Fixed Income Research & Macro Strategy (FIRMS) – 4X Global Research

- The Dollar has treaded water in the past three months, in line with our benign view that “forecasts of the Dollar’s demise as the world’s number one reserve currency are at best extremely premature, at worst unfounded”.

- Our fundamental perspective is that a structural shift out of Dollars remains unlikely near-term, regardless of the outcome of the Presidential and Senate elections on 3rd November.

- One reason is that other major reserve currencies such as the Euro, Sterling and Canadian Dollar – which account for a large share of the Dollar Nominal Effective Exchange Rate (NEER) – face a number of headwinds unlikely to dissipate materially any time soon.

- Moreover, in the past week the Chinese Renminbi NEER has been broadly unchanged, in line with our forecast that “the People’s Bank of China” is more likely in a first instance to […] ultimately arrest the currency’s climb”.

- We acknowledge, however, that the outlook for the Dollar and equities in the days (and potentially weeks) following the US elections is shrouded in multiple levels of uncertainty, which has translated into lower not higher realized volatility.

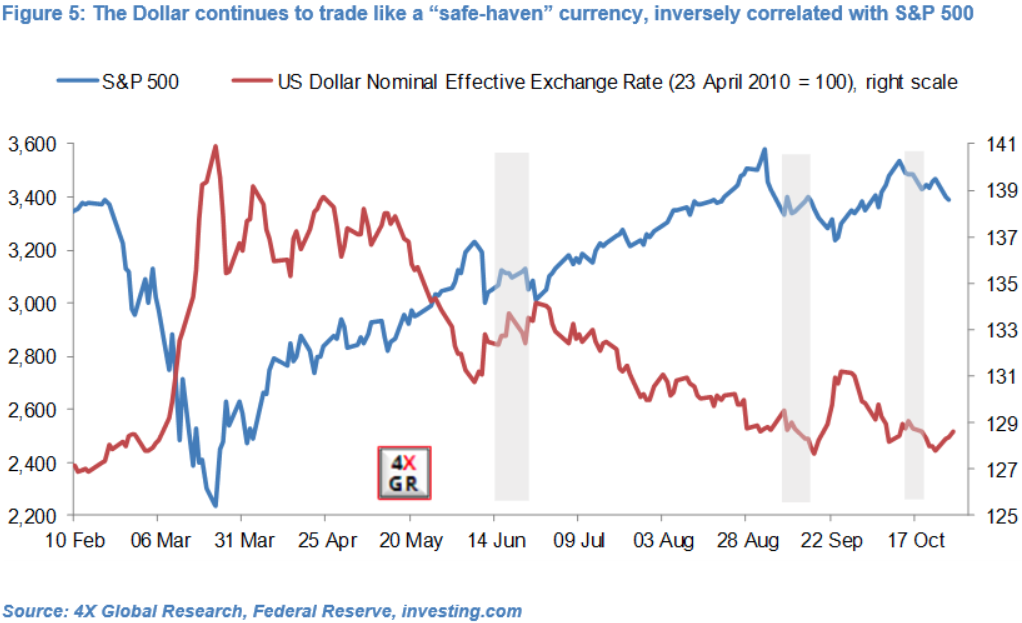

- Since February the Dollar’s underlying performance has largely reflected its “safe-haven” status, in our view, with the Dollar NEER inversely correlated with the S&P 500. However, this inverse correlation briefly broke down in June, September and mid-October.

- Our view is that an over-whelming victory for either candidate on 3rd November is more likely to buoy global risk appetite and thus weigh on the Dollar. Conversely, if the election result remains open-ended for a few days (or longer), uncertainty could weigh on market sentiment and perversely see the Dollar appreciate and market volatility tick up.

- The Dollar NEER has on average in the past decade been strongest in the month of November (+1.1%), but this is partly skewed by the Dollar’s 2.6% gain in November 2016. Moreover, monthly seasonality has, somewhat unsurprisingly, broken down this year and historical patterns are of little help in ascertaining how the Dollar may trade next month.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022