Fixed Income Research & Macro Strategy (FIRMS) from 4X Global Research

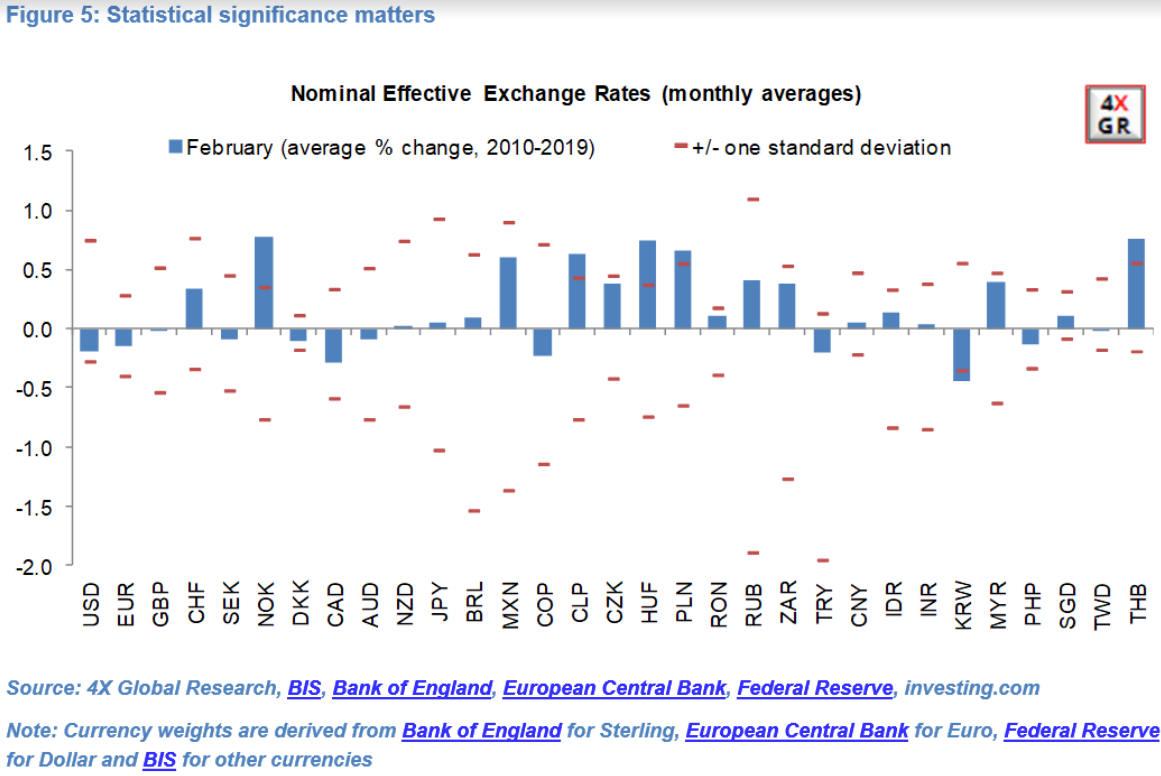

- This report updates the monthly seasonal patterns of 31 major Nominal Effective Exchange Rates (NEERs) going back to January 2010, using over two million daily data points with trade-weights derived from the BIS (April 2019) and national central banks (see Nominal Effective Exchange Rates: Monthly seasonal patterns, 10th January 2019).

- A number of factors can drive currency seasonality, including underlying seasonal patterns in balance of payment flows, the timing of public holidays and market liquidity. Identifying monthly seasonal patterns and why they may break down (significant changes in central bank or government policy, market positioning, macro data surprises and unexpected domestic events) can thus potentially augment investment returns and generate alpha.

- Unsurprisingly the Covid-19 pandemic – a once-in-a-lifetime “black swan” event – and accompanying measures such as national lockdowns severely disrupted typical monthly seasonal currency patterns in 2020, particularly in March and June (the trough and peak in global risk appetite) but also in Q4, with a few exceptions (see Monthly currency seasonality: Down and out?, 4th January 2021).

- Central European and Latin American currencies, which outperformed in November, have underperformed in past five weeks. Emerging Asian currencies, including the Chinese Renminbi, have done little since 10th December pointing to still active central bank FX management. This price action has broadly tallied with our near-term view that EM currencies will be “prone to sharp sell-offs (even if short-lived)”.

- A number of emerging and developed market currencies continued to deviate from their 2010-2019 historical patterns in January 2021. In particular the “normally” strong Brazilian Real and to a lesser extent Colombian Peso and Polish Zloty depreciated. The Swiss Franc, contrary to history and in line with our forecast, also weakened slightly. The South African Rand depreciated 2.1%, five times as much as its 11-year historical average.

- Conversely the “normally” weak Turkish Lira was the outperformer, with the NEER appreciating nearly 4%. Sterling, the Australian Dollar and Norwegian Krone also outperformed in January relative to their historical seasonal patterns.

- However, and while early days, about 17 currencies, including the Dollar, Euro, Kiwi Dollar, Mexican Peso and most Asian currencies performed in line with their historical seasonality.

- Based on 2010-19 data Thai Baht, Norwegian Krone, Hungarian Forint and Polish Zloty were strongest currencies in the month of February while Korean Won was the weakest.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022