A brief look at the possible market risks with the upcoming Italian elections

This is the final trading week before the Italian general election on Sunday 4th March. The result is widely anticipated to be a hung parliament, followed by the usual shenanigans of parties trying to form coalitions. given the usual theme in Italian politics, this is likely to be very lively.

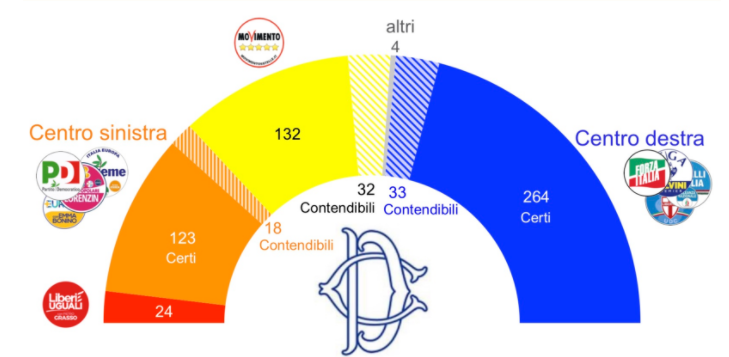

One of the last polls showed how Italians may cast their votes;

Latest Italian election poll: Blue = Forza party (Belusconi). Orange = PD (Renzi). Yellow = 5 Star party (Di Maio)

It’s believed that the Berlusconi and his pre-election coalition has the best chance of taking power, as he saw his popularity rise in the last rounds of polling but otherwise, a hung parliament is still the most likely outcome.

What’s the market risk?

We’ve not really seen anything resembling market pricing risk for this event but that could change the closer we get to the weekend. The three main contenders have mostly kept away from rhetoric about leaving Europe, which has helped dial down fears that that would become a big issue, depending on who won. The market is also well aware that Italian politics is mad as a box of frogs most of the time anyway, so it will take something really shocking to spook the market.

If we apply the lessons learnt over other European elections, especially the French election, we can gauge the sentiment for pricing risk. In the French elections we saw some decent hedging in EURJPY due to the Japanese holding some 13% of French bonds. The numbers are vastly lower for Italy by comparison. In France, around 60% of government debt was held by foreigners, while in Italy, that’s around 35%. The lions share is held domestically in Italy at around 64%. In France it was around 42%. On that basis we’re unlikely to see much hedging coming in but I’ll be keeping an eye on various euro 1-month & 1-week volatility indicators.

Unless we get any last minute inflammatory headlines from Italy this week, the most we should be on watch for is squaring of positions into the weekend. As per Friday’s CFTC data, EUR longs we’re still riding high, so there’s scope to see some positions cut this week ahead of the weekend risk.

Moving forward and Sunday’s opening. If we do get a shock then we could be set for some turbulence. Confirmation of a hung parliament might get the algo boxes pushing the price around but we’ll probably settle down fairly quickly and get back to trading everything else that’s going on in the world.

We’ll keep you updated throughout the week on any important news and we’ve also got some boots on the ground to supply us with any relevant information regarding the elections.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

but things happening at Germany, will it be market risk too?

Of course QF but it’s a low risk at the moment. Merkel’s party voted overwhelmingly for the coalition yesterday.