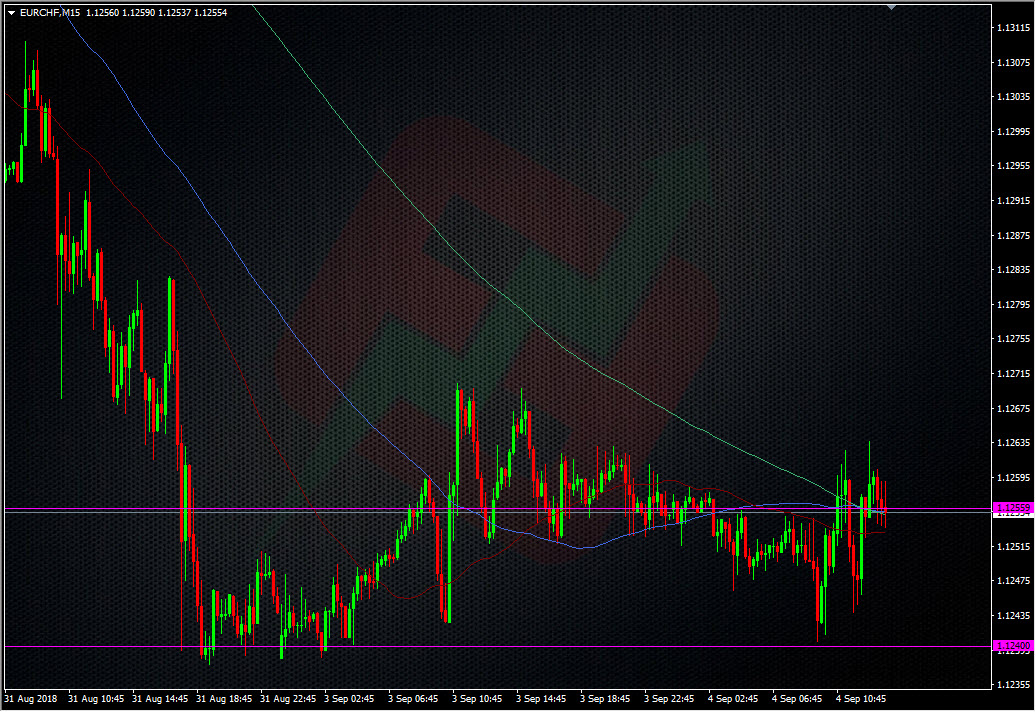

EURCHF looks like it doesn’t know what to do

I’m long EURCHF at 1.1260 as per my post last week but I’m not sure what I want to do with it. We’re up and down around the 55/60 support I leant against but there’s no signs of a bounce. Support is holding around 1.1240.

Part of the reason for the sideways action today is the gain in USDCHF vs the loss in EURUSD. It’s keeping it neutral. But, that in itself is a bit of a conundrum as the latest round of EM jitters should be causing a rise in safe haven pairs. Yet, once again seeing the US dollar as the main choice of flows for investors who see solid growth and rising rates. We could also possibly have the SNB sitting around the 40 level just warming the bids around there.

Whatever the reason, I’m wondering what to do with the trade. It’s not going to sit 1.1240-1.1260/70 for long and I really don’t know which way it will go. If the USD bid comes out while EM nerves still jangle, we could slip below 40, but if the EM’s take a breather, we could head back higher. I could try jobbing the 40 level while holding a core long, or try and scratch the 60 entry and try to catch it lower. That risks missing out on a move higher and I don’t think a break trade is the right strategy right now.

My provisional stop is just under 1.1190 and I had a view to add into 1.1200 but I may decide to swallow a smaller loss on a 40 break and then try again nearer 1.1200 (as long as the PA is favourable).

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022