Trading the Fed FOMC today is all about whether any news sets us up for a test of any of the well worn ranges

The window for Powell making excuses to not taper, or announce a taper is growing smaller and so price reaction risk is growing. The longer he leaves a taper message, the more disappointed the market will get, and the greater the reaction will be when he does. The Fed Volatility Vampires have done well to suck the life out of the taper trade these last few months but that only creates another problem now.

I’m sticking to my view that they will want some post-job support labour data under their belts before making a final decision, so I don’t see any taper starting until Q1 2022. As far as an announcement on their intent to start tapering, they could start setting that up from today and give themselves a decent lead-in into the new year but again, I think Nov-Dec is more likely, for the jobs reason.

And then we move on to the rates question. That’s pretty simple. The more any dots come closer, the more possible upside USD & yield reaction we’ll get. I think if we only see a couple of dots change, that will have a limited reaction, so look for something like 3+ dots to move (per year).

As for the ranges;

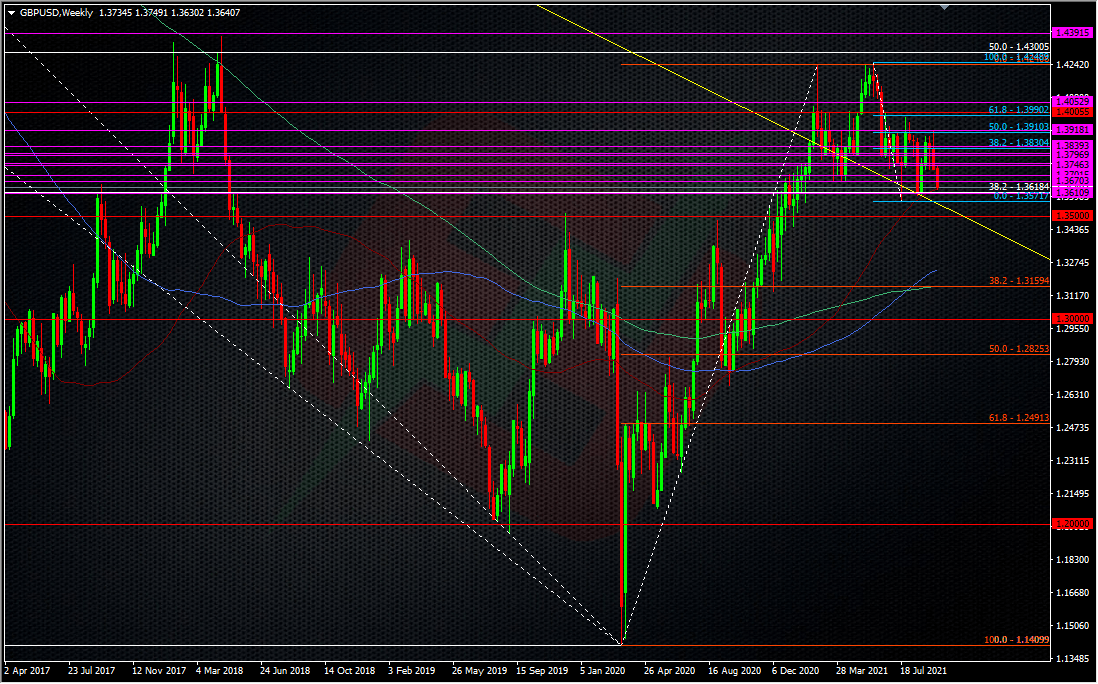

GBPUSD – Range is 1.35-1.40 (1.39 inside).

EURUSD – 1.15-1.20 is the main range, Inside we have 1.17-1.19 but as we’re close to 1.17, I won’t be trusting that, so will be watching the Sep/Nov 2020 double bottom around 1.16.

