Spain heads to the polls this Sunday

This weekend’s Spanish General Election isn’t getting too many headlines right now but it’s still a market risk.

A tight race is expected, and the prospect of a hung parliament followed by lengthy coalition talks is very high as Spanish voters have their say in politics this Sunday. The main parties are expected to lose plenty of votes to many of the smaller parties, and as has been the case in other European elections, more extreme left and right wing parties could benefit. Of course, the Catalan issue will be a big factor too.

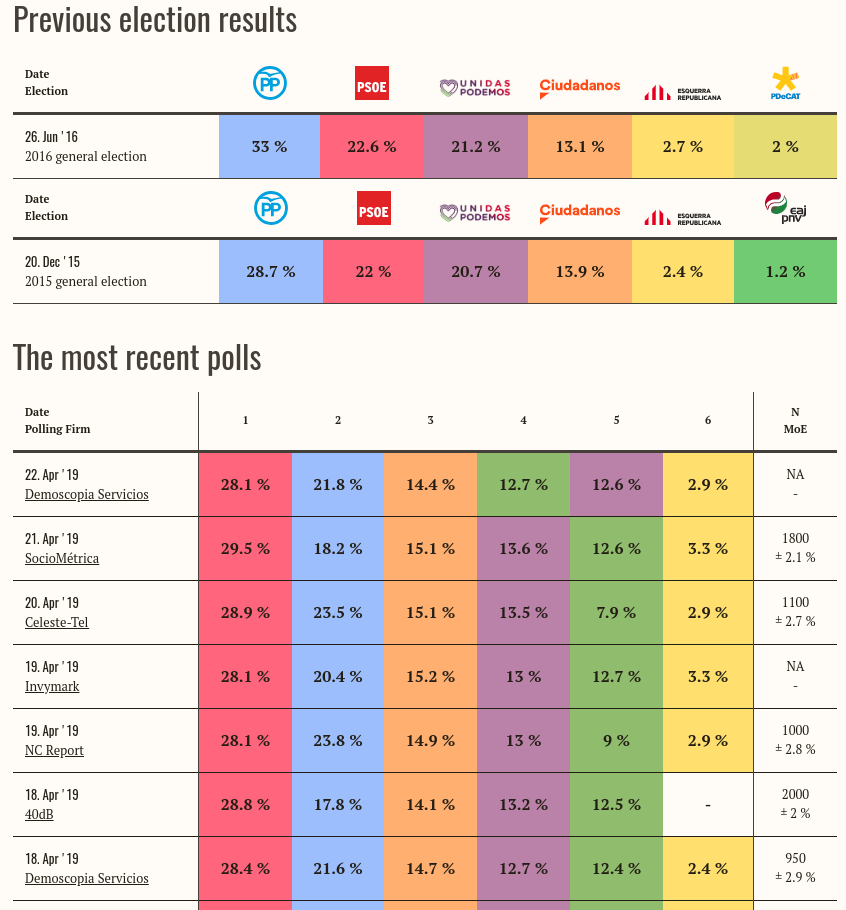

Polling has all but ceased as Spain stops them a week before an election (though there are one or two that still happen H/T FXJ). Recent polls show how the gap has closed between the main parties, and the shift down the spectrum.

Spanish election 2019. Details from Pollofpolls.eu

There’s not too much market risk being attributed to the elections and that might be an underestimation by the market, if there’s big swings by voters, or if Spain doesn’t form a government, and the process drags on. It’s also dawned on me why Spain have touted the news that they will lower debt issuance this year. It’s a drip feed of positive market headlines to offset any market jitters about the weekend. Perhaps we should expect some additional titbits ?

The timings of the full results might be a bit lengthy.

- Polls open 09.00 – 20.00 local time (07.00-18.00 GMT)

- Once polls close, provisional counting begins

- Full counting starts on the Wednesday, to include overseas votes and must conclude by 4th May

- Official results should come no later than 13th May

- The new members of Congress will be due to meet 21st May (should things go smoothly).

The Guardian has a good run down of the elections here.

Either way, it’s a weekend risk for EUR and one we need to be aware of possibly Sunday night or early Monday, and/or into the rest of the week (If we get any headlines about the provisional results).

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022