Trading preview of the US CPI data today

Both CPI and Core CPI are expected to jump again. CPI is expected at 4.7% vs 4.2% pr y/y. Core 3.4% exp vs 3.0% pr y/y.

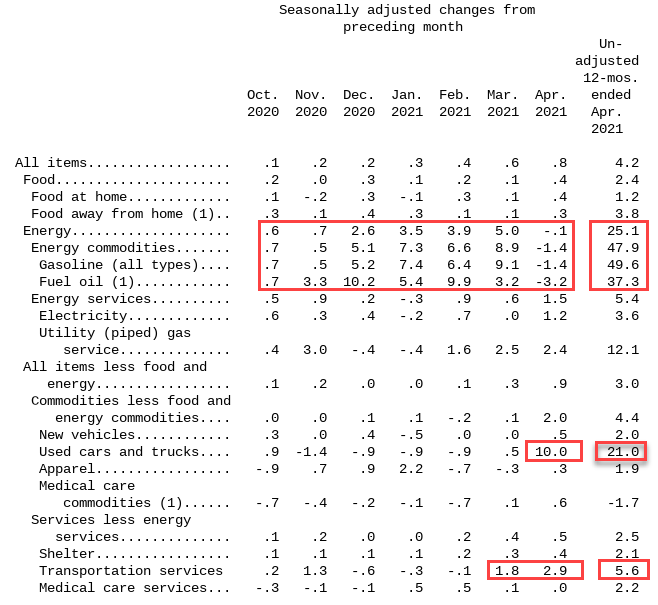

Obviously energy inflation is a big part of any inflation data and that stands out clear enough in the headline CPI.

In the core (CPI ex-fuel/energy/food etc), the rise is being put down to some particular items, used cars, transport and travel services, so this is likely going to get a lot of attention on the “transitory” side. If the core isn’t as hot as expected, and these components look to be behind that then the Fed potentially win their transitory argument, for today. The worst outcome for the Fed is that these items come out lower but the headline core stays up. Whatever happens, it’s the fine print that will be important.

The market is climbing all over this CPI report and I’m not sure why (could be boredom). We’re hearing about this big unwind in inflation (and thus Fed) expectations but it’s happening very quickly. I don’t know if that’s a result of goldfish thinking, the trade not going as far as expected so traders are getting cold feet but it smacks of short-term thinking. With something like inflation, you can’t trade a long-term position with short-term thinking. Inflation can take months to tell the full picture. That’s not to say I’m judging what folks are doing but that this sudden unwind it doesn’t make sense to me.

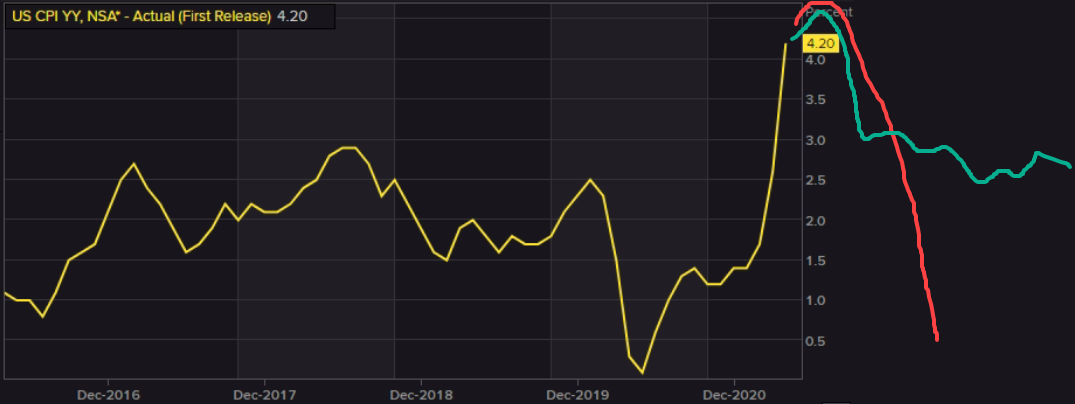

If we look at the charts we can see that rising inflation isn’t a temporary thing. However, we do have to acknowledge that it’s come off a big negative event, and we also need to acknowledge that there are transitory factors at play.

It seems as if that today, the market thinks that inflation is going to peak and then nose dive (red line), where in reality, we may blow off a top, then see a bit of a sharp drop before things smooth out (green line).

The issue I have is how far away the top is before pulling back, and then how long “transitory” lasts for? I suspect it’s going to be far longer than the Fed and others expects. It’s very hard to cut prices once they’ve risen, without fundamental economic weakness that would drive prices lower normally. Economies are recovering so firms have a tail wind to raise prices into, and these are happening right through to the end of the chain, rather than staying nearer the producer/input end.

And that’s the issue at hand, how entrenched price rises become because if that happens, that then smashes the transitory theories.

The core can often become more important than the headline CPI number, for the fact it takes out the wild stuff like energy, and even I’m surprised how quickly that’s bounced as it usually lags quite a bit. That it looks like its gone parabolic does smack of temporary factors but again, it’s how long those last, and what level we settle at when/if they wash out?

Overall, I still think inflation is here for the long-haul. I still think the Fed (and others) are going to be forced to move quicker than they’re saying now but how the market trades all that in between is becoming a much muddier picture than normal.

For trading it, I think the market is looking for too many extremes right now, like it did with the NFP. Unless the data blows the expectations out of the water, I can see the current unwind of expectation trades continuing. I can even see a decent beat getting sold into as that unwind uses any better price moves to do just that. Of course, a miss would likely accelerate the unwind of expectations and we’ll see USD and yields suffer.

That makes the whole thing very strange because the market will be going against what it’s been getting behind these last few months, just when the data backs up that thinking 🤷♂️ But that’s markets for you. For me, I’ll keep in my USDJPY long trade and playing the longer-term game, hopefully avoiding this noise in between.

As always, good luck if you’re trading it, and stay safe.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022