Fixed Income Research & Macro Strategy (FIRMS) – 4X Global Research

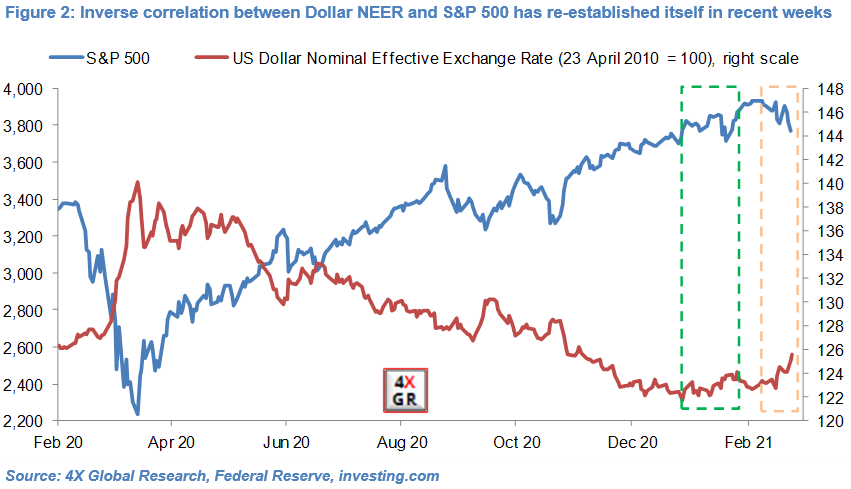

- The US Dollar NEER has since 12th February appreciated about 2.3% to a 4-month high and its inverse correlation with the S&P 500 (-4.2%) has re-established itself. This is in line with our forecast that the Dollar’s sell-off in early February was “a small, short-term correction” rather than “another prolonged downtrend”. If anything we were not bullish enough.

- We are also sticking with our view “that material Dollar depreciation may not resume for another couple of months, until it becomes clearer that a matrix of loose US fiscal policy but still low US interest rates will dent the Dollar’s attractiveness”.

- At the same time we think the slow start of the vaccination process in many major developed and EM economies could delay a meaningful rebound in global confidence and GDP growth and continue to act as a brake for emerging market currencies as a whole.

- Macro data indeed point to still weak global growth in early 2021, in our view. However, the significant build-up of private sector savings in developed economies offers the prospect of pent-up demand being unleashed once vaccination programs have matured and governments have materially eased domestic lockdown measures.

- Moreover, US economic activity – as measured by income and consumption – recovered in January-February, albeit from a low base, thanks in part to fiscal stimulus measures, a strengthening of the labour market and reasonably loose social distancing measures.

- It is early days but so far financial markets’ reaction to British Chancellor of the Exchequer Sunak’s UK Budget announcement on 3rd March 2021 has been pretty tepid.

- This is in line with recent years’ budgets, with Sterling, the FTSE 100 and UK Gilts moving little on budget day and in subsequent trading sessions, and in line with our forecast that this year’s “two-pronged transitional” budget would be no different.

- We maintain our view that policies largely outside of the Chancellor’s remit – particularly the relative pace of vaccination in the United Kingdom and by extension the likely timeline for a relaxation of still stringent lockdown measures and recovery in domestic economic growth – will continue to drive domestic financial markets, including Sterling.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022