A great analysis piece by ForexFlow platform member Jorge Celio

MXN

My main driver on MXN has and continue to be Remittances. The slow down makes me nervous. In terms of positioning will have a cautiously approach. I would be a seller of EURMXN on any EUR strength. Reasons a dovish ECB will favor this cross over USDMXN.

- Remittances in June contracted for the first time in three years, registering a 0.7% decrease, although during the first half of 2019 they added $16.846 million, + 3.7%.

In 2018, 1.65 million households in Mexico received remittances, 4.7% of the total. 27% of remittances-receiving households are in the two lower income deciles, and 12.7% in the two upper income deciles. Remittances-receiving households have a consumption pattern very similar to the national average. 36.0% of the expenditure went to food, beverages and tobacco; 18.6% in transport and communication; and 10.8% in education and recreation, mainly. (BBVA)

- Rates: Was not expecting a rate cut in this meeting. The (cautious) tone of the statement is largely unchanged despite the relatively hawkish wording, more rate cuts are on the way and joining the Dovish CBs…

- The majority of the Board came around to the view of the need for monetary policy easing with a real ex-ante rate above 4.0% in a context of a weakening economy and falling inflation

- The tone of the statement was broadly unchanged and it remains on the relatively hawkish side

- In spite of this, and the absence of any (and thus poor and misguiding) forward guidance, this cut should mark the start of an easing cycle

Analysts covering Mexico expect an additional 25bp rate cut (to 7.75%) before year-end and 100bp worth of cuts (to 6.75%) by year-end 2020

Initially the cut had no significant effect on the MXN, as rate cuts were priced-in and as the risk adjusted carry trade remains among the highest in the emerging market world. (WITH THE EMPHASIS ON RISK)

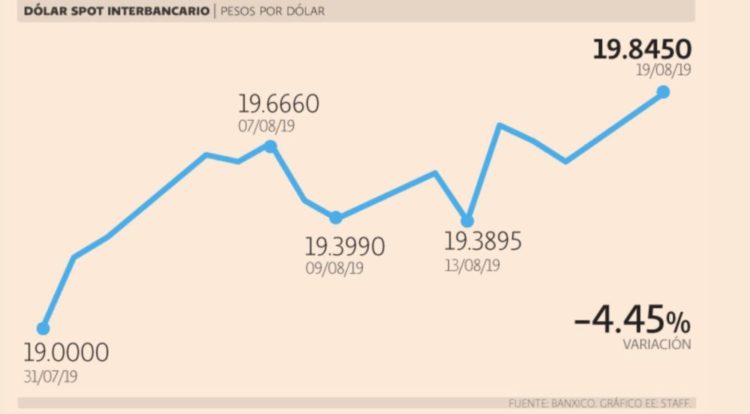

It is also worth noting that on Monday after the cut was digested the peso hit its lowest level of the year vs USD

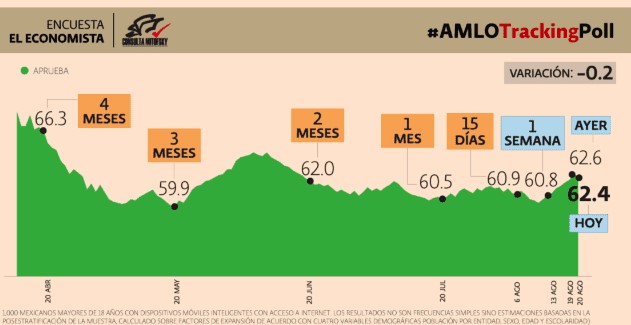

AMLO popularity

US INDEX VIEWS

While all the major US indexes broke new highs this year the RUS2000 has been a laggard in the bull run. On any economic stimulus and downturn would expect the RUS2000 to outperform. Given the current environment any trade here is ST or day scalping until getting a clear direction -if we ever get one- on trade and geopolitics. On the RUS2000 not looking to trade the index but the ETF. Below is a snapshot on SPX as have found lately the other indexes much tougher lately aside from a quick scalp.

SPX: From one of my sources, not ready nor willing to make a call on direction just taking it one day at the time. Yesterday we had Lots of defined levels. Bulls defended 2822-2839 last week. Bears defended 2935 area as resistance. It probably has some traders caught short. But overall, from 2822 last week and 2931 this week. Has held the top third of that range/active sequence with 2900, yesterday’s low as a point reference.

Let’s see how yesterday’s low of 2899 gets treated. 2873 is a level below.

BTW: Aside from the above also have been looking at: DAX, IBEX and SMI.

METALS

Still Silver bullish… And is the only call I am willing to sustain towards medium long term.

Platinum has recently reached a bottom and has not had any noticeable upside with all the bad news discounted in its current price. Silver on the other hand do believe has more upside potential -as has been shown lately compare to gold- given its use in other areas aside from jewelry. I would mention 3 from my current research reading:

- Today silver is invaluable to solder and brazing alloys, batteries, dentistry, glass coatings, LED chips, medicine, nuclear reactors, photography, photovoltaic (or solar) energy, RFID chips (for tracking parcels or shipments worldwide), semiconductors, touch screens, water purification, wood preservatives and many other industrial uses. Washington-based industry group the Silver Institute calls it “the indispensable metal”.

- Photovoltaic (solar energy) silver demand. Silver’s sensitivity to light has found fast-growing use in the photovoltaic, or solar energy, industry. Using silver as a conductive ink, photovoltaic cells transform sunlight into electricity.

- Medicine’s growing silver use. Of all chemical elements, silver has the most powerful antibacterial action with the least toxicity to animal cells. Because like the other, more expensive precious metals, it interrupts the ability of bacteria cells to form certain chemical bonds essential to their survival. But cells in humans and other animals have thicker walls, and are so undisturbed. When added to water, silver releases silver ions. These ions also kill and prevent biological growth, again disabling the metabolism of germs and hindering their membrane functions. The value of these properties has been known and used for centuries.

But yes, there is always a but… Economic slowdown as the biggest consumers of silver for industrial applications this past decade have been the US, Canada, China, India, Japan, South Korea, Germany and Russia. Over that time, as we see from the above, silver demand from older industries has faded, only to be replaced by new technological uses.

After being caught long in early February and closing the positions was not willing to ride the wave down. Was not until saw enough bullish comments that entered new longs from 14.98. Up to date have been scaling in and out of the bullish PA and currently out of it. Will we see 18 and upwards that is my next homework…

DISCLAIMER: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. IT IS NOT INTENDED TO BE AN EXPRESSION TO SELL OR BUY ANY SECURITIES.

NOTE : This document is intended to also generate and challenge the views I express here by the members.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022