The market is waiting for a language change from the ECB, so is it coming today?

Promise, promises. We’ve been told that the ECB will give us an idea about their next moves “in the early part of this year”. January came and went with nothing, and pretty much all we’ve had since is stories telling us that there’s not much likely to happen at this March meeting. But what’s in a date eh? The early part of a year for me is Q1 and maybe (at a stretch) into early May, and then we start heading into the middle of the year. So if we’re not getting anything this month, that only leaves the April meeting still in “the early part of the year”, and that’s near the end of April on the 26th. As I’m sitting here writing this I can’t believe we’re all trying to analyse the definitions of time to try and work out a trade. So I’m not going to. My bottom line is that we either get something today, or the can gets kicked until April, so sit back listen to the waffle today, and get on with something else.

In all seriousness, I don’t see much price risk for today myself but the market may see things differently. As Kman posted on the Live Blog, if Draghi isn’t forthcoming with any new information, the euro might not take kindly to that. On the flipside, we could get the merest hint of a possible something but with “details to follow at the next meeting”. I’ll give evens on him dropping in the old “staff are working on the technical aspects (of whatever plan)”. We’ve already been tipped off that the economic projections aren’t going to change much.

The only big news that could rock markets is if he talks about inflation not rising as much as expected and how that might put pressure on the expected QE end date. That will sink the euro. If he hints that there’s changes in the pipleine for April, and QE is still on course to end in Sep. That will gives the bulls some ammo to take it up.

Anything in between all that and it’s going to be snoresville.

Looking at the charts, there’s really only a few levels I’d be interested to trade.

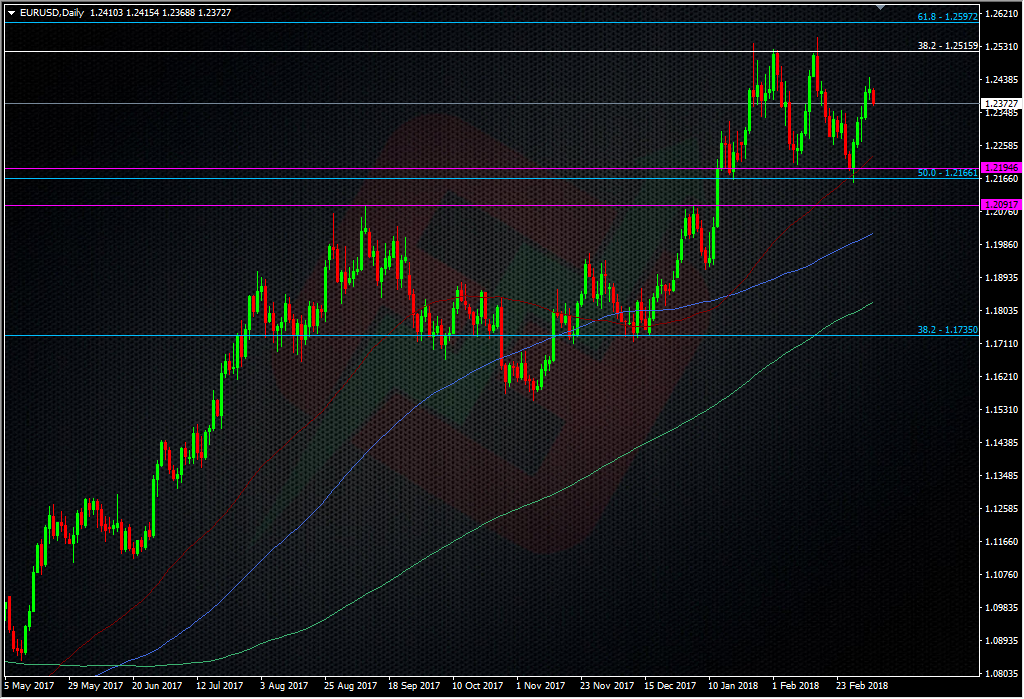

EURUSD daily chart

On top, anywhere into the 1.2500 area I’d be looking for short-term shorts as a test of the strong resistance up there. Down below, the 1.2200-1.2195 area, and 1.2160/70 area have proven their worth previously. I’d like to add to my core long-term longs into 1.21, where we had that strong looking resistance last year.

Anything other trades will be trades on the fly, depending on the moves and news. I hope we get something to get our teeth into but I’m very much leaning towards a piecemeal meeting and can kick.

Good luck to you if you’re trading it. Keep safe.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

IMO I do not see the reason for huge EUR rise even if they change the message (except probable short-time reaction), since everybody and their dog know, that they will be forced to end QE (because of growing political pressure, if nothing more) in not too long time, almost sure before end of Draghi mandate. Talking about interest hike possibility is another thing, but I do not expect anything like that anytime soon.

I agree but the market is always looking for something to trade, even if it’s confirmation of what it already knows. The market is like a small child near Christmas, you have to keep telling it regularly that Santa’s coming 😉