In the excellent weekly Morgan Stanley FX Pulse report, they’re looking to buy a dip in EURUSD

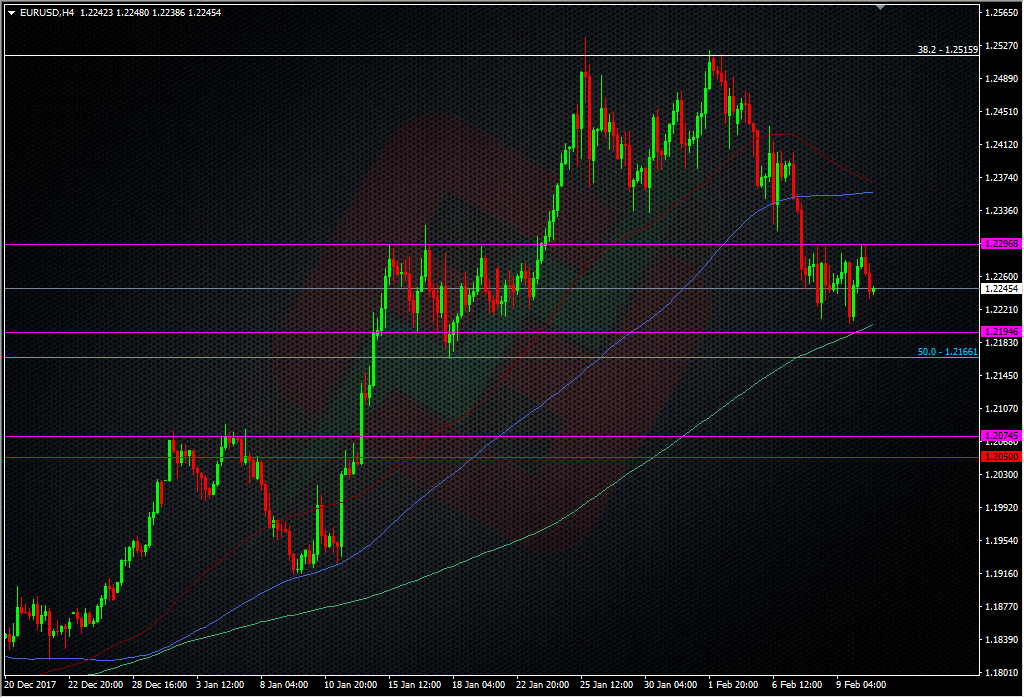

Morgan Stanley like the look of EURUSD longs and they’re waiting for a dip to buy into. They have an order in to buy at 1.2165 with a stop at 1.2050 and a target of 1.2800.

We look to enter a long EURUSD position after a further pullback to 1.2165. The announcement of a CDU-SPD coalition agreement in Germany should support the prospect of European integration

further and reduce risk premia, while bolstering continued FXunhedged inflows. Economic data in Europe continue to surprise to the upside, most recently seen in the services and composite

PMIs, which keeps expectations for euro area growth high. Meanwhile, we continue to project USD weakness over the longer-term, with strong global growth aiding USD weakness as USD funding for foreign investment continues to rise. The risk to the trade is that risk sentiment wanes, leading to USD strength.

I’m looking at their entry point and I can only see that it’s the old 50.0 fib of the 2014 drop and a support point from 18th Jan.

The stop looks solid enough, sitting just under some decent looking support in ath e1.2070/80 area.

In another part of the report, they also see further volatility coming in to markets, and explain what that means for investment choices and subsequent FX moves;

Markets are heading towards a late cycle environment which should include elevated volatility – with reduced global liquidity conditions working as a key catalyst. Importantly, equities and other risk assets rarely top out when volatility trades near extreme lows. Instead, these occur when volatility has already rebounded. As a result, deteriorating liquidity conditions should put a new and higher volatility regime in place. This higher vol will not prevent risk markets from putting a new top into place, providing economic conditions remain strong. Higher vol, though, creates an environment where, once macro conditions turn, weakness in risk assets can accelerate. We are not there yet.

Investors should become more discriminating. The past risk rally beginning in March 2009 has been liquidity driven, with valuations rising, while the projected risk advance will receive most of its support from economic fundamentals (i.e., rising earnings). If the market is primarily driven by earnings, this suggests more differentiation between winners and losers. Liquidity lifting all boats is a topic of the past.

