Fixed Income Research & Macro Strategy (FIRMS) 7 June 2019

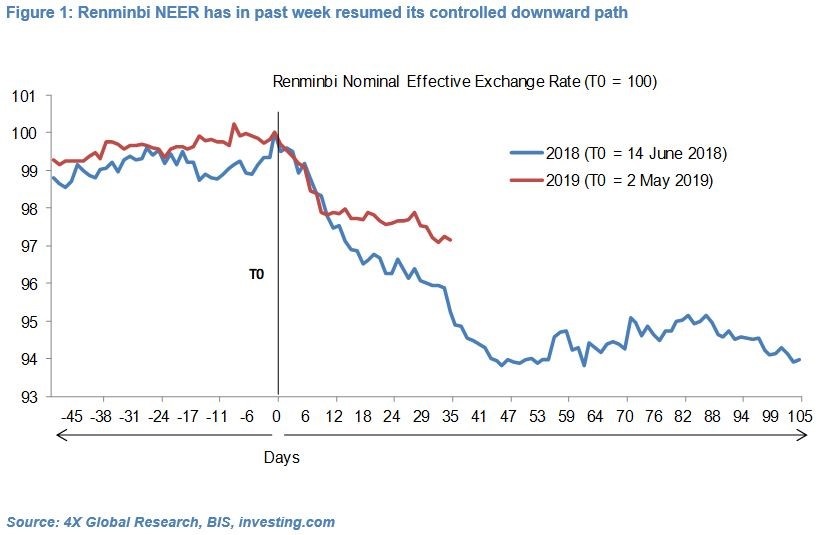

- We noted in “Renminbi depreciation – Case of déjà vu” (16 May 2019) that the Renminbi’s performance since early March had been very similar to that of May-June 2018 and that if, as we expected, history was to repeat itself the Renminbi would weaken further.

- While the Renminbi Nominal Effective Exchange Rate was broadly stable between 16th and 30th May, it has since weakened about 0.8% to its lowest level since 10th January (see Figure 1). This pace of depreciation is commensurate with that observed over 9-16 July 2018.

- Since 16th May, the PBoC has raised the daily USD/CNY fix by about 0.4% and USD/CNY spot has increased by a similar amount.

- Markets are for now seemingly content in keeping the USD/CNY spot rate near the PBoC’s fix. However, recent history suggests that in the event of an escalation in tensions between the United States and China, Renminbi spot would likely depreciate to the weak end of its permissible +/ 2% range around the USD/CNY fix.

- Moreover, since 16th May, the Renminbi has on average depreciated even faster against the currencies of China’s main trading partners – namely the safe-haven Japanese Yen, Euro and Korean Won – in line with our bullish Won view (see More to FX markets than US-China trade war, 24 May 2019).

- We think that Chinese policy-makers are once again using Renminbi depreciation as both a weapon and a tool. Recently released macro data pointing to a further cooling of Chinese economic growth in May, at the margin, may have incentivised the PBoC to allow Renminbi depreciation to resume.

- The moderate pace of Renminbi NEER depreciation suggests that the PBoC is keen on avoiding a repeat of its August 2015 “devaluation”. We also have sympathy with the consensus forecast that near-term the PBoC will stop USD/CNY spot from breaching the psychologically important level of 7.00.

- However, unless the US and China quell this trade war and/or Chinese economic growth rebounds, the risk near-term is that the Renminbi weakens further.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022