Fixed Income Research & Macro Strategy (FIRMS) – From 4X Global Research

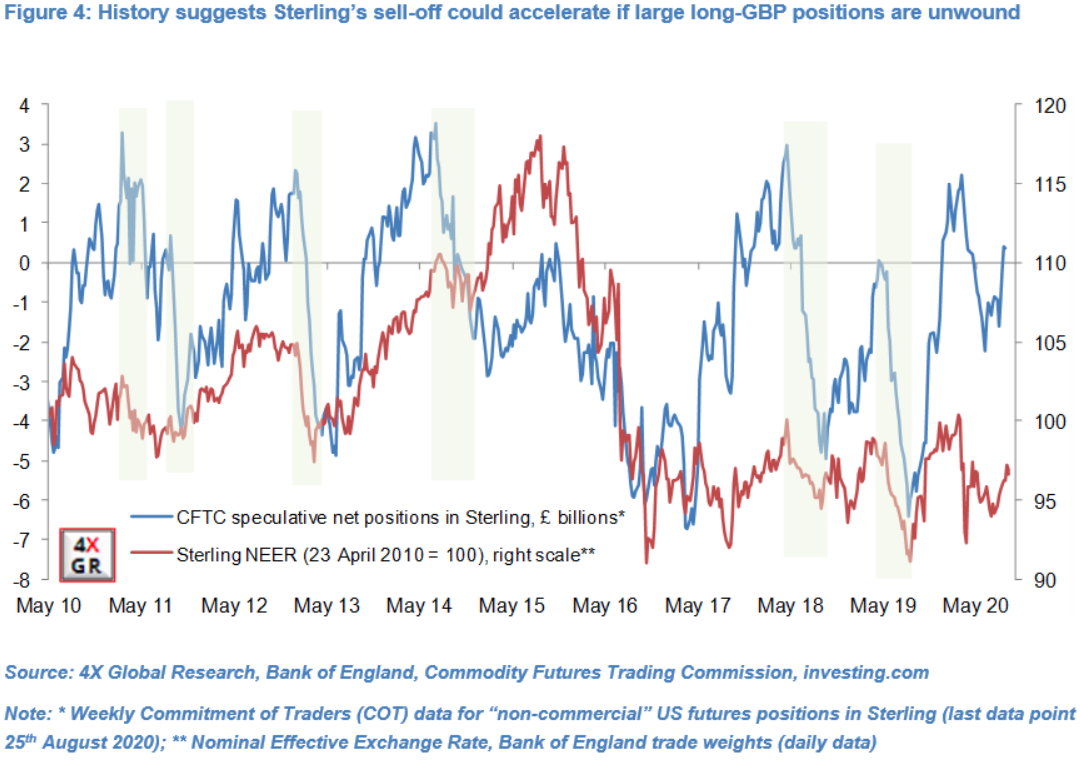

- Sterling has enjoyed a strong, if bumpy ride, since late-June. It has been the second strongest major currency against the US Dollar and appreciated 3.7% in NEER term, thanks in part to a build-up of speculative long-Sterling positions.

- Markets have seemingly taken heart from government measures to support the economy, including the labour and housing markets and service sector, the Bank of England’s so-far unflinching commitment to quantitative easing and the sharp rebound in economic activity in June-August.

- At the same time markets have seemingly ignored the British economy’s material underperformance relative to other major economies in Q2 and the government’s arguably incompetent and incoherent handing of the covid-19 pandemic.

- However, the economy faces a potential quadruple whammy in coming months of fiscal stimulus measures being unwound, a no-deal Brexit, higher taxes and a re-tightening of national lockdown measures in the event of the number covid-19 cases rising sharply during the winter months.

- This leaves Sterling vulnerable, in our view, particularly in the context of relatively elevated long Sterling speculative positions.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022