4X Global Research Fixed Income Research & Macro Strategy (FIRMS) – 27 February 2020

- In reaction to the coronavirus epidemic governments across the world have enacted measures unprecedented in recent decades, including closing national borders, setting up quarantine zones, restricting travel and closing factories and schools.

- Economic activity in China has slowed sharply and disruptions to international supply chains are impacting global trade and production with the slump in tourism heaping further pressure on retailers. However, putting figures on the current, let alone final economic, financial and social cost of the coronavirus epidemic remains guess work.

- Markets accustomed to the bullet-proof, metronomic rise in global and US equities have seemingly been “surprised” by the sharp sell-off in global equity markets this week.

- At the same time global FX volatility has remained modest, despite its recent up-tick. This can be partly attributed to EM central banks’ tight FX management, including FX intervention to smooth out currency moves. A number of developed central banks (including the SNB) have also stepped up their FX intervention to tame their currencies.

- Chinese exchange rate policy is central to this theme. The PBoC has in the past three weeks set its daily USD/CNY fix near the 7.00 level, despite the Dollar’s underlying appreciation, and in the process sacrificed some export competitiveness, in line with our view (see What next for Asian currencies, 31 January 2020).

- The relative stability in USD/CNY has contributed to both muted volatility in Non-Japan Asian currencies and limited directionality year-to-date versus the Dollar, which has resulted in the PHP, INR, IDR and TWD appreciating in trade-weighted terms.

- The THB and KRW have been the main exceptions, in line with our forecast, and we expect further downside. Similarly, the IDR – down 2.7% since 20th February – remains vulnerable.

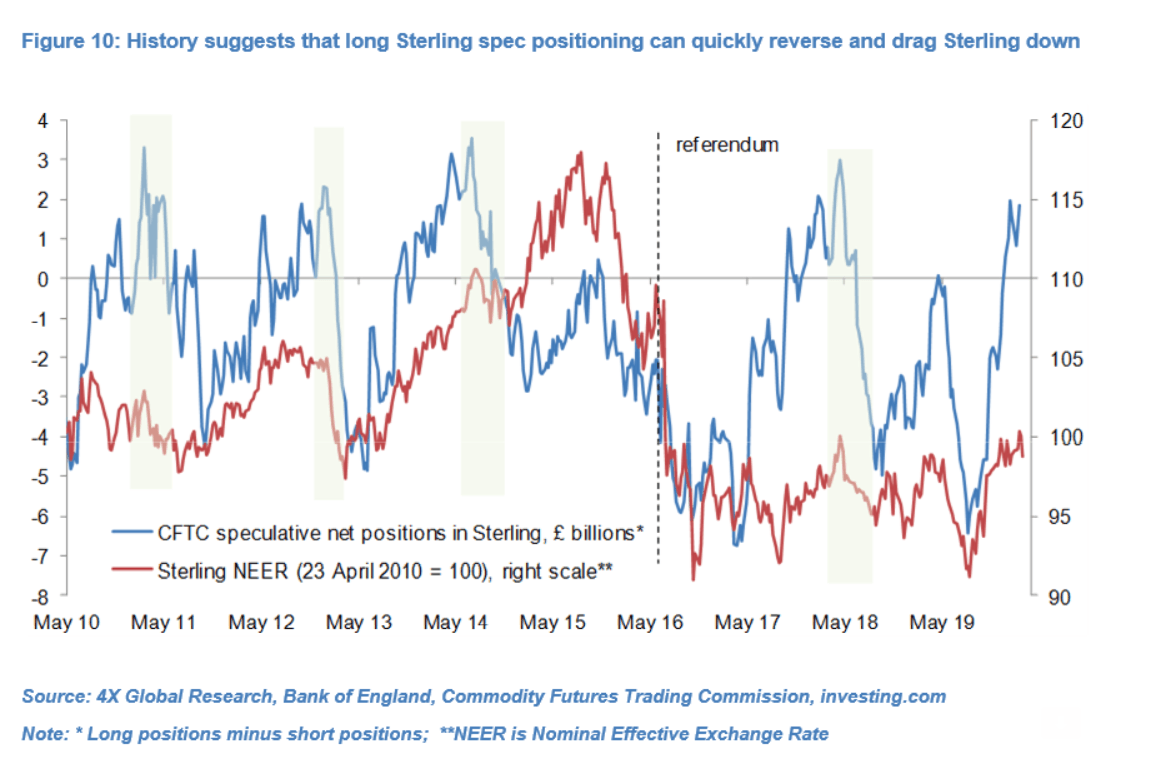

- Sterling has also dropped this week, to a 5-week low, and history points to a fall in elevated long speculative positioning and further Sterling depreciation. Conversely, the unwinding of short Euro positions has seen the currency hit a 12-week high. We expect the Euro to trend higher but for weak Eurozone macro data to cap the pace of appreciation.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022