Fixed Income Research & Macro Strategy (FIRMS) from 4X Global Research

- The volume of retail sales – the value of the sale of goods adjusted for domestic inflation – rose a faster-than-expected 14% mom in June. In level terms UK retail sales were only 1% below the average recorded in the 12 months to February 2020.

- This points to a very rapid recovery in domestic economic activity, albeit from a low base, and tallies with the surge in the UK composite PMI from 30.0 in May to 47.7 in June. There were greater opportunities to spend on goods as the lockdown was eased and the government continued to pump billions into the economy to support employed and self-employed workers and those on benefits and ultimately disposable incomes.

- The corollary is that global GDP growth likely accelerated from 1.8% mom in May and we stick to our forecast of record-high growth of 10% mom in June. This would still imply that GDP in June was at the level which prevailed in late-2009 and that UK GDP contracted a record 20.6% qoq in Q2 according to our estimates.

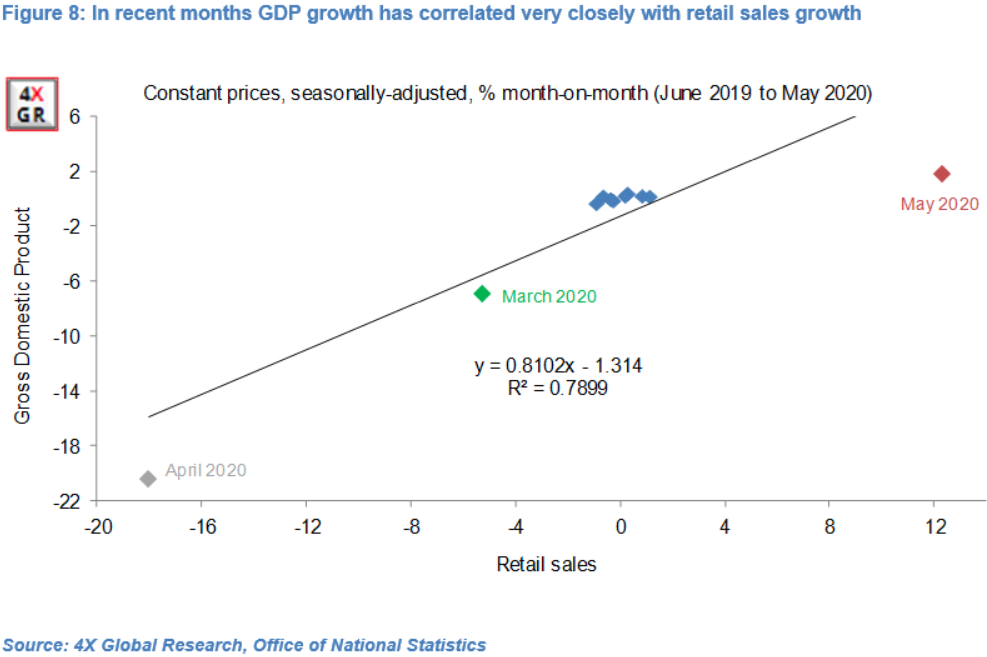

- In “normal” times UK retail sales figures provide a timely but only partial picture of economic activity. The historical correlations between retail sales and the broader measure of household consumption and between retail sales and GPD have been quite weak.

- This should come as no surprise as retail sales exclude the sale of services (three times as large as goods sales) and motorvehicles and spending abroad and thus only capture a fraction of household consumption, which in itself only accounts for “only” 60% of GDP.

- But these are not “normal” times. In the run-up to and after the introduction of the lockdown on 23rd March, households’ opportunities to spend on services and cars and to travel abroad were very limited, while fixed investment dwindled. As a result retail sales (sale of goods in UK) and GDP contracted and recovered in lock-step in February-May.

- The correlation between retail sales and GDP growth likely remained strong in June but may weaken slightly in July given the partial re-opening of the hospitality, leisure and entertainment service industries and pick-up in outbound travel from the UK. Over time this relationship will likely “normalise” but for now retail sales remain a timely and powerful indicator of headline GDP growth in the UK and a focus for market participants.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022