Fixed Income Research & Macro Strategy (FIRMS) from 4X Global Research

- Chinese GDP growth (seasonally-adjusted) was 11.5% qoq in Q2. This was stronger than consensus forecast (+9.6% qoq) and more than reversed Q1 contraction of 9.8% qoq. This record-high growth reflects both a post-lockdown bounce in economic activity and of course extremely “favourable” base effects.

- This is pertinent for China but also its key major trading partners and global economy. China accounts for about 20% of world GDP in PPP terms and thus growth single-handedly contributed about 2.3 percentage points to quarter-on-quarter global GDP growth in Q2.

- We estimate that in constant terms China’s GDP hit a record high in Q2 2020, was 0.6% larger than in Q4 2019 and only 2.2% lower than if GDP growth had continued to trend at 1.4% qoq. For GDP to return to “trend” in Q3 GDP growth would have to be about 3.7% qoq.

- In this scenario the shape of China’s GDP level would approximate that of a square-root (a broadly symmetric recovery). In comparison we expect the recovery in global GDP to resemble that of a hockey-stick (an asymmetric recovery) as most major economies likely contracted sharply in Q2 (Shape of Recovery: Square Root & Hockey Stick, 5 June 2020).

- Over the years analysts have queried the accuracy of official Chinese data, with the consensus view seemingly that they overstate the “real” pace of domestic economic growth. This remains difficult to prove (or disprove) in our view.

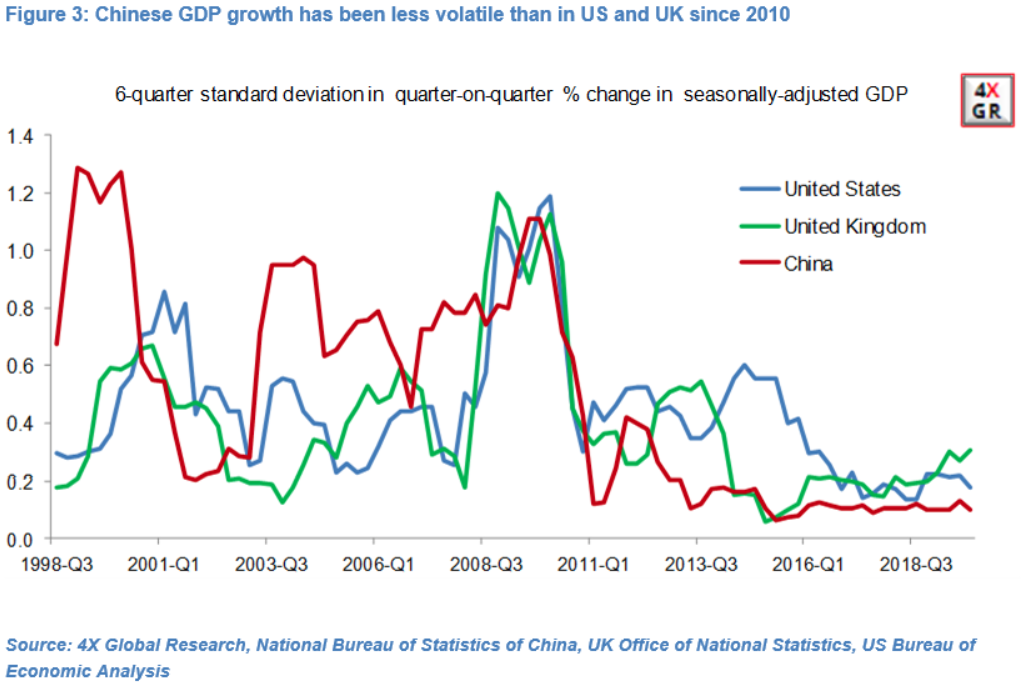

- In the past decade quarterly Chinese GDP growth has been steady and less volatile than in major developed economies, including the United States and United Kingdom, which has led to suggestions that Chinese GDP data are being “smoothed”.

- Chinese Policy makers could counter that they have more policy-levers at their disposal than their US and British counterparts and that GDP growth in China was far more volatile in Q1 2020 and likely Q2 than in the United States and United Kingdom.

- Our analysis suggests that official GDP data do capture the broad changes in the direction of Chinese economic growth. Notably unofficial manufacturing PMI data have historically correlated more closely with the official GDP than official PMI data have.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022