Fixed Income Research & Macro Strategy (FIRMS) from 4X Global Research

- Barring another dramatic twist in an already torturous two months of political upheaval, Joe Biden will find a very full in-tray when he settles into the famed Oval Office in eight days time. The two most pressing issues which he will need to resolve are arguably the Covid-19 pandemic and the associated impact on already tepid US economic growth.

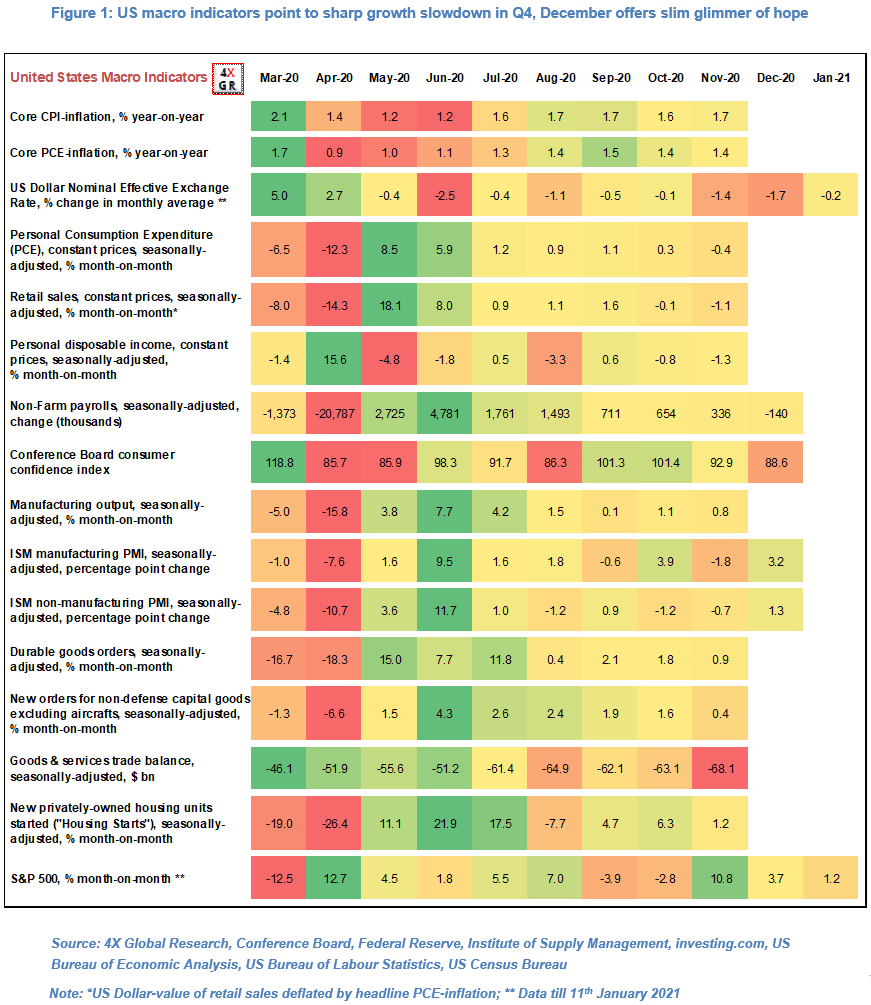

- The overall picture is one of less confident US consumers faced with a decline in personal disposable income having cut their spending on goods and services (see Figure 1). Corporates confronted with declining demand have slowed their hiring and in December shed labour while domestic investment growth has slowed to a trickle.

- Despite the Dollar’s slide since May, the goods and services trade deficit hit an all-time high of $68.1bn in November as a result of a collapse in US exports, a clear stain on President Trump’s track record given his penchant for protectionist measures.

- ISM manufacturing and non-manufacturing PMI data for December offer a glimmer of hope, with both having risen at their fastest rates since July. Nevertheless the rate of annualised, seasonally-adjusted quarter-on-quarter GDP growth in Q4 was likely significantly slower than the all-time high of 33.4% recorded in Q3 and potentially negligible, in our view.

- This has not stopped US equity markets from rising to new-all time highs but these wealth gains have likely been very unevenly distributed.

- Biden’s administration will face many challenges but also has a reasonably strong political platform from which to launch and fine-tune its policies. The Democratic Party has a majority in both houses of Congress (albeit by the slimmest margins in the Senate) and the US economy should in theory benefit from the recently approved $900bn stimulus package.

- However, the near-term outlook for the US economy remains lacklustre in our view. The fiscal stimulus package is a fraction of the $2.2trn (10.6% of GDP) CARES Act which came into effect in late-March and the US cannot escape weak global growth. Finally, tougher social distancing measures would likely weigh on US economic growth.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022