September 2017 US factory orders and durable goods revisions 03 November 2017

- Prior 1.2%

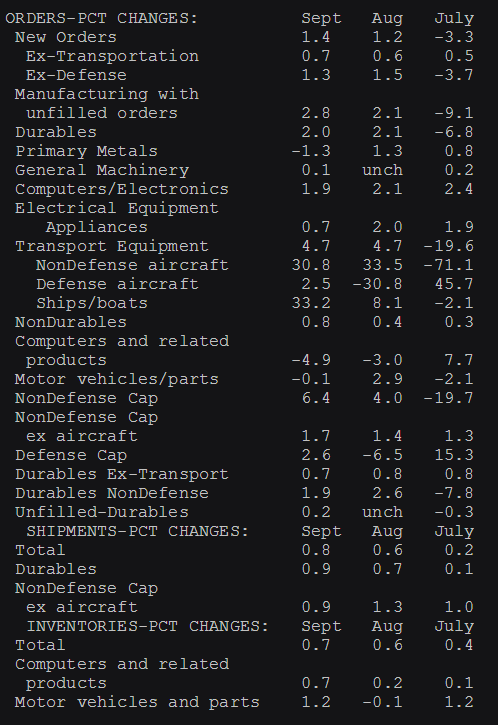

- Ex-transport 0.7% vs 0.4% prior. Revised to 0.6%

- Durable goods orders revision 2.0% vs 2.0% exp. Flash 2.2%. Aug 2.0%

- Ex-transport 0.7% vs 0.7% flash. Aug 0.7%

- Ex-Def 1.9% vs 2.0% flash. Aug 2.5%

- Cap goods orders non-def ex-air 1.7% vs 1.3% flash. Aug 1.3%

- Cap goods shipments non-def ex air 0.9% vs 0.7% flash. Aug 1.2%

Better numbers all round but was was interesting was that the dollar jumped vs EUR and elsewhere but for around a minute, minute thirty, the options players in USDJPY kept the price glued right at 114.00, and only now has it popped.

That’s not a bad way to kick the final quarter of 2017 off. Add in the services report, which is at the pre-crisis highs, it’s showing the US is cooking nicely.

As mentioned above EURUSD was the main loser to the dolalr and it matched yesterday morning’s low at 1.1625. USDJPY shook off the options and ran to 114.16 but is back down at 114.07. It’s been a big week so I’m wondering if we’ll start to see some profit takling as Europe heads out. Keep an eye on cable as the minutes roll on.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022