Fixed Income Research & Macro Strategy (FIRMS) from 4X Global research

- Forecasts of the scale of a likely global economic recession and the shape of the recovery often give little thought to the economic variables being measured or their timeliness.

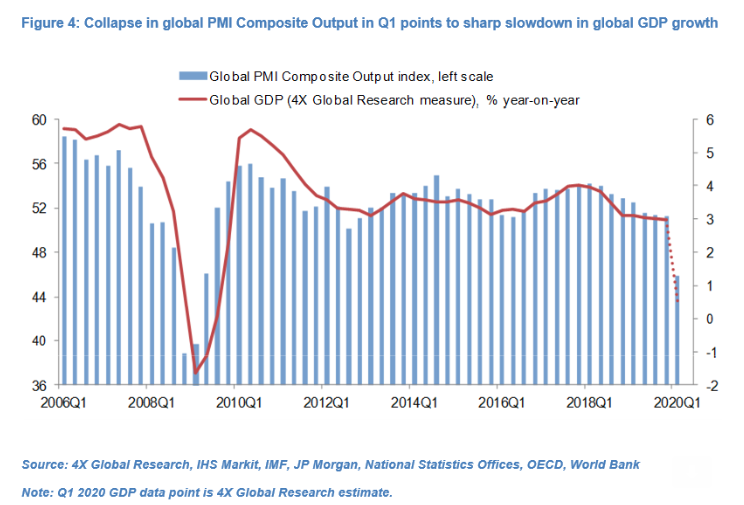

- Based on 4X Global Research’s own quarterly global GDP series and its correlation with the global PMI Composite Index, we estimate that global GDP growth slowed to about 0.5% yoy in Q1 from 3.0% in 2019.

- This would imply that global GDP contracted about 1.7% qoq in Q1 and 2.0% qoq when adjusted for world population growth. Moreover, industrial output likely also contracted.

- Therefore, based on the IMF’s definition of a global recession, it is very likely that the world was very much in recession in Q1 2020 for the first time since 2009. If our estimates prove broadly correct, global GDP in nominal terms was about $2.1trn lower than it would have been had real GDP growth been broadly unchanged in Q1 2020 at around 0.75% qoq.

- Moreover the risk to our GDP estimates for Q1 is to the downside.

- Based on GDP data from China, South Korea and Canada and estimates of GDP growth in the United States, Eurozone and United Kingdom – which account for half of the world’s GDP – global growth slowed from about 3.4% yoy in Q4 2019 to -3.1% yoy in Q1 2020.

- This would imply a quarter-on-quarter contraction in global growth of over 5% in Q1.

- The million Dollar question of course is what next. There is currently no consensus view on how global GDP growth will evolve in coming quarters, let alone years, beyond the belief – which we share – that global GDP will likely contract even more sharply in Q2 2020.

- Moreover, such GDP-focussed analysis does not factor in the unprecedented cost of fiscal, credit and monetary policy measures designed to curtail this contraction in GDP nor the drop in households’ net wealth – a theme which we will explore in our next Fixed Income Research & Macro Strategy report.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022