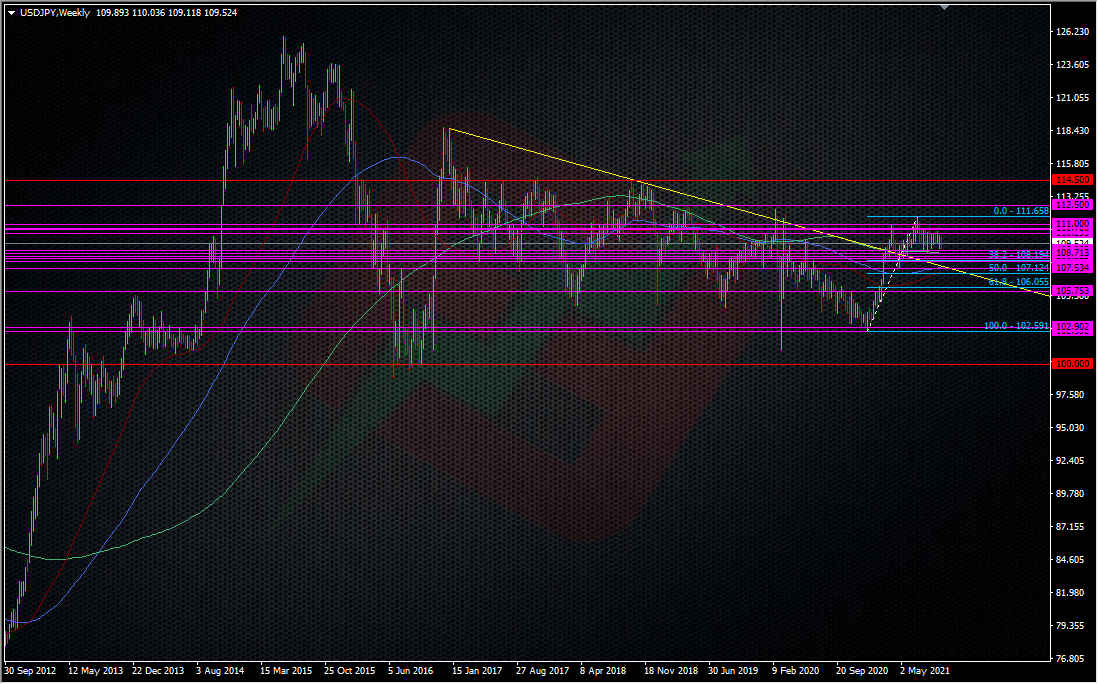

USDJPY – Stuck in glue 109’s-110’s, inside 108’s-111’s. I’m long this on my LT trades so I will be watching closely any moves that take us to either end of the 108-111 range.

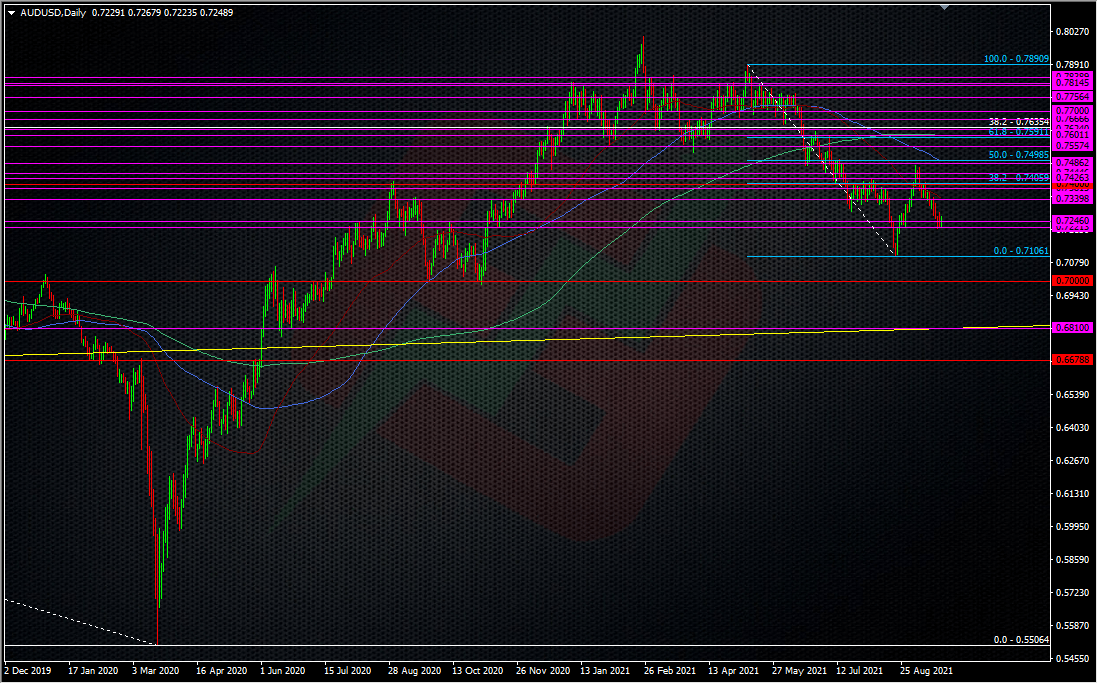

AUDUSD – 0.70-0.74 is where we’re at, and I’ll be looking at 0.71 if 0.72 breaks (0.70 being the big juicy level).

