With the Japanese new financial year underway, we’re starting to see some numbers on the flows

Japanese insurers have been reporting their investment intentions and this is what is going to be behind a lot of the moves in JPY. Here’s what we know so far;

- Sumitomo is going to raise overseas bond portfolios by ¥240bn ($2.15bn)

- Taiyo Life is looking at EUR denominated debt

- Taiju Life is planning to pump ¥35bn ($3.13bn) into (FX unhedged) foreign bonds

- Asahi Life is looking to increase foreign bonds by ¥150bn ($1.34bn)

- Nippon Life has around ¥1.6tn ($14.3bn) to invest and will look to increase foreign bond holdings (without FX hedging), domestic bonds and fully yen hedged foreign bonds using asset swaps,foreing stocks and real assets and will look to shoft into corp bonds and project finances from Treasuries with FX hedged US debt

Obviously being three weeks into April, they’ve probably been pretty active already, and indeed in our trading room we’ve been heard about insurers and investors hoovering up the dips USDJPY, but these folks also spread themselves out so flows have been steady. The unhedged exposure is an indication that firms don’t see a huge currency risk right now. If we do see any large moves in JPY, those unhedged positions might start seeing some hedging action and that will bring additional vol to JPY markets.

Trading wise, we can’t really front run anything or get into trades hoping that we get support from these guys but having the information does help us define the sentiment and market moves. We know USDJPY is well supported right now and we know that sellers are waiting to hit the rallies (this is the other side of the flow coin). All this information is defining why USDJPY ranges are so tight right now. On balance, the investment flows should see USDJPY more supported on dips than sold on rallies, which favours further upside, though it’s likely to be a crawl.

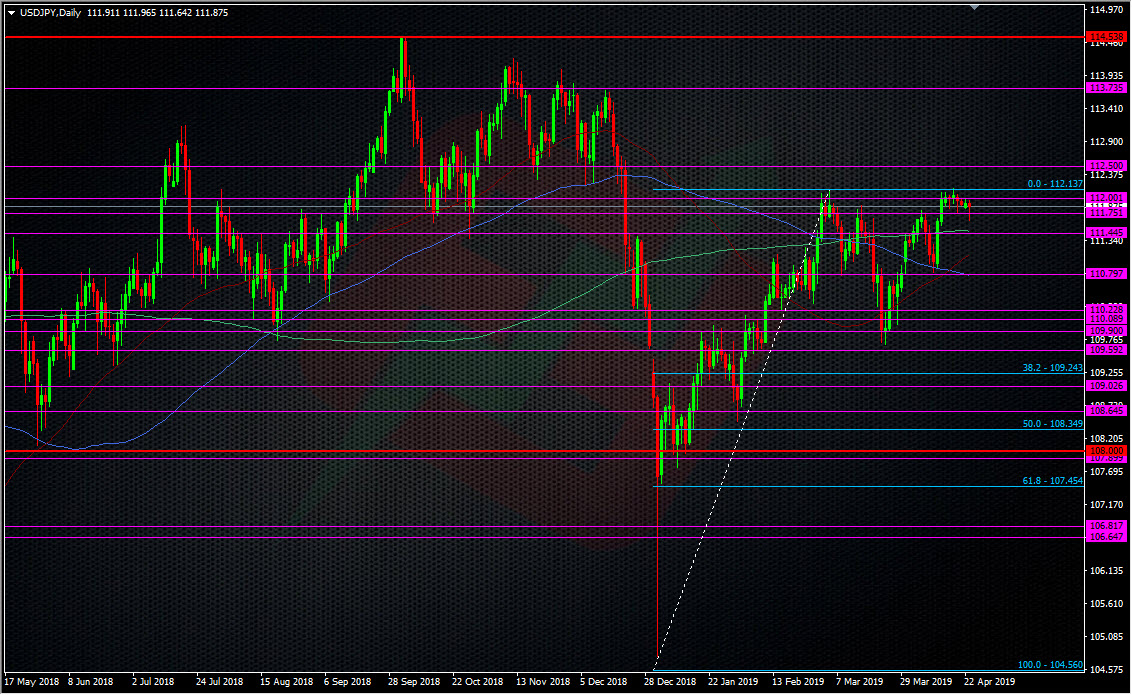

The line in the sand right now is around 112.00/20 and a break there will likely see these flow bids stepping up as support.

Tight shorts into 112.00/20 could still yield rewards but the more often we test it, the greater the chance it breaks. Dips down to 111.60/50/40 are going to be well received. All this is outside of whatever news and data we get in the meantime and we should also remember to factor in the long Japanese holiday coming up as these flows might suddenly stop or slow.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022