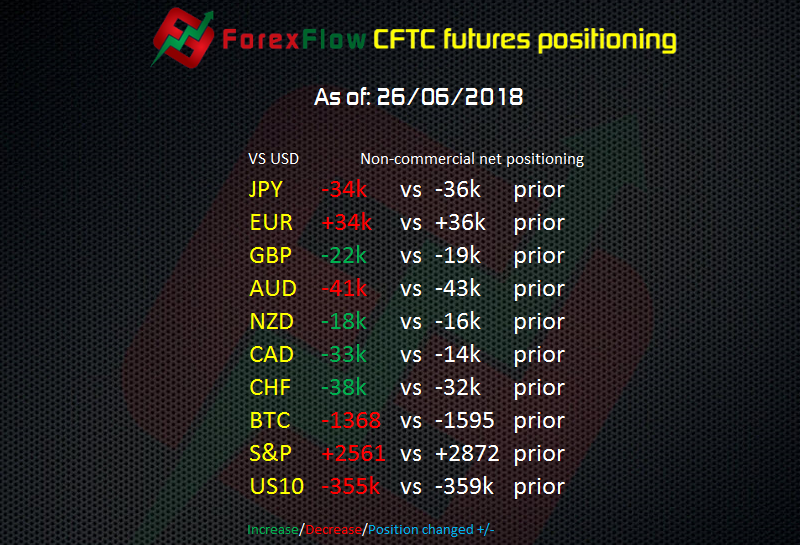

The Commitment of Traders net speculative positions report from the CFTC as of Tuesday 26 June 2018

- JPY -34k vs -36k prior

- EUR +34k vs +36k prior

- GBP -22k vs -19k prior

- AUD -41k vs -43k prior

- NZD -18k vs -16k prior

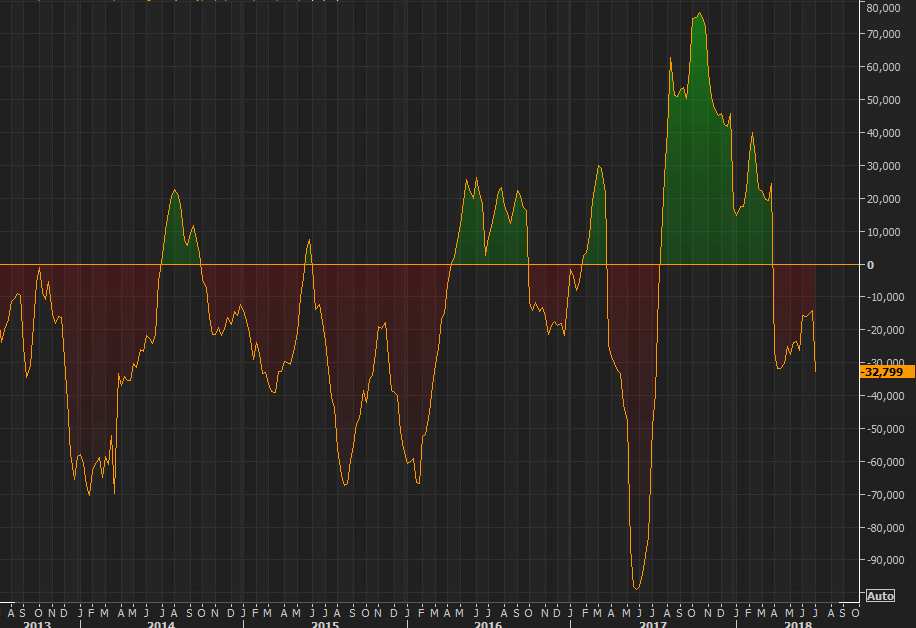

- CAD -33k vs -14k prior

- CHF -38k vs -32k prior

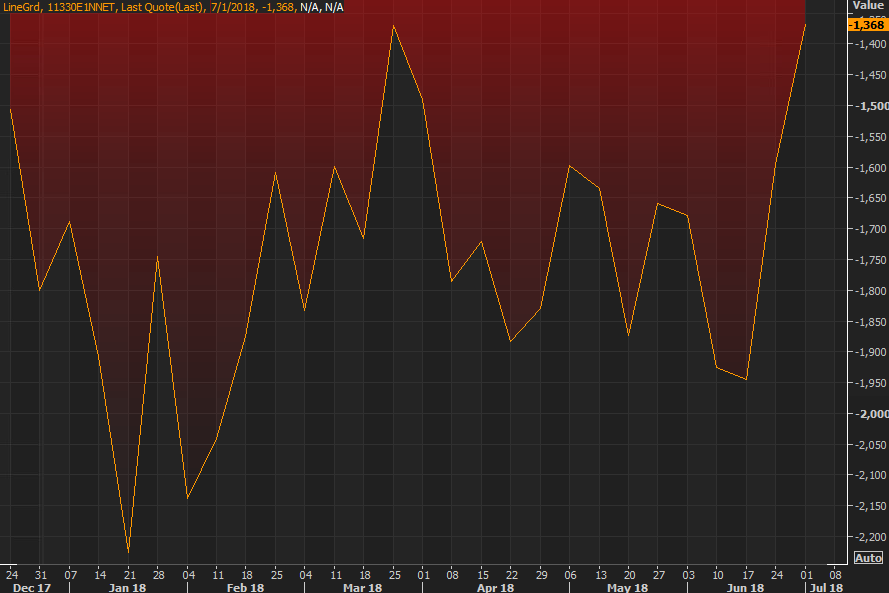

- BTC -1368 vs -1595 prior

- S&P +2561 vs +2872 prior

- US10 -355k vs -359k prior

A big jump for CAD shorts, and they’ve had it their way until today. Have/will they be hedging in options into the BOC in just over week’s time?

Bitcoin futures were just two futures short of the least amount of shorts since the contract opened back in Dec.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022