Fixed Income Research & Macro Strategy (FIRMS) from 4X Global Research

- The BEA will release tomorrow its first estimate of US GDP growth in Q1.

- Consensus estimate for the quarter-on-quarter seasonally-adjusted annualised rate of growth is -4.0%. If correct this would imply that growth in Q3 and Q4 2019 was effectively wiped out and that GDP in Q1 2020 shrank by annualised $200bn.

- The estimates span from -0.3% to -10% – an unprecedented range for a first estimate of US GDP of almost ten percentage points.

- 4X Global Research’s analysis suggests that US GDP growth in Q1 was close to the Atlanta and New York Fed estimates of about -0.3%.

- The most pessimistic estimate implies that growth suffered its greatest quarterly contraction since Q1 1958. Even the most optimistic estimate would represent the first quarterly contraction in six years and bring to an end the record-low volatility in US GDP growth recorded in recent years.

- While Q1 GDP data are now considered “old”, upon their release financial markets could be jittery, even if temporarily, if US growth is at the low or high end of this range of estimates.

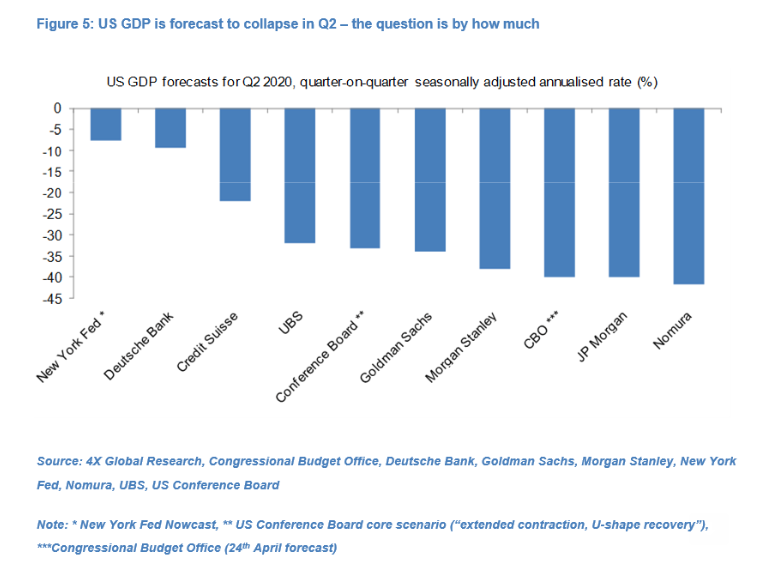

- There’s an even greater dispersion of forecasts for Q2. At one extreme the New York Fed forecasts that GDP contracted “only” 7.8%. At the other extreme a number of major investment banks as well as the Congressional Budget Office forecast that the US economy will contract a record 40%.

- Assuming GDP contractions of 4% in Q1 and 35% in Q2, we estimate that real US GDP would be lower than in Q4 2019 by an annualised $1.86 trn – roughly equivalent to the annualised GDP of the state of Texas, the second largest US state as measured by GDP.

- The divergence in forecasts for Q3 GDP growth is also great but the consensus forecast is that it will be positive, with a number of investment banks forecasting double-digit growth. The broad assumption is that US social distancing measures will be eased in coming months but in all likelihood these forecasts will be revised again between now and October.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022