Last major Central bank to wish us out of 2017

The decisions should be for no change again this meeting . Keep the YCC in place, the interest rate at -0.1% ,the longer term interest rats around zero %.Keep the JGB purchases at around 80 Trln JPY, ETF target at 6 Trln and REIT’s at 90 Bln JPY . The vote should be 8-1 again with Kataoka dissenting to do more on the 15yrs front to keep rates below 0.2%.

Anything outside this will be a surprise, which I reckon we won’t get just as of yet. Maybe no dissenting?

There’s for sure no need to do more,economic data have been good. Growth is picking up,results have been good, the business mood is up. There’s some case to screw back a little on the Bond/ ETF buying but I reckon any significant change in hard monetary policy numbers will wait as Inflation stays to low (but isn’t that the case all around the major economies). The other reason why I reckon we don’t get any change is timing. There’s the fresh Government stimulus plan to be put through and wage talks in Spring. Couple it to the end of Kuroda’s term as BOJ governor, my base case for now is we see no change in the effective monetary policy. Announcement time anywhere from 2.30-45 am gmt , most likely around 3.

The venom will be in the tail imo, that is during Kuroda’s press conference from 6.30 am gmt tomorrow morning. He did hint at BOJ’s reflection on how to screw back on easing back in November, only to try and wiggle his way back out of it in his next interventions. The effect was pretty immediate as that’s what the market is eagerly waiting for like kids for their Xmas gifts, only to slowly be reversed on the denials.

It’d be the first message something’s about to change, in Japanese tradition probably sloooowly. So would it be (unexpected) in the Monetary Policy Statement or (possible) Kuroda’s presser, be ready for a decent move once the market will have dissected any word, syllable, letter change. My base case is he’ll be very cautious not to send JPY spiralling higher, every word will be carefully weighed.

How to trade it? Here’s a few scenarios:

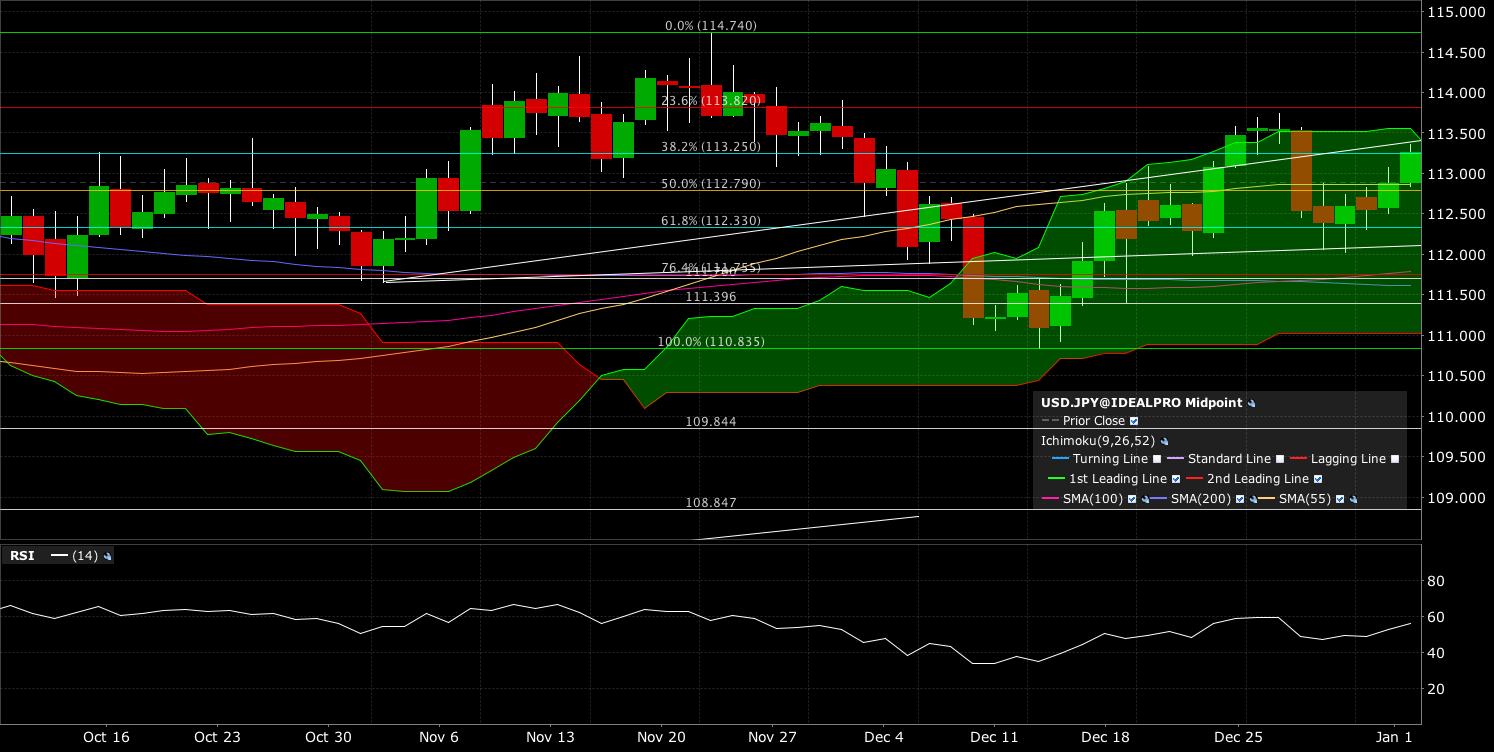

- No change, zip, nada in either the statement or the press conference: I expect USDJPY to continue the slow,steady rise as we seem to have selective USD demand vs the low yielders into the Yearend. Break of 113.40 TL resist, 113.54 top of the daily cloud and 113.80 fib for a move I would target around 114.75-115 towards yearend. Don’t forget we have big barriers around there,it’ll be a tough nut to crack. For those not liking to trade USD this time of the year, look at crosses , EURJPY for instance.EURJPY would then decisively break the 134.50 and aim for a yearend close of 138.65 , possibly even a 140 print , who knows. I don’t like GBP for the moment , I’ll leave that one alone.

- No change in MP, Kuroda hints at the reflection ongoing, but downplays the impact and not ready at all right now: I expect USDJPY to see a fast blip lower back to 112.30 or the support line around 112 which held solid twice this month, not sure we can see a break. That’ll depend on the yearend flows. My impulse would be to try and buy in between.Again , away from USD , EURJPY should find support 133.30/50 zone; I’d be inclined to buy that dip with a stop under 132.80.

- No change in MP, slight tweak in JGB or ETF buying ,Kuroda hints at advanced talks about ways to curb back on easing: USDJPY falls through 112to the bottom of the cloud at 111.05 and tries to find its way to 110, where the other side of the BIG barriers are sitting. It’ll be an as big nut to crack as the 115 imo, as we’ve seen on the last drop under 111 that bids started to hold it up pretty rapidly despite the market trying to put it lower. No USD? I will probably lean more towards GBP breaking back below 150 for 148-147.Or CHFJPY as SNB will be recognised to be the last major CB in negative behaviour territory. We could be looking at 110 in not to far a future.

- CH CH CH Chaanges (David bowie would be proud of me !) : Well if Boj moves and Kuroda puts up his most beautiful smile , it’ll be Armageddon. That’ll be the green light for massive JPY buying. I think in current overall situation in Japan as described above, we can rule this option out but I had to put it on in case all BOJ voters had their Bounenkai( yearend party but you’re all fluent in Japanese right) with far to much sake .

I’m firmly in the first 2 options camp for today .

For 2018 there will be another preview made but I already mentioned the timing about when I expect real changes to occur.

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020