In their latest excellent weekly FX report, Morgan Stanley have loaded up on AUDUSD shorts

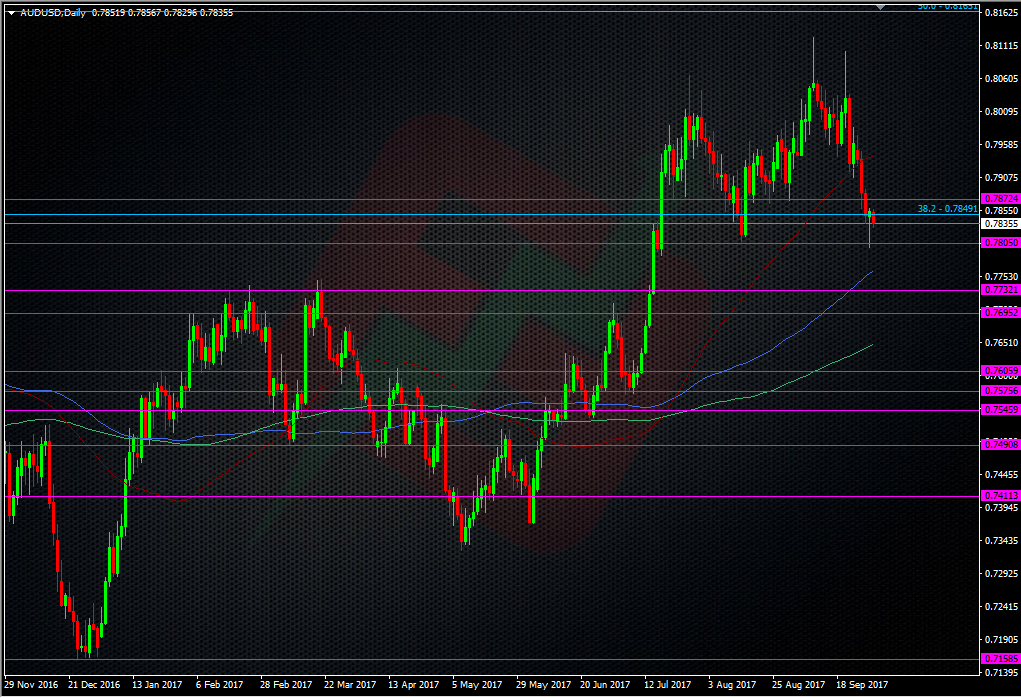

Morgan Stanley went short with a limit order at the New York close last night (that’s about 0.7850 by my reckoning). Their reasoning;

The rates market have priced in two RBA hikes for the next 12 months which we find to be overly aggressive given highly levered Australian households and weak medium and long-term fundamentals. We think it is worth fading against this breakout in Aussie rates and should result in a weaker AUD, if our view is correct. The AUD remains vulnerable to lower commodity prices, weaker data of China and higher rates in general. We think the Aussie rate should outperform relative to US leading the AUD/USD cross to fall. The risks to this trade come from continued strength in domestic data, a rebound in commodity prices and wider AUD/USD rate differentials.

They’re looking for 0.7500 with a stop at 0.7960.

For me, the target is quite a long shot but there’s no denying the trend at the moment. More short-term, the Aussie held the 0.7800 line, just, and that has the potential to see a strong double bottom put in against the Aug low.

The break of 0.7870/60 has already shown up as resistance after that low yesterday which bounced to 0.7860 before turning south again. The battle is on between there and 0.7800. Should the lows break then the low 0.77’s down to 0.7680/90 is going to prove a tough nut to crack.

What do you make of the trade and what will Morgan’s see first, their profit or their stop?

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

i am waiting todays decision to get in …. i dont trust aussies so waiting to get through this before “moving in”….

btw on the polls seems i am the only one agreeing with MS…. i would love to know who the other ones are….