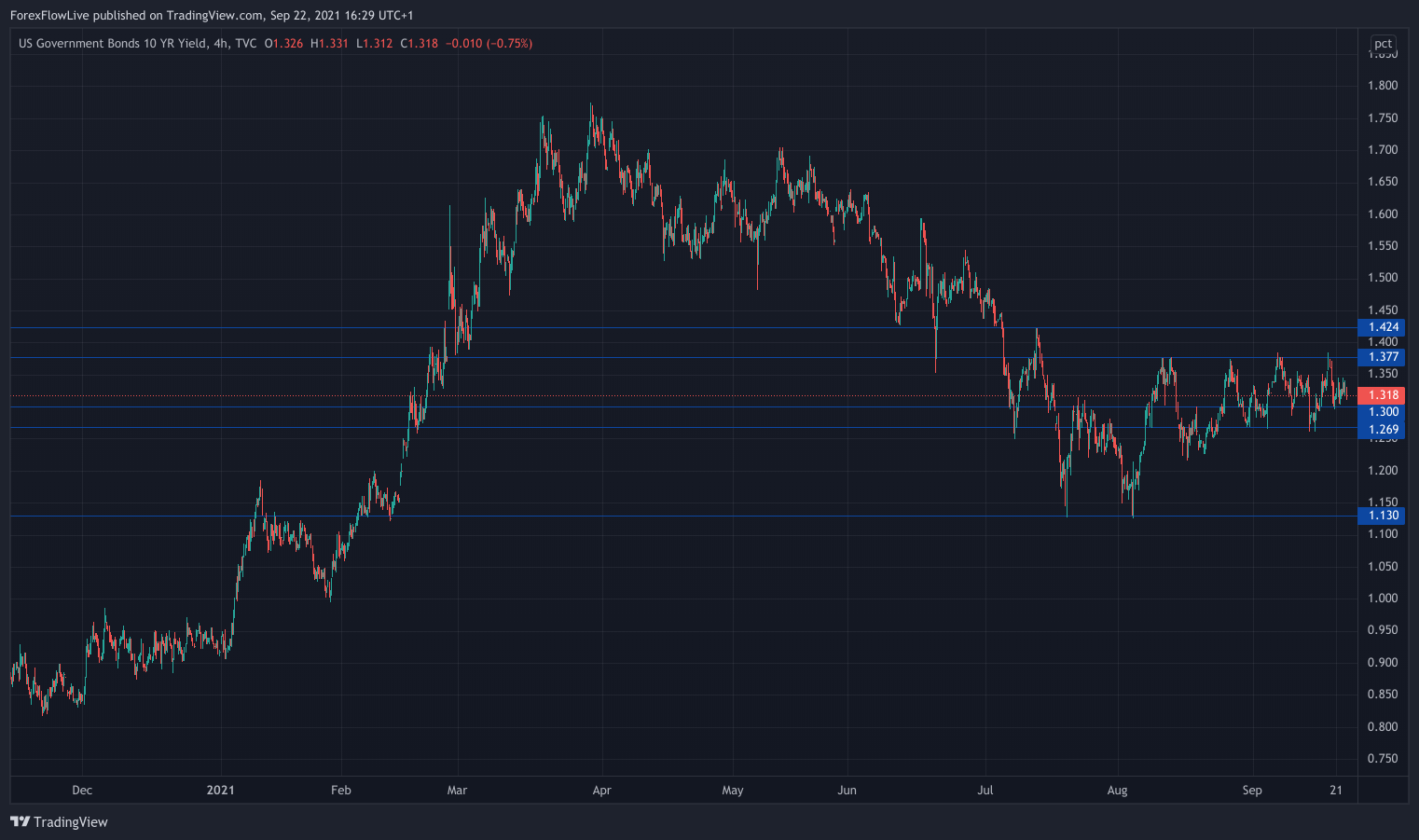

Bond yields will obviously be important and for 10’s, sub-1.30% will look very dodgy for USD, and on the opposite side, we need to see a proper sustained break of 1.38%, then 1.40%.

For big events like this you can go round and round and round the analysis and possible permutations, and that can mean 100 different trade possibilities. Or, you pick your wider levels, let the noisemakers do their thing, and wait for the price to come to you, rather than trying to chase it around with everyone else. Either the FOMC will be a game changer or it won’t. Either your levels will hold or they won’t, and so, you trade that accordingly.

As ever, good luck, KISS and trade safe.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022