Fixed Income Research & Macro Strategy (FIRMS) – 4X Global Research

- The Federal Reserve at its policy meeting on 16th June, whether inadvertently or by design, reset financial markets’ clocks.

- The dust has since settled somewhat, with US short-end and long-end yields, the US Dollar and S&P 500 trading sideways for the past couple of sessions. When looking at the past month, hawks, doves, bulls and bears can all claim at least a partial victory.

- The million Dollar question remains when the Federal Reserve will start tapering its asset purchases and hiking its policy rate. FOMC members will undoubtedly try to refine their thoughts in coming weeks, as will Chairperson Powell today in his testimony before the Joint Economic Committee.

- But the next big hurdle for markets is Friday’s release of PCE-inflation data for May. Markets in May glided past US inflation data releases largely unscathed, in line with our forecasts, but the financial landscape has undergone a paradigm shift in the past week.

- Our view is that that unless PCE-inflation in May surprises materially to the upside, US short-end yields may retrace somewhat and the Dollar give back some its recent gains – but this is admittedly not a high conviction call.

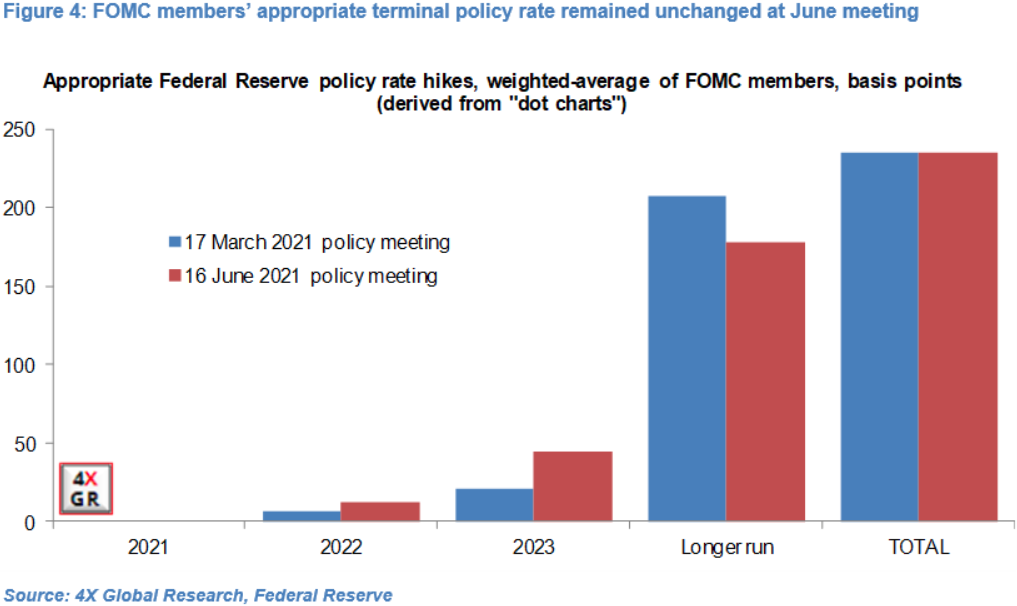

- The Federal Reserve’s anonymous dot-charts have their limitations but for now we are sticking to “our core scenario that the Federal Reserve will only start tapering its monthly asset purchases in 2022 and only start hiking its policy rate in 2023”.

- We also think that that the gap between the start of the taper and the start of the rate hiking cycle will likely be materially shorter than the 24 months gap in 2013-2015.

- Our next FIRMS report will focus on Sterling and Euro, which are drawn level as we approach half-time. Sterling has at the margin dominated the encounter in the past month, with the GBP/EUR cross currently trading around 1.168 – the upper half of a still depressingly narrow 18-week range of just 2.7%. We think Sterling will continue to slowly pull ahead in Q3 before losing steam in Q4.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022