The European session has swung into action with broad USD strength

We’ve had further headlines about the Trump tax plans overnight and the buck has responded favourably. The key points from that are:

- A top rate of 35% of individuals

- Congress to decide on a new higher rate band for high earners

- 3 tax rates for individuals (12%, 25%, 35%) vs 7 currently

- Cutting corp taxes to 20% vs 35% currently

- Allow corps to write off Capex spending for 5 years

As always the devil will be in the detail and governments rarely give from one hand without taking with the other, so we’ll still have to wait until we get the full details before deciding hopw good this all might be. That won’t be until around 21.00GMT tonight when Trump speaks in Indianna, where he’s touted to announce all this officially. In the meantime, we can probably expect a raft of tweets from him about how great it all is and if they contain additional details, the market may move.

For now, the dollar is exerting som,e pressure on the fX space.

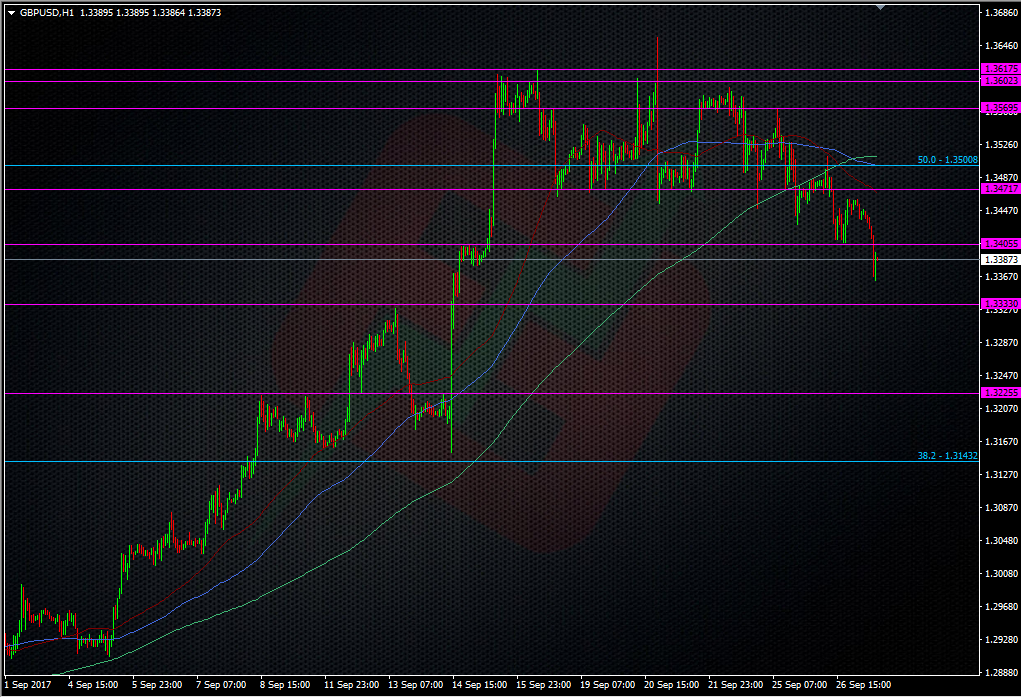

GBPUSD has broken under 1.3400 to 1.3362 low where it’s found support.

The support at 1.3360 is developing so we need to watch to see how further tests react. If it breaks, the next support is down around the 1.3330/40 are. That level also has the 100 H4 ma at 1.3329.

From here I’m watching how 1.3400/10 now behaves as if we test and hold there, we’ll head back down lower and resistance will be confirmed. We’ve already had a run to 1.3396 which has found resistance so it looks like it’s building already.

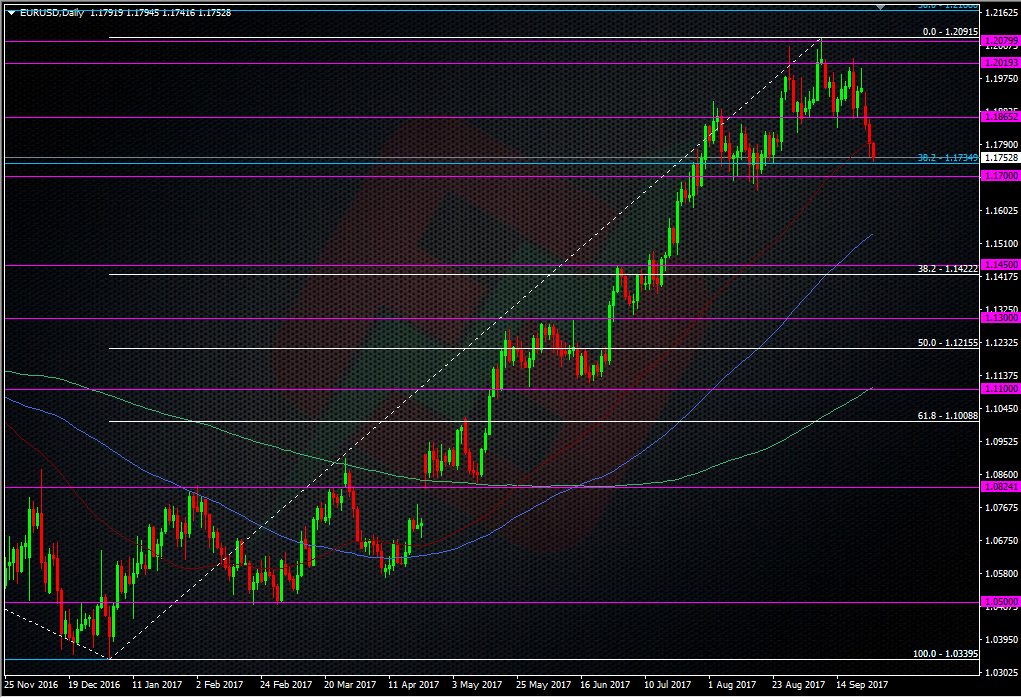

EURUSD has found some support around the 1.1740 level. It’s been an area around the old 38.2 fib of the 2014 drop that’s seen some action and most recentl;y support mid-Aug.

The low 1.17’s to around 1.1680/90 has been decent support in the rally and it has been a level I’ve had my eye on to take a long, both to add to my overal long position and for a shorter-term trade. As always, I assess any moves and reasons for why a market has moved to a level and right now, I’m a bit more cautious. The market is in the grip of Trump tax fever and that’s not a sensible environment to trade longer-term until we get the full details on the table. So that means patience for me until tonight, and we find out what’s what. However, that’s not to say we can’t trade the intraday levels in the meantime so I might still look at any further dips towards 1.1700 for a quick jobbing play.

Much like GBPUSD, we’re fiinding resistance at the prior break level, in this case 1.1760, so we’re in 1.1760/40 ping-pong mode.

The guys here at ForexFlow have had some great results with shorting the euro over the last few days and targets have already started to be hit.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Great numbers in there Ryan. I am looking at that 3330 level in Cable as well. feels good, looks good and could be good. See what markets think of the tax plans. Great trades coming along either way. Looking around various pairs, they seem to be moving to significant levels ahead of the great plan. That is market efficiency for ya.