Fixed Income Research & Macro Strategy (FIRMS) from 4X Global Research

- The United States’ post-war record GDP contraction in Q2 of 9.5% qoq and the Dollar’s recent depreciation have been making headline news but some perspective is required.

- The US GDP contracted about 10.6% in H1 2020, far more than in China (+0.6%) and South Korea (-4.6%). However, of other economies which have so far released Q2 data – including the Eurozone’s four largest economies, Mexico and Singapore – all posted larger rates of contractions in H1 2020. The UK’s GDP likely shrunk more than twice as much whilst France (-19.0%) and Mexico (-18.3%) fared only marginally better.

- Moreover, GDP in the US outperformed in H1 2020 despite GDP growth in 2019 (+2.4%) being materially stronger than in Mexico (-0.1%), Italy (+0.3%), Germany (+0.6%), Singapore (+0.7%), the United Kingdom (+1.5%), France (+1.5%) and Spain (+2.0%).

- How major economies will perform in Q3 in the context of a rise in the number of local or national covid-19 cases and some countries having (partially) frozen or re-tightened national lockdowns is up for debate. The outlook for Q4, which for Western countries will mean colder weather and a potential increase in covid-19 cases, is even more uncertain.

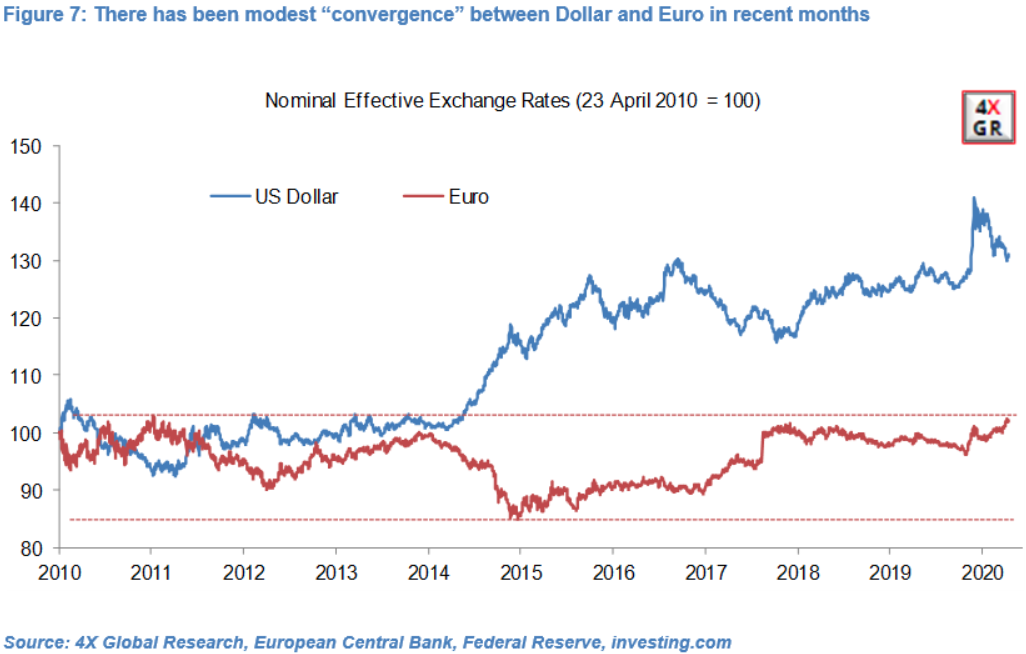

- The Dollar’s depreciation in the past six weeks from a strong level is mainly due to successful central bank policies to address imbalances in its supply and demand and a cyclical rotation out of Dollars into other FX reserve currencies, including the Euro.

- As a result, the share of Dollars in the world’s central bank FX reserves, which has hovered around 62% in the past two years, may have fallen slightly in recent months while the share of Euros (20%), Sterling (4.4%) and Swiss Franc (0.15%) may have increased marginally.

- However, we do not think that FX price action in the past couple of months, including the Euro’s appreciation to multi-year highs, points to the beginning of a structural and permanent shift in the currency composition of central banks’ FX reserves.

- In the same way that apocalyptic forecasts in the past about the Eurozone and Euro have failed to materialise, current forecasts of the Dollar’s demise as the world’s number one reserve currency are at best extremely premature, at worst unfounded in our view.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022