It’s been busy busy in our trading room over the last few days

- Shorted EURUSD from 1.1104 to 1.1003

- Longed USDJPY at 107.67 to 107.90

- Longed EURGBP at 0.8854, took a bath at 0.8840

- Shorted USDCAD at 1.3297 (took a 7pip loss on one trade due to the PA then entered again) to 85 before the trailing SL was hit.

- Longed GBPUSD yesterday on the DUP headlines but it didn’t perform today so cut it for +4 into the retails sales. Of course, it duly bounced after.

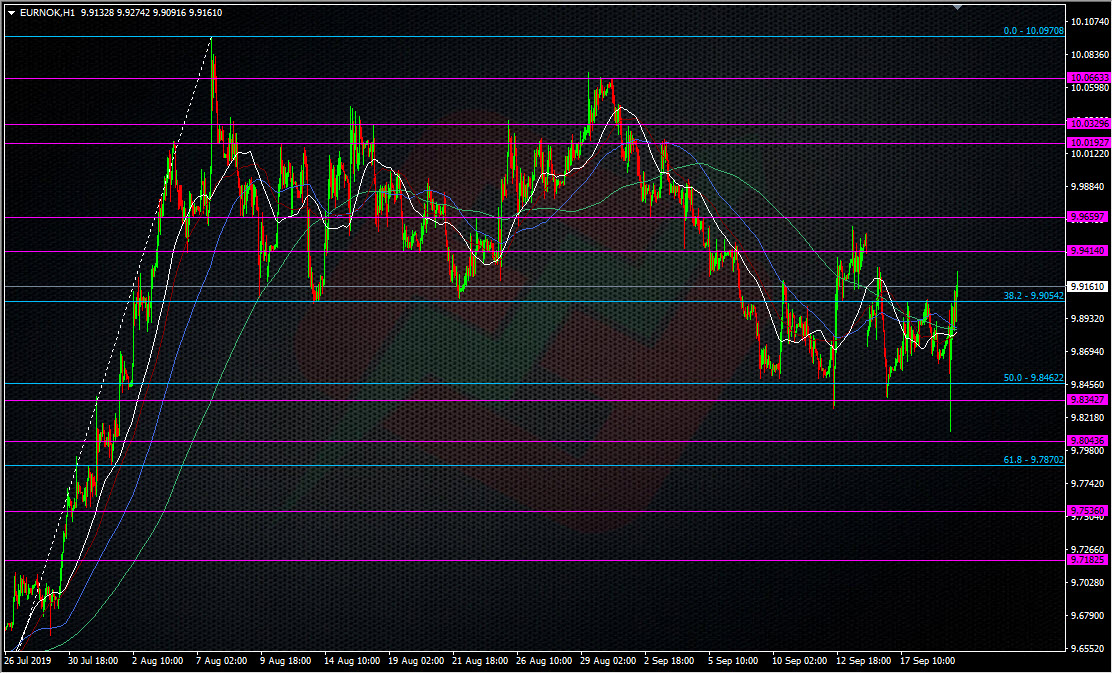

- Long EURNOK today at 9.8346, still open but slcied on the way up

- Long USDCHF today 0.9914, open and sliced at 27.

- Long GBP today for a longer-term Brexit trade.

The folks in our trading room have also been smashing it over all these central bank meetings, which has been great to see. What’s obvious is that we’re getting increased and regular volatility, which is bringing plenty of good opportunities.

The EURNOK long is the one I’m most looking forward to. A couple of weeks ago in the room we shorted it up in the 10’s for a run into an easing ECB and tightening Norges, and now they’re over, there’s a good chance it heads back up towards there. There’s plenty of speedhumps in the way though. EURNOK H4 chart

EURNOK H4 chart

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022