A trading preview ahead of the Bank of Canada’s monetary policy meeting Wednesday 17th January 2018

This one is going to be a whopper. The CAD is still the most volatile major currency on the block at the moment. We struggled to see a 50 pip move in the dollar over a Fed hike yet the CAD can move 200 pips on economic data. That alone shows you where the volatility lies right now. The Fed trade is dead, long live the BOC trade.

Pretty much the world and his mate are expecting the BOC to hike rates tomorrow to 1.25% from 1.00%, with the most recent jobs report being the kicker. Surely, it’s a done deal isn’t it?

There a few arguments to look at to judge whether the market is right in expecting a hike, so here are some pros and cons.

Pros

- The BOC is heavily data dependent and the latest numbers are either mostly better, or pretty unchanged;

- CPI is at 2.1% from 1.2% & 1.6% in hike months Jul & Sep

- Core CPI stands at 1.8% vs 1.5% & 1.2% over the prior hike months. BOC core is 1.8% vs 1.3% & 1.4% over prior hikes

- PPI prices higher at 1.4% vs -1.4 & -0.4% Jul/Sep

- Unemployment rate is down to 5.7% from 6.3% in Jul 2017

- Average weekly earnings stand at 3.1% vs 1.4% & 2.9% Jul/Sep

- GDP y/y 3.4% vs 3.8% & 3.4% Jul/Sep

- The trade deficit is a touch lower but overall activity is still strong

- Consumer confidence 60.5 vs 59.5 & 58.3 Jul/Sep

Cons

- Survey data like the PMI’s have been softer but still show decent expansion

- Markit Manufacturing PMI in Q3 55.5/54.6/55.0 vs Q4 54.3/54.4/54.7

- Ivey PMI was better but had a bad finish to Q4. Q3 52.9/56.8/68.6 vs Q4 63.5/62.4/49.3 (NSA)

- Q4 Business outlook survey (future sales) 8.0 vs 19.0 in Q3

- Retail sales 6.7% vs 7.7% & 6.5% Jul/Sep y/y (though posted the biggest monthly rise since Jan 2017 in Oct at 1.5%)

- Poloz has persistently told us that it will take some time to see the effects of recent hikes. In one speech he said six to eight quarters (Nov), in Dec he said he hadn’t learnt much and that it takes a year to have a noticeable effect on the economy

- He also said the situation is muddied due to changes to mortgage rules

- He didn’t expect a 50bp rise to have a large effect on the economy

- Poloz said the BOC pays more attention to quarterly data than monthly, and they want the economy to run hotter for a while to use up excess capacity

This isn’t an exercise in having more pros than cons, or vice versa but taking a simple look at the above, it paints a slightly more balanced view than perhaps the market is seeing. For me, key points are that the economy is doing much better but the BOC hasn’t seen the effects of the prior two hikes show through yet. As most central banks usually side with caution rather than throwing caution to the wind, I’m leaning towards them wanting to hold off hiking again unless the data continues to trend higher as strongly as it has. There is no rush to hike as inflation isn’t running away and the jobs reports fall right into the “monthly” category for BOC data watching. The BOC has got time to wait and Poloz confirmed that also by saying that (in response to BOC vs Fed policy) they have independent monetary policy and are a year or two behind the US in the cycle, and that they’re happy to let the economy run hot for a while.

On the basis of all that, my heart says that they won’t hike tomorrow.

What’s the trade then?

Fortunately, I trade with my head and not my heart, or otherwise I’d be a very poor boy. Just because I feel the BOC may not hike tomorrow it doesn’t mean I won’t look at both sides of the trade. Firstly, the risks.

If the market is all leaning one way, the bigger price move risk is if they’re wrong. In this case, that’s a no hike, and USDCAD will fly. We could be talking 200-300 pips, or more. On that basis, my trade into the meeting will be to place a stop buy entry maybe 50-100 pips above the market seconds before the announcement. If there’s no hike (and spreads and slippage are favourable) that should put me on the upside train at a good level.

In the case of a hike, I’m not inclined to pre-trade the announcement, as I’ll want to see the details that accompany it. Something like a hike with a strong message that they’re going to go on hold for a prolonged period might see any hike gains in the CAD reverse. The trade for me on a hike will be to look for any opportunities after. In the wider picture, and given where prices are now, I’d really only be interested in a long down around the 2017 lows and into 1.20.

