Both ideas are to take advantage of any possible CAD weakness going into the new week

Barclays announced a trade idea to buy USDCAD using call options. This got me thinking about other ways of selling CAD on selected crosses. I’m taking more of a technical view here, as i do not have a particular feel for CAD at this time, The strength in CAD across the whole spectrum of crosses since BOC raised the rate has been impressive and can’t be ignored.

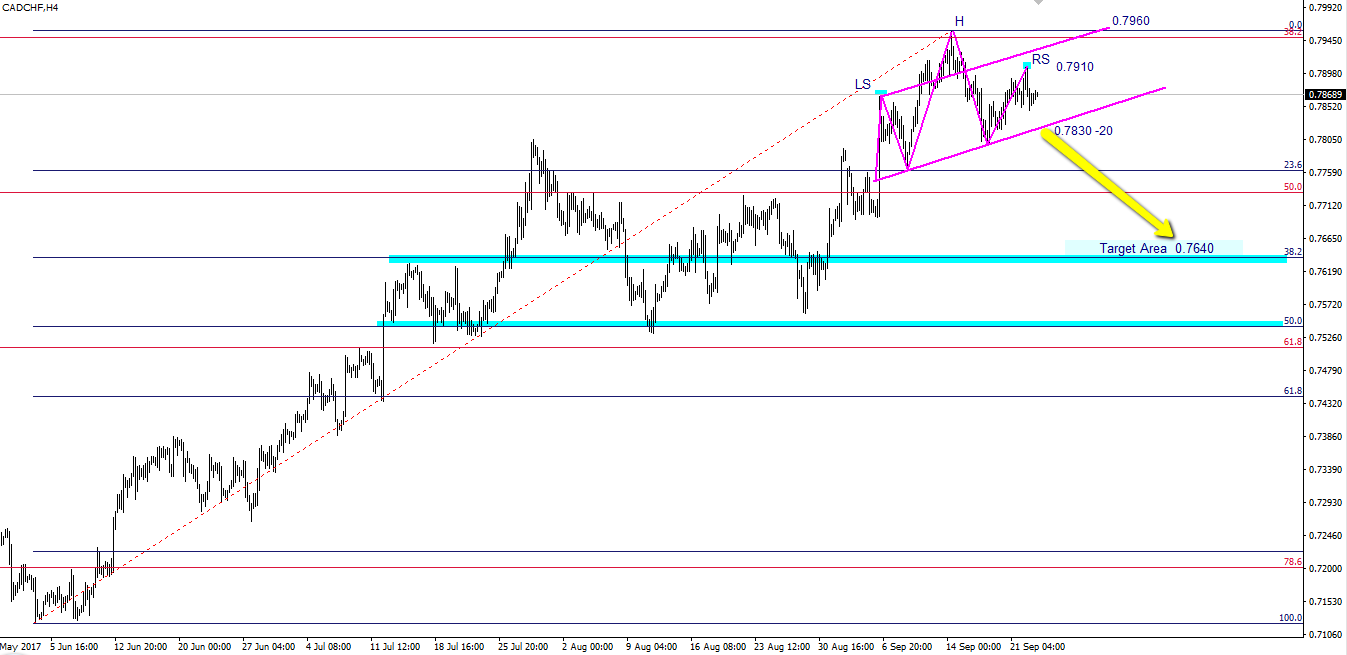

CADCHF-H4

Firstly CADCHF. Slanting head & shoulder set up with a measured move/ target area around the 38.2% of the June low. Any move up towards the ‘RS’ will also get me interested, with my stop loss at or above the highs (head).

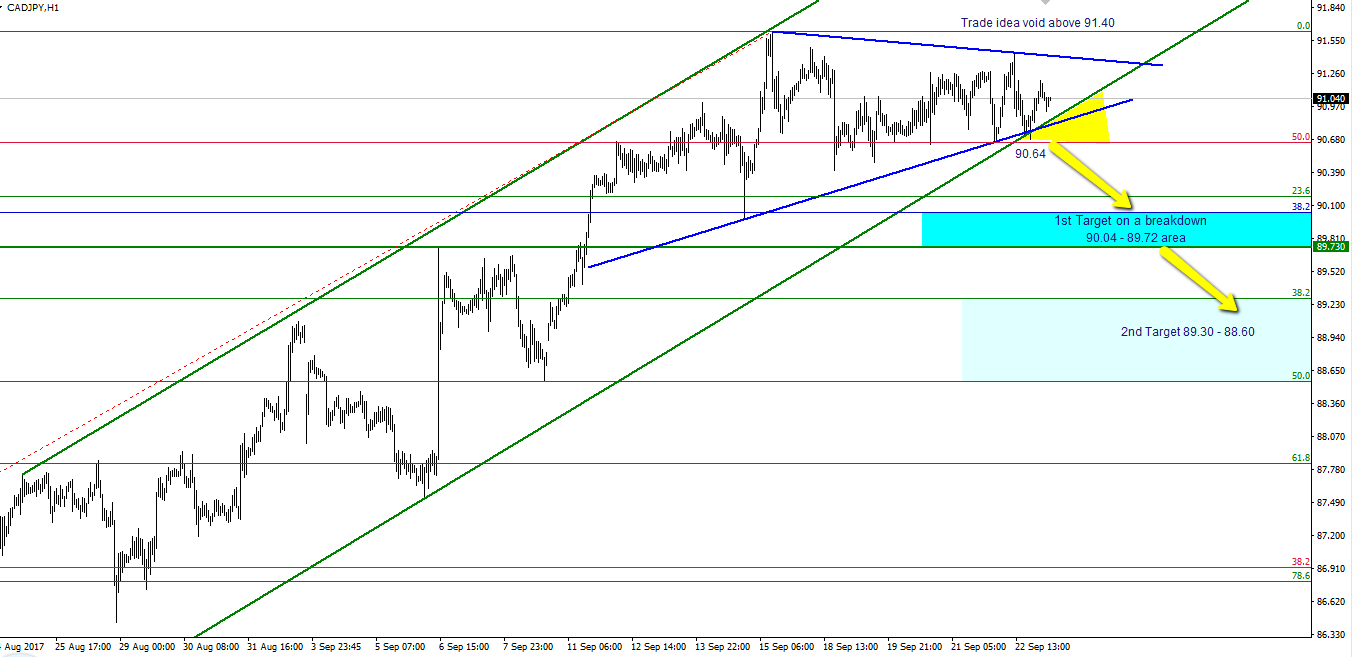

CADJPY-H1

Watching CADJPY for a short trade on the failure to hold the channel and the 50% of the Dec 2014 – Nov 2016 high/low.

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019