Large Japanese life insurers and financials are increasing unhedged US bond buys and that’s supportive of USDJPY

Some news overnight that two massive Japanese insurers Nippon Life and Meiji Yasuda Life will continue to buy USDJPY and foreign bonds will help support the downside in USDJPY. The CIO of Nippon said that they are ready to buy USDJPY under 105.00 and that the firm will also be looking to sell stocks on further rallies. They will also continue to buy US Treasuries unhedged.

Japan’s life insurers and pension funds are big big players and they can drive markets across the globe. Even though we’ve seen a big sell off in bonds, there’s still got to be someone buying them and the rising US yields are looking very ripe vs zero yielding JGB’s. In the last numbers from the MOF (for Jan), Japanese insurers increased overseas debt holdings to the highest since August 2016. However, other investors have been selling at the end of Jan, and into last week, to the tune of $22bn. If the life insurance mob are getting in, it’s pretty safe to assume that the other institutions are too.

What this means for bonds and FX is that while there’s currently a big move to shift out of bonds and into other assets, there’s some very big players hoovering up what others are selling. They key point for us trading is that we now know there’s some big fish swimming around the 105-104 area in USDJPY, and that information is gold. We can pretty much use this news as an indicator on the charts now but bear in mind that these folks tend to scale in and layer their orders. The low last week could well be one spot they’re sitting at.

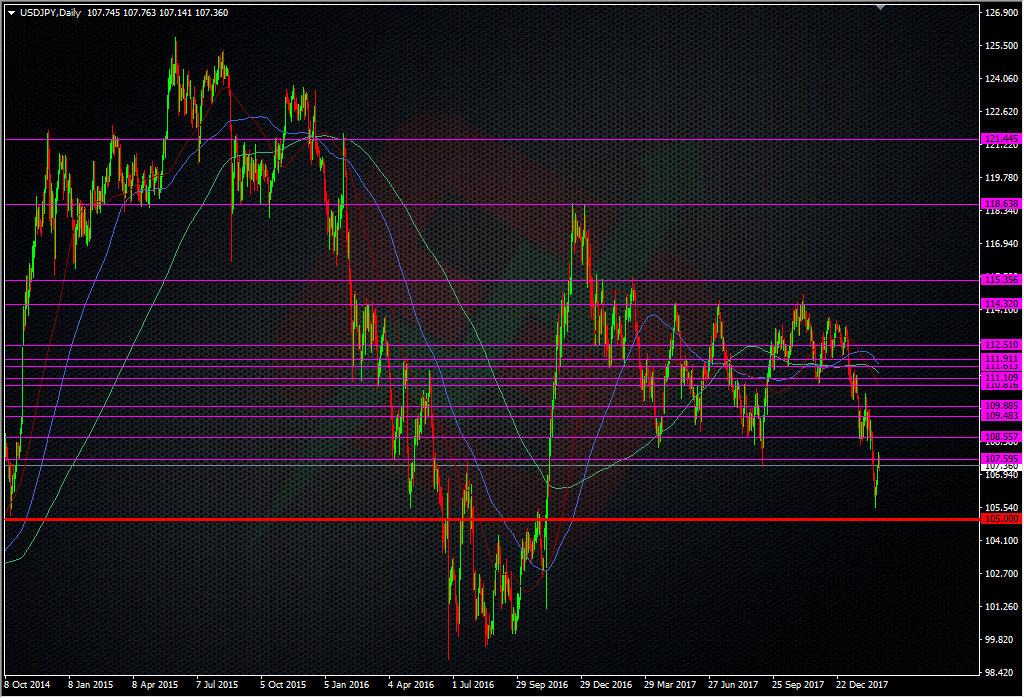

USDJPY daily chart

While I’m still bearish on USDJPY, knowing there’s potentially some big support around 105.00, makes it a level I’ll either look to exit shorts into, or start taking longs from. From a long perspective, scaling in buys from 105.50 down to 105.00, with a stop underneath offers a fairly tight trade. If I wanted to push the boat out then buying in smaller size all the way down to 104.00 is another option but I’d be concerned as the 105 level seems the bigger of the two, so a break could be bad news. Don’t forget also adding to the support picture is the binary barrier options at 105 & 104 too (which we’re increased during last weeks drop). The way it’s looking, the 104 level could be a big defining level if it breaks. In the near-term, the 108.00/50 area is still the level that’s important for how USDJPY plays out now. Keep bellow and the bearish pressure remains. Get above and there will be further relief for bulls and they’ll probably have a crack at taking it up to 110.00

As ever, nothing is guaranteed in trading, and some of these guys we’re buying bonds and USDJPY as it broke 110 and 108, and they didn’t manage to halt it then, so we’ll judge any moves on their merits at the time.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

This kind of analysis is worth it`s weight in Gold. Great stuff Ryan

Thanks Si. It’s certainly tradable info .

so wait for your realtime trade entry points.

It’s something to keep note of if we move down there Cheung but don’t worry, if we trade it, you’ll hear about it.

Sweet for BOJ to know they have their support. Abe’s adviser Hamada came out last night calling for BOJ to buy foreign bonds too .

“Japan PM Adviser Hamada: Reiterates BoJ should consider buying foreign bonds – US financial press – Suggested that the BoJ consider buying foreign bonds as part of its reflation efforts.

– Hamada said the BoJ is allowed to buy foreign bonds for the purpose of ‘delivering proper monetary policy’

– There is a limit to how much monetary easing can keep the yen (JPY) rises in check, said Hamada. ”

One and all should mean that IF USDJPY would come into the area, we can expect BOJ and MOF to get a lot more vocal , maybe once their good friends have filled their boots. Certainly worth to build some longs in the zone on the first few visits

Good stuff K.

Good job Ryan…i like it

Thanks Raka. We’ll see how it plays out. We might not even get there 😉

I hope you give to us where place for sell or buy on real time trading, like at forexlive. Thanks and GBU

As per the post. I’m interested in longs from close to 105.50, down to 105.00 but I will judge any move down there to see what’s the driving force before trading.

Thanks so much Ryan…

Excellent info mate. Seems we have a great old battle going on in this pair at the moment.