The same logic can be applied to FX markets. Currencies with strong economic fundamentals should appreciate, while those currencies dependent on capital imports for funding extended balance sheets may weaken. The higher volatility regime corresponds well with our “Canaries in the Coal Mine” concept, projecting long-term currency weakness for currencies representing countries with high leverage, current account deficits, and weak asset quality. These currencies are where the bearish FX impact will be felt first: AUD, CAD, GBP, and NZD fall into this category.

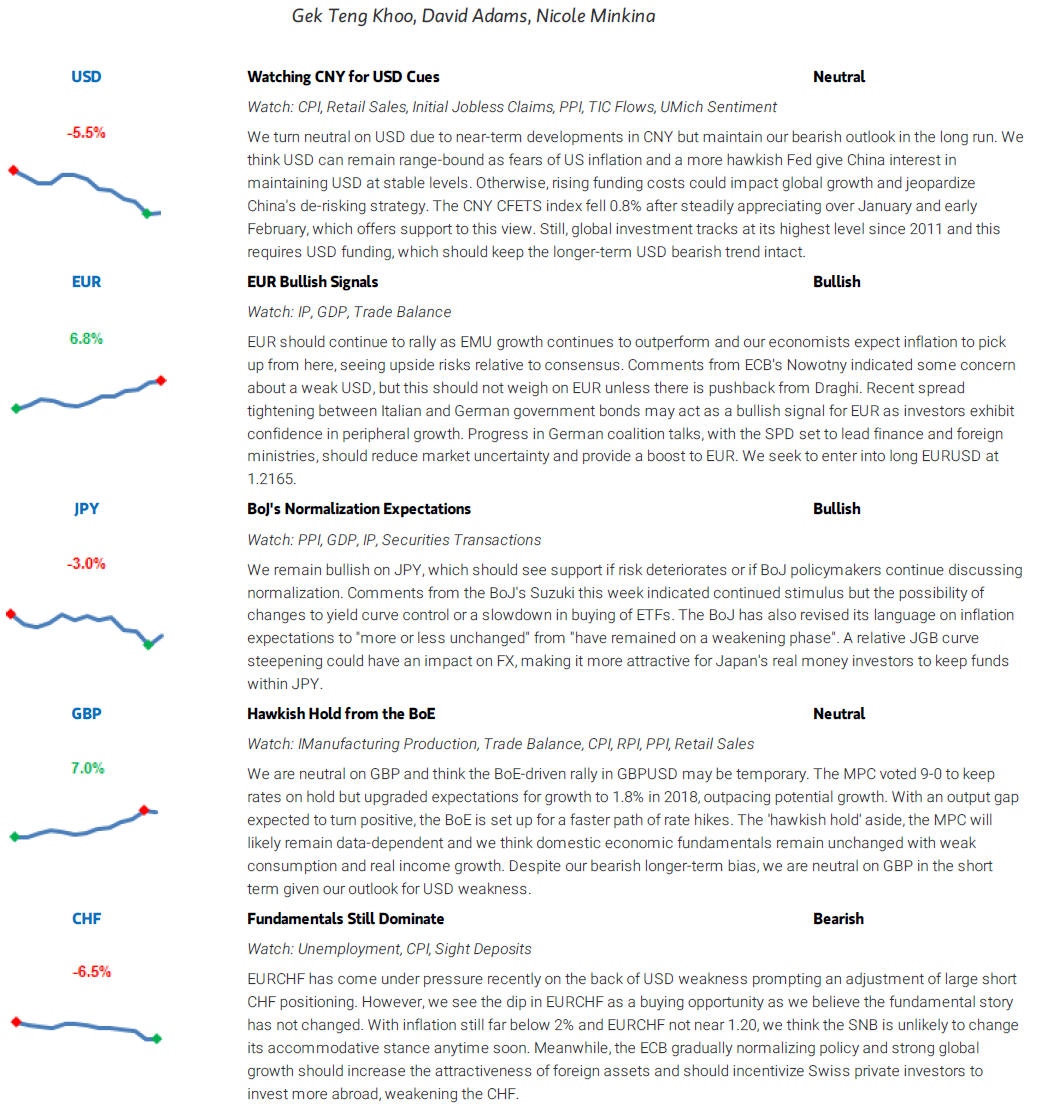

Here’s their views for some of the majors;

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Have they been reading Forexflow again to go long EURUSD in the same area where I want to add?

Ha, copy cats.

What do you see around that entry level?

38.2 fib Oct to Jan rally…21615….I have a pending in there

Exactly like Si just mentioned 1.2163 I have it as the fibo of that rally and it’s the 18th Jan low

Quite a fan club building there it seems 😀