4X Global Research – Fixed Income Research & Macro Strategy (FIRMS) – 26 June 2019

- It is now three years since the referendum on 23rd June 2016 in which 52% of the British electorate voted for the UK to exit the EU. The issue of whether, when and how the UK will leave the EU has shaped the UK’s political agenda and economic and social landscape.

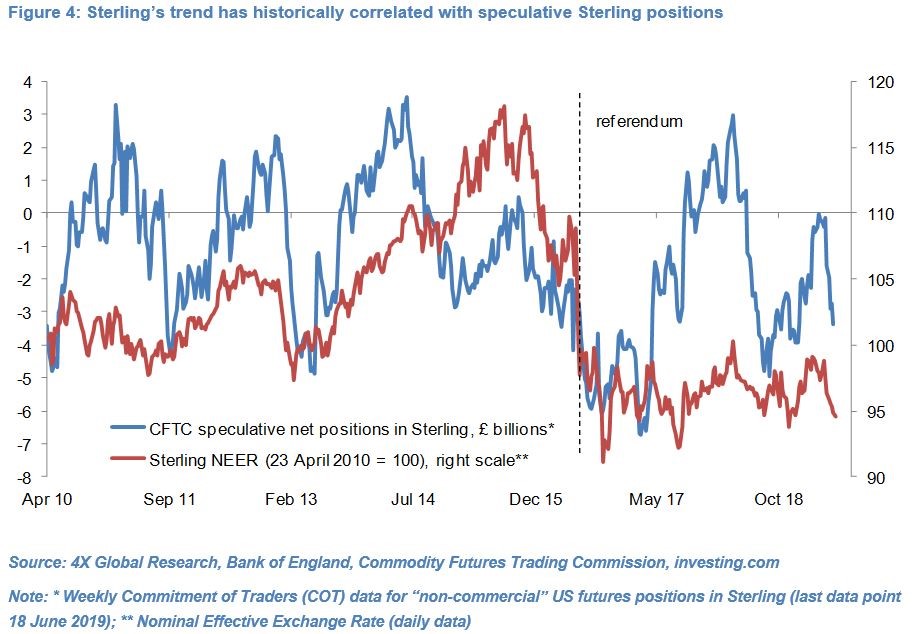

- The chronic uncertainty associated with Brexit has had a significant negative impact on the UK’s key balance of payments flows and in turn Sterling, with the Nominal Effective Exchange Rate still 14% weaker than pre referendum. Brexit has both weighed directly on net foreign direct investment, inflows into gilts and UK equities and other financial flows, and indirectly via its drag on UK GDP growth.

- Speculative short Sterling positions fell from £3.9bn in mid-January to £0.3bn in early May and the Sterling NEER appreciated about 4%, thanks to i) shrinking odds of a “no-deal” Brexit following critical parliamentary votes in Q1 and pro-EU parties’ strong showing in British local elections on 2nd May, ii) UK GDP growth rising to 0.5% qoq Q1 and iii) the Bank of England becoming more hawkish.

- However, speculative short Sterling positions have since surged to £3.4bn (as of 18 June) and Sterling depreciated 4.8%. Markets are digesting the Brexit Party’s strong showing at the European Parliament elections on 24th May and the commitment by Boris Johnson, the front-runner to succeed Prime Minister May, to take the UK out of the EU by 31st October with or without a deal. Moreover, UK GDP growth likely slowed sharply in Q2 and we maintain our forecast that there is little chance of a policy rate hike any time soon.

- Near-term, we expect Brexit convolutions, a more dovish Bank of England and unfavourable seasonal patterns to keep a volatile Sterling under modest pressure. Furthermore, the underlying trade deficit has increased in the past three years to around £9bn per quarter. Despite Sterling’s significant competitiveness gain post referendum, there is little evidence of UK exporters winning market share or of import substitution.

- However, we maintain our long-held view that the path of least resistance for the incoming prime minister will be to again delay the UK’s exit from the EU and call a confirmatory second referendum – a path which would see Sterling appreciate materially.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022