Another belter or?

First a warning: StatsCan reports can be volatile. We’ve seen enough huge revisions to prior reports to always make sure to keep the bag of salt close to hand when they produce data.

This being said, we’ve had increasingly good Canadian labour report of late.

The unemployment rate has steadily come off, job creations have been positive, the participation rate has been stable and last but not least the balance between full and part time jobs is positive for the past 3 months.

BoC has also been happy with the latest data, testifying their ending of the pandemic QE last mth and by doing so placing themselves in the leading CB pack for possible rate hikes although they kept their extraordinary forward guidance. They wouldn’t be a 2020/21 CB if they would have dropped it, right?

For today’s report then: We’re looking at another 50K job creations with the unemployment rate coming off to 6.8%. Pay attention as usual to the balance between the full and part timers as that’s a booster/brake

to the viability of any moves on the headline numbers.

Trading them?

We know Canadian job reports can be volatile, especially when they drop at the same time as the US labour data.

So for the USDCAD I’m going to be brief tis time as we either may have a double whammy or opposite reports.

Levels in the USDCAD have been set out pretty nicely of late with a bottom side around 1.2290-1.2300 and a short term topside struggle around 1.25. Add 1.2520 and the 1.2570/1.2610 zone with multiple fibs, tops and bottoms and we know where the boundaries for holds/breakouts are. I’ll trade those levels if seen depending on the balance of the US-Canada reports

Today I want to have a closer look at EURCAD. That one has been a near perfect CB divergence play, helped by energy prices, which as such are in their own right a pretty decent overlay with Europe and Canada being on the other side of the energy market, expressed in very simple terms I know, no time here to go into details that may not be 100% in line. But you see the global picture.

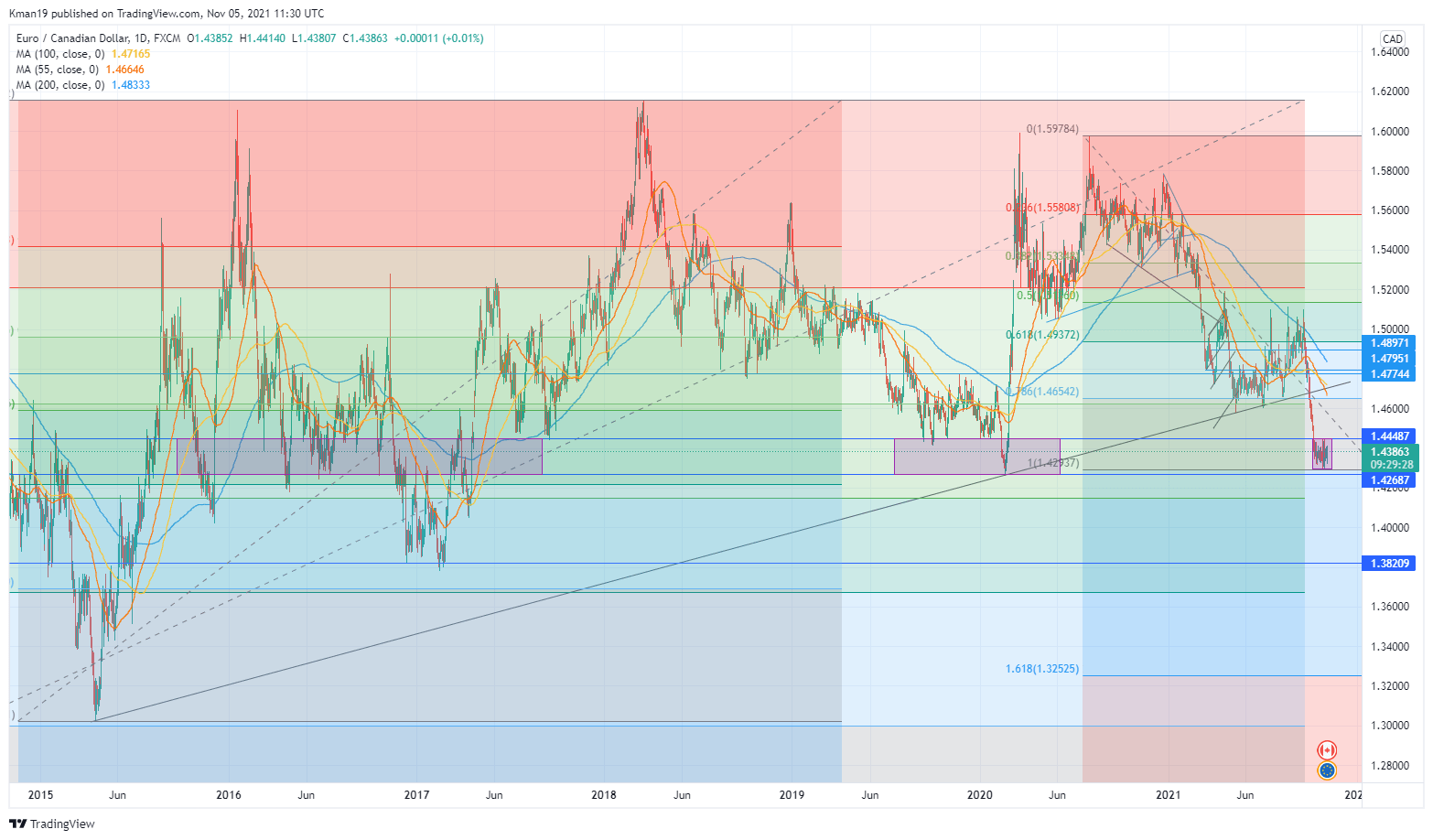

EURCAD has been coming off and is now trading in a 1.43/1.4450 box, which was already a zone in 2020 and has been a traffic area already in 2015/2017, after having broken quite dramatically trough th elonger term TL high 1.46s.

I’ve been mostly biased to the short side of EUR and into today’s report that hasn’t changed as, even with USDCAD bouncing, EURCAD hasn’t shown much of a rebound, USD having done most of the heavy lifting.

So Ill be having a close eye on this box.

If the report is good, I’ll be looking to trade a break to the downside of this box, which may see an acceleration through 1.4270 Feb low, down to 1.4150, possibly seeing a future test of the 1.38-1.40 range.

Neutral I’ll be inclined to play the range with a bias to open the shortside as well (CB divergence) but after first monitoring any differences between the US and CAD report as USDCAD may go a bit wild.

Getting a bad report will see me initially sit on the dock of the bay (still biased short EUR remember) and closely monitor the break above 1.4450 if seen and then 1.4570/80 above there, prior lows for any viability of the move. USDCAD or CADJPY may be a better play in this case.

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020