Fixed Income Research & Macro Strategy (FIRMS) 8 October 2019

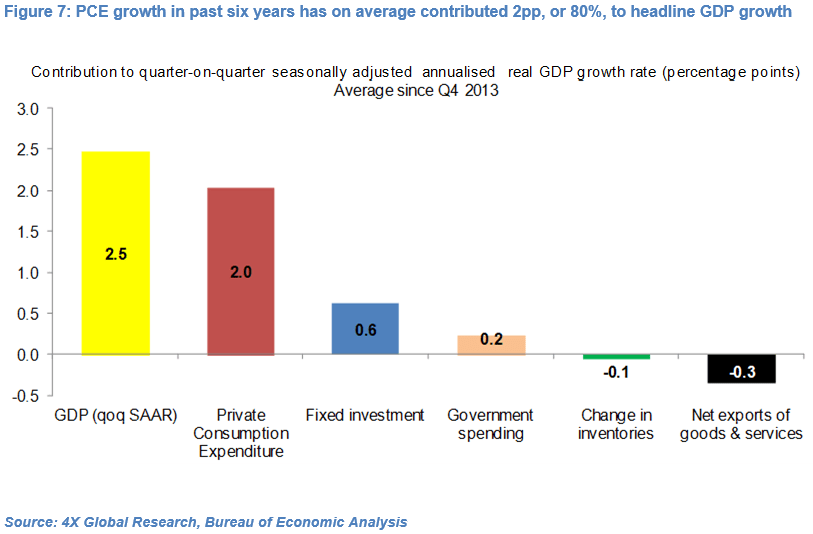

- It is perhaps obvious that Personal Consumption Expenditure (PCE) or consumer demand is critical to US economic growth. PCE growth has accounted for over 80% of US real GDP growth since end-2013 (see Figure 7), thanks to its relative size (nearly 70% of GDP) and the fact that PCE is the only demand sub-component which has positively contributed to GDP growth every quarter since 2010.

- PCE amounted to about $14 trn in 2018, equivalent to China’s annual GDP. US spending on services alone equates to about $9.1 trn the combined GDP of Japan and Germany. Every day US consumers on average spend $38bn, roughly the size of Tunisia’s annual GDP.

- If one was to focus on just one macro variable, it should probably be US PCE in our view. It is certainly central to Federal Reserve monetary policy decisions and fiscal policies.

- And yet PCE data, which the Bureau of Economic Analysis releases both monthly and quarterly, receive very little coverage compared to say non-farm payrolls figures or PMI numbers. Monthly US retail sales data, published two weeks before PCE figures, are a useful but imperfect lead indicator of the broader measure of consumer demand.

- The recovery in real PCE growth in Q2 to 4.6% qoq (seasonally-adjusted annualised) was impressive but benefitted from weak growth in both Q4 2018 (1.4%) and Q1 2019 (1.1%). Indeed, month-on-month PCE growth gradually slowed from 0.8% in March to just 0.3% in July and 0.1% in August, with expenditure on services contracting in August.

- Moreover, the recent fall in US consumer confidence, slowdown in income and wage growth and jitters in US equity markets, a theme we will explore in our next report, suggest that PCE growth remained weak in September and thus slowed materially in Q3.

- At the same time, in the past 18 months, growth in fixed investment and government spending has been in line with GDP growth while inventories and net exports have been a drag.

- We conclude that US GDP growth in Q3 may have slowed to below 1.8% qoq, the current AtlantaFed GDP Now estimate, from 2.0% qoq in Q2, putting the Federal Reserve under pressure to cut its policy rate 25bp again before year-end

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022