Fixed Income Research & Macro Strategy (FIRMS) – 18 April 2019

- Much has happened in the past two months and yet the UK finds itself in a similar situation as in mid-October 2018 when it had just over five months to get a deal through parliament before its (original) exit date from the EU on 29th March.

- We have so far correctly forecast that the UK and EU would reach an agreement on a Brexit deal but that the House of Commons would repeatedly vote it down with significant majorities. We also correctly anticipated that Prime Minister would survive a Conservative Party leadership challenge and a parliamentary no-confidence vote. Finally, we predicted that the House of Commons would vote against a no-deal Brexit and seek (and obtain) from the EU an extension to Article 50.

- Our long-standing, underlying view has not changed, namely that the more extreme scenarios – the UK leaving the EU without a deal or revoking Article 50 – are still unlikely to materialise. We still think that a second referendum is the most likely outcome.

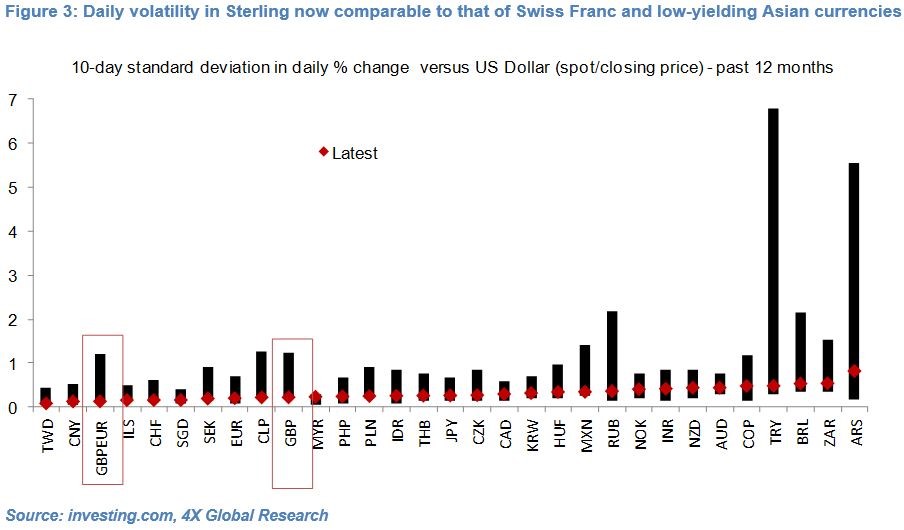

- Despite the increasingly frequent twists and turns in the Brexit saga, or perhaps because of this chronic uncertainty and likelihood that the Bank of England will keep rates on hold at 0.75% for the foreseeable future, Sterling has traded in remarkably narrow ranges in the past two months. Daily volatility in Sterling crosses has been crushed.

- However, this lack of directionality has masked more significant intra-day volatility, including in GBP/USD, triggered by a never-ending stream of parliamentary votes, UK-EU meetings, “special” European Council summits and occasional macro-data surprises.

- The government now has until 31st October to find a way out of the current impasse, which has removed some sense of urgency. Thus, while Sterling may occasionally spike higher or dip lower intra-day, it will likely remain largely directionless near-term, in our view.

- Nevertheless, at current levels we think Sterling is more likely to appreciate (modestly) as the risk of a “no-deal” Brexit is low and historical seasonal patterns point to Sterling upside in the months of April and May

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022