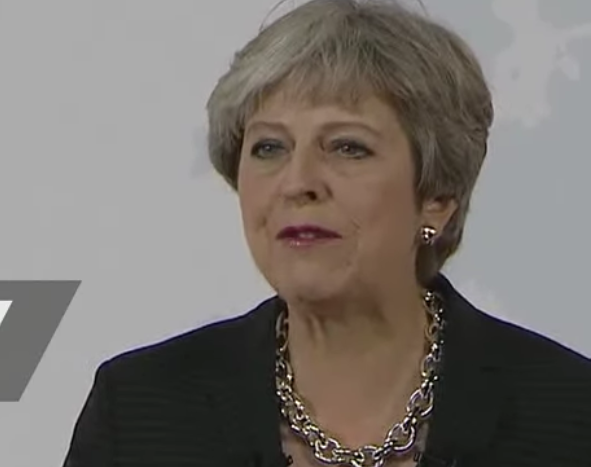

Mrs May spelled out her vision for the future UK/EU relationship in a keynote speech, aptly in the City of Renaissance, Florence, so what happens next?

The key takeaway from the speech was the transition period (TP) Mrs May proposed, which should last “around 2 years” she said, for business and people “to adjust in a smooth and orderly way”. The EU will likely demand that a transition period would need to see the UK remains under EU rules for the period. The EU initial negotiating stance will include for the UK to follow rules laid down surrounding the ECJ, (European Court of Justice) and free movement, therefore borders and possibly rules surrounding customs and trade deals. Trade deals which cannot be signed, sealed and delivered by the UK with prospective partners outside of the EU until the Transition period expires. All quite thorny issues, as are the Divorce Bill, border issues with Ireland and the ex-pats saga.

Markets for the time-being are likely to focus on UK, US, and EU data principally and divergence in cash rate expectations, to determine sterling’s fortunes in the near term as the UK still shows signs of slowing down. Against that backdrop, Moody’s ratings agency reduced the UK credit rating 1 notch, Friday of last week. This news will undoubtedly weigh on sterling but possibly, only for a short time, because it should not make borrowing costs for the UK government to increase more than a marginal amount.

Markets will look out for reaction(s) from other ratings agencies. They do like to wait for one of their brethren to make the 1st move, and markets reactions before responding if at all. Look out for the next Public sector borrowing requirements print for signs of borrowng stress.

Markets focus will also now be looking for when an agreement is likely to be made on the transition period, as proposed by Mrs May and an agreement on the “divorce bill” which Mrs May hinted at being around 20bln Euros (EU eyeing between 50 and 100bln Euros). When can this TP be signed, sealed and delivered?

The short answer is no one knows, however, generally speaking, opinions range from a few – 12 months, and so markets might start writing this in sooner than later. This (TP) is the key news to look for in the Brexit stakes and as leaks come out regarding negotiations, we can expect sterling to be affected. The TP is very market friendly. Good news signalling a timely agreement will be very positive for both sterling, Non-Euro (EU members) currencies, the shared currency and Scandis.

Therefore, UK data releases and TP news should be the premium for now. It would not be surprising to see the knee-jerk reaction to Moodys downgrade, negated by markets liking the prospect of the TP and some fairly conciliarity remarks already coming out after the May speech in Florence, so long as UK data does not overshadow by taking the downside generally.

Here’s how we finished the week;

- Cable finished the week at 1.34857 down from the weekly high of 1.36568

- UK Gilts yields finished the week: 2yr 0.447 down from the high of 0.473 but up from the low of 0.389,10yr 1.356 down from the high of 1.382 but up from the low of 1.283.

- DXY finished the week at 91.97 up from the open of 91.86 and up from the low of 91.22. Friday action in DXY opened at 91.94 post a slightly hawkish Fed last week and closed 91.97 in consolidation. A daily close above 92.50 is needed to resist more downside toward 91.

Data in the week ahead for Sterling: (GMT)

- Mon 25th 08:30 BoE FPC meeting minutes (mostly known but watch out all the same)

- Tues 26th 08:30 BBA mortgage approvals

- Weds 27th 10:00 CBI Distributive Trades Survey

- Donald Tusk, President of the European Council, due to visit Downing Street on Wednesday 27th.Time unknown

- Thur 28th 08:15 BoE Governor Carney speaks celebrating BoE 20 years of independence from Government and is expected to make closing statements on Friday around 14:45 GMT

- Fri 29th 08:15 GDP 2nd Estimate

This is one of a series of posts following Brexit. Click here for the prior post or click the authors name for all previous posts.

- Why is the Buck so strong? - May 2, 2018

- What have we on the board today? - April 18, 2018

- A time-tested strategy for account management - March 19, 2018