Fixed Income Research & Macro Strategy (FIRMS)

- The Renminbi Nominal Effective Exchange Rate (NEER), which had appreciated 3.5% in the two months up to 5 March 2019 and then traded in a narrow 1% range in the following two months, has since 2 May depreciated 2.1% to its weakest level since 25 January.

- This is broadly line with our view that “the PBoC could conceivably slow or even temporarily reverse the Renminbi’s appreciation, irrespective of the pace of progress in trade negotiations with the US” (see Politics and geopolitics driving currencies, central banks in stasis…for now, 5 March 2019).

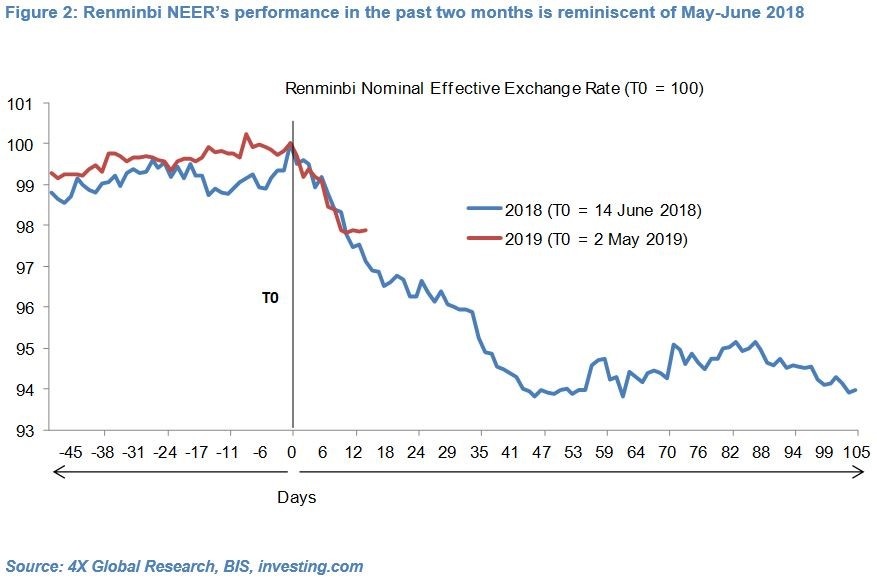

- This pattern in the Renminbi is very similar to that of May-June 2018 (see Figure 2). The Renminbi NEER had been broadly stable in the 6 weeks up to 14 June 2018 but then weakened about 2.5% over the following fortnight. It weakened a further 3.8% in the month to 27 July 2018, before stabilising and staging a modest and short-lasting recovery.

- Chinese policy-makers’ motivation to allow and ultimately encourage Renminbi depreciation in the past fortnight – namely retaliation for an escalation in the trade war with the US and a loosening of monetary policy to stimulate Chinese growth – are not too dissimilar to a year ago, in our view.

- The Renminbi has been broadly stable in the past 3-4 sessions, suggesting that the PBoC is keen to keep a tight leash on its currency and avoid a repeat of its August 2015 devaluation which rattled both domestic and international financial markets. The consensus forecast is that near-term the PBoC will intervene in the FX market to stop USD/CNY spot from breaching the psychologically important level of 7.00.

- However, unless the US and China quell this trade war and/or Chinese economic growth rebounds in the very near-term – which we think is unlikely – the risk is that the Renminbi resumes its downward path.

- Looking beyond the next few weeks, US Presidents Trump and Jinping could conceivably try to bridge the gap in their current stances and announce (some) progress in negotiations ahead of the G20 Summit on 28-29 June. This could in turn see Chinese policy-makers shoring up or even appreciating the Renminbi, in an implicit sign of goodwill.

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022