Fixed Income Research & Macro Strategy from 4X Global

- We argued in Lack of US market & macro volatility both reassuring and troubling (17 January) that “the market’s willingness to look through domestic political and geopolitical events suggests that only a significant exogenous or endogenous shock currently beyond markets’ radar screens (an “unknown unknown”) is likely to really move the needle”.

- That unknown unknown, a “black swan” event, has turned out to be a global viral pandemic on a scale not seen since the Spanish influenza pandemic of 1918-1919.

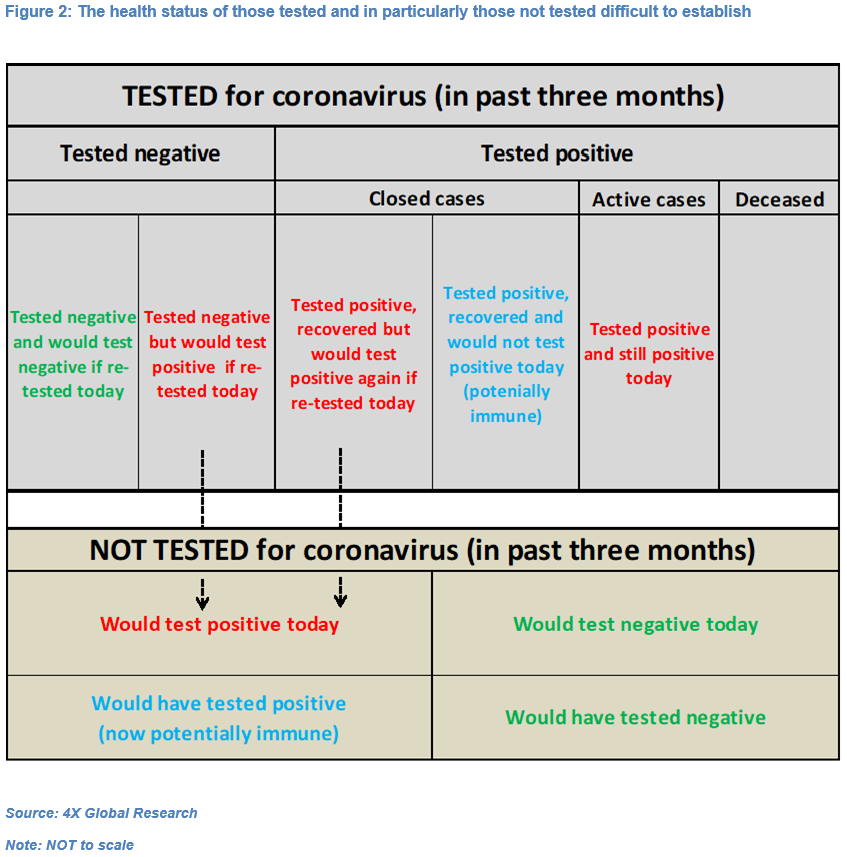

- The coronavirus outbreak is now three months old but governments, central banks, corporates and households still face a critical known unknown, in our view, namely the total number people who 1) had the coronavirus, acquired immunity and are no longer contagious and 2) currently carry the coronavirus and are thus potentially infectious.

- This includes people who have not been clinically tested – more than 99.9% of the world’s population. We estimate that only 3.3 million people (4 out of every 10,000) have been tested for coronavirus, although testing data are patchy and often released with a lag. The main reason so few people have been tested is the still limited capacity to rapidly and reliably test a very large number of people.

- In econometric terms that is a very small sample from which to extrapolate country-wide trends. One implication is that the actual mortality rate may be far smaller than reported.

- The high number of tests-per-capita conducted in countries such as South Korea has been posited as an explanation for their relatively low number of coronavirus-related deaths. However, other factors have likely been at play, including the timing of clinical tests, demographics, national health systems’ capacity to treat infected patients and the timing and efficacy of self-isolation and self-distancing policies, including country “lockdowns”.

- For now what policy-makers know they don’t know will likely continue to influence country-specific containment plans, as well as domestic measures to support economic growth while ensuring the functioning of financial markets.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022