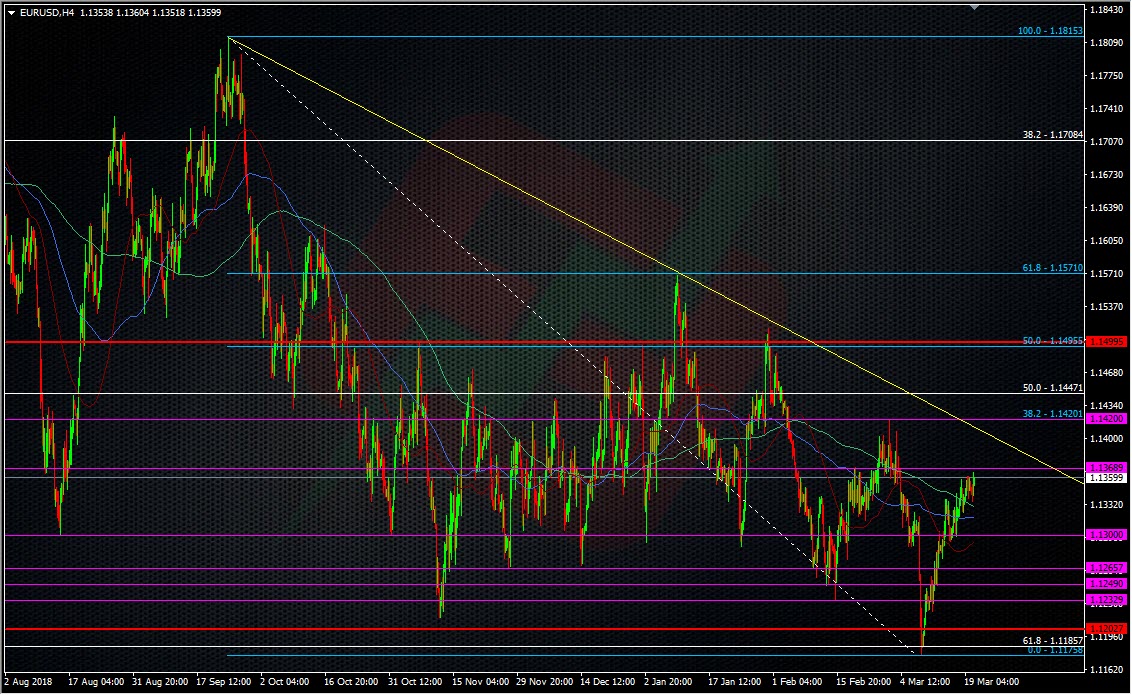

The two extremes would be looking to fade any hawkish (or non-dovish) messages, or indeed any overly-interpreted dovish comments from Powell, against the key levels and ranges in play. For USD positive remarks, that would be into 114-115 in USDJPY, and 1.12 in EURUSD. The topside USDJPY levels are probably a big ask even if Powell was to say he’d hike rates tomorrow, so closer to home the 112.00-50 area would be my first levels of interest. The 1.12 level in EURUSD stands out for itself.

For anything extreme to the downside (as long as Powell hasn’t muttered that they’re cutting rates next meeting), USDJPY down into the low 110’s would be where I’d be watching for longs, and up into 1.15 in EURUSD for USD longs. 1.1400-20 is on my intraday radar but we might be too close to the price come tonight.

So, the name of the game is to be reactionary to whatever gets delivered. Unless I see anything standing out to me, I’ll leave it well alone and get back to watching the general price moves.

As per usual, stay safe and don’t hold any big expectations for any big price moves, just be ready to pounce if we do get them.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022