And that brings me to the last point. Poloz is not a fan of forward guidance. In an article back in Dec he bemoaned the market jumping on words and phrases as if they were secret codes. He then later said that the use of the word “cautious” in BOC communication is not a code word to insinuate that they won’t move on rates again. He also thinks that central banks will dial down on forward guidance. That potentially adds some increased risk into this meeting because the market could well be thrown if there’s a lack of, or diminished, hand-holding messages in the statement or presser after. Trading wise, it could inject some extra volatility as the market (and algo’s) try to make sense of any less communication. Personally, I think we’ll get the usual explanations that go along side these sorts of decisions but we’ll have to wait and see. I do agree with him though and I’d prefer to go back to the old days when central banks said nothing and moved rates as and when they saw fit without uttering a word to markets but then I’d also like my hair back too, and that’s not happening anytime soon 😉

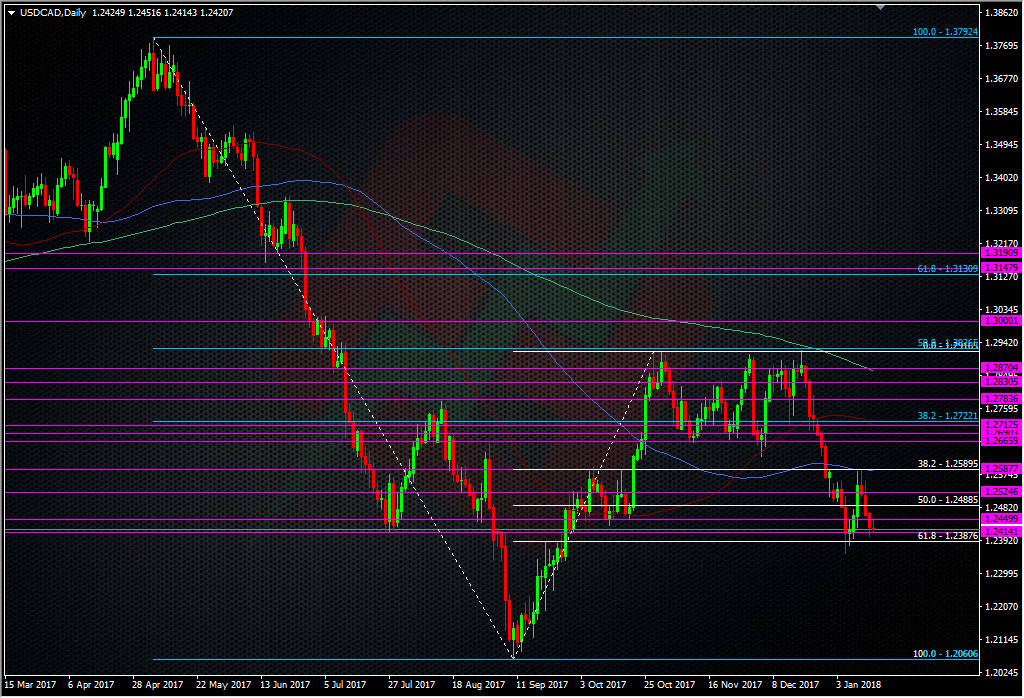

Looking at the trading levels, the mid-low 1.20’s stand out clearly, and we have some very well-defined levels up at 1.2590/1.2600, 1.2660-1.2700 & into 1.2900.

My final warning is on the volatility. It’s folly to try and pick tops and bottoms at the best of times over data and economic events but in this pair, it’s madness. I’ve had some great trades in this pair over the last few months but I’ve also had to wear some bigger than expected moves. whatever the decision, we won’t get one quick knee-jerk and then it’s all over. If it’s big news, we could see the price move persistently for 3 or 4 sessions before settling down. Don’t be hasty to jump in trying to fade a move. Give yourself a wide berth on entry or exit levels, and stick to the wider tech levels tightly. This is one pair that’s not taking any prisoners right now and you can find yourself offside very quickly with little hope of the price coming back in your favour.

If you’re trading it, I wish you good luck.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Great preview Ryan. I have a long CADJPY but my plan is to cover before crazy horse Poloz starts the rodeo. Going with the flow may indeed be the right trade as soon as he’s done.

Thanks 5m.

You’re right, this is not one to to leave to positions open over. You may miss out on a move that would have brought a big profit but you also might miss one that would bring a big loss.

Yes, one of the thing I hate the most if you’re trading events such this is that even if you place a not so tight stop that may anyway be triggered by whiplash action during the announcement. So that you end up having the right position but stopped out by a nasty spike/spread widening/Poloz cursing your trade

Similarly, I’m usually not a fan of placing entry stops either side of a market over events but in this case, given the volatility we’ve seen in the CAD, I thinks it’s a pair that it works on.