Fixed Income Research & Macro Strategy (FIRMS) from 4X Global Research

- Only four currencies have appreciated by more than 4% versus US Dollar since end-July: the high-yielding South African Rand (4.6%) and Mexican Peso (5.8%), the Chinese Renminbi (4.4%) and Korean Won (5.2%).

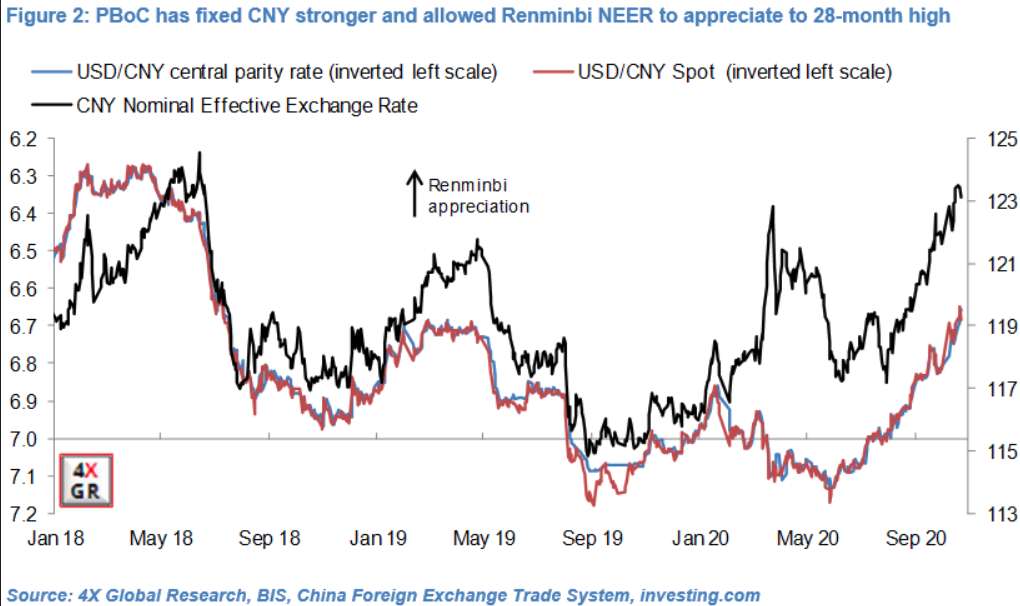

- The Renminbi’s steady pace of appreciation will, all other things equal, put further downward pressure on Chinese headline CPI-inflation (1.7% yoy in September) and dent export competitiveness. This has led to growing speculation that the People’s Bank of China (PBoC) could take (potent) measures to reverse the Renminbi’s climb.

- We have greater sympathy with the more benign near-term view that the PBoC is more likely in a first instance to slow the pace of Renminbi appreciation and ultimately arrest the currency’s climb.

- For starters the more relevant Renminbi Nominal Effective Exchange Rate has only appreciated 4.1% in the past three months, with its current monthly pace of increase (about 1.5%) commensurate with its historical pattern.

- Moreover, the PBoC is after all facing considerable speculative FX inflows and foreign direct investment into China, attracted by China’s economic outperformance, and a rising merchandise trade surplus spurred by a surge in export growth.

- Beyond the 3rd November the Renminbi’s path is clouded by the outcome of the (still uncertain?) US Presidential elections but precedent suggests that the PBoC will want to keep its currency on a tight leash.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022