Fixed Income Research & Macro Strategy (FIRMS) – 4X Global Research

- The consensus forecast is that GDP contracted in many major economies in Q1 and will most definitely contract in Q2 as a result of the negative impact of national lockdowns on supply and demand.

- The implication is that these economies will be in recession – defined at a country level as two consecutive quarters of negative quarter-on-quarter GDP growth.

- A number of major economies, including Japan, France, Italy and South Africa, already recorded negative GDP growth rates in Q4 2019 and may therefore have already been in recession in Q1 2020.

- Quarterly GDP data are typically released with a lag of at least a month and so we turn to other key macro variables, released weekly or monthly, to ascertain the magnitude of the current economic downturn.

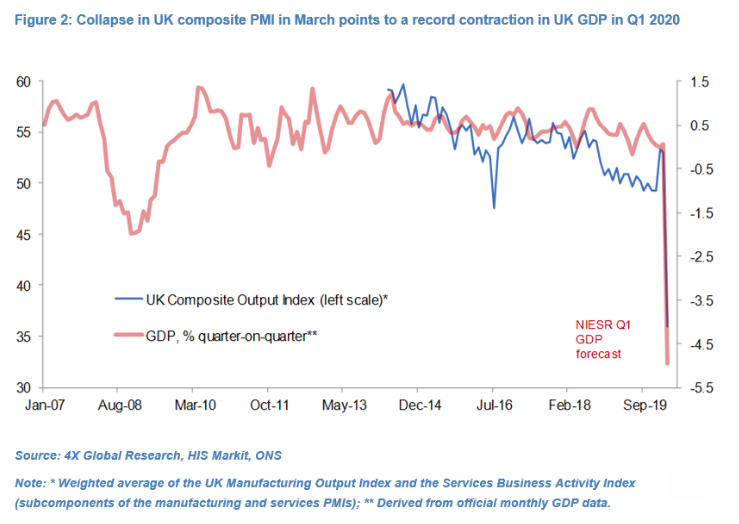

- In the United Kingdom, the collapse in the Composite PMI in March gives credibility to the National Institute of Economic & Social Research forecast that GDP shrank 5.0% quarter-on-quarter in Q1. To put this in context the largest quarterly contraction during the Great Financial Crisis was “only” 2.1% qoq (in Q4 2008).

- In the United States, the Atlanta Federal Reserve’s GDPNow tracker, a running estimate of the seasonally-adjusted annualised rate of US GDP growth in Q1 based on available data, stood at 1.0% qoq on 9th April.

- This number will likely be further revised downwards following the release of other key March data, including retail sales and industrial output (on 15th April), durable goods orders (24th April), goods trade balance (28th April) as well as housing data.

- The US Conference Board’s core scenario, which is certainly not the most bearish, is that US GDP will shrink 5.8% qoq (annualised) in Q1 and by a third in Q2 – three times more than at any other time since World War Two.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022