Greg Gibbs does a great EUR deep dive in his latest report from #ampgfxcapital

As you know EUR CPI and PMI’s had not been matching up to the EONIA curve pricing in June 2019 for the first hike. This is now rapidly fading – along with spot. It’s my firm belief (along with a few others) that Draghi will not fire the rate path gun until the end of his tenure Dec 2019. The curve is slowly supporting this.

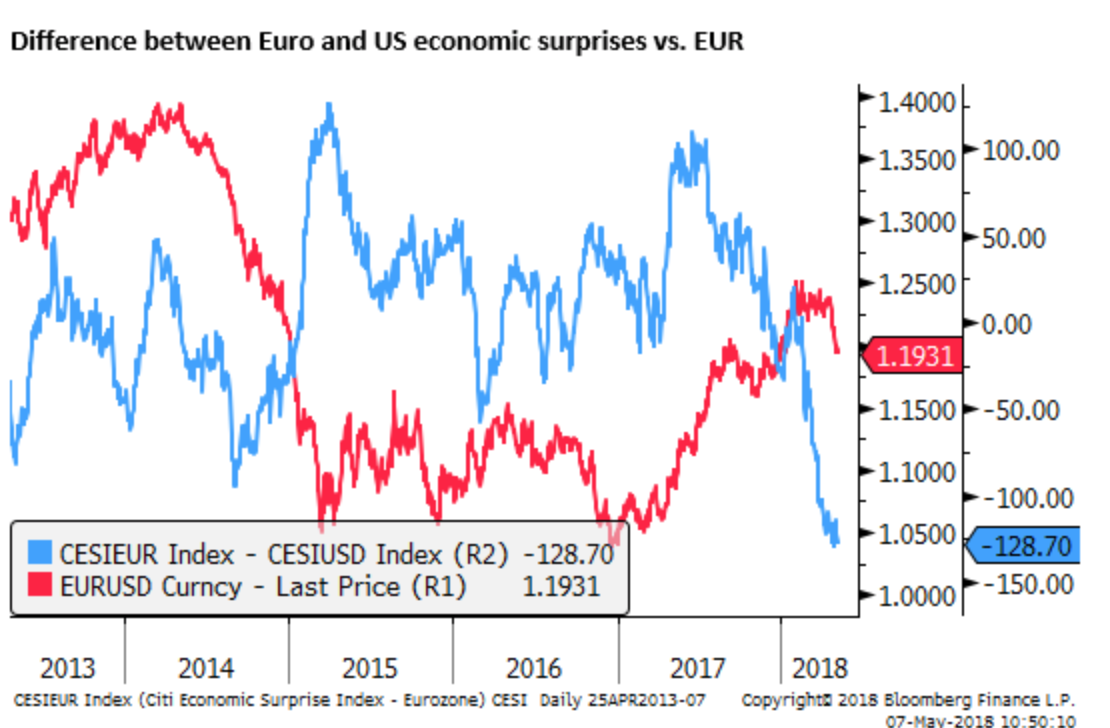

Citi’s surprise index spread is a beaut. Say’s it all really. One thing Greg mentioned is when forecasts get revised lower -128 should recover. That in itself doesn’t mean EURUSD will recover. It just means it lowers our expectations – and lessens the “surprise”

I’ve been a big fan of Greg for a while and i fully recommend his reports.

- How to trade: A LEVEL - August 4, 2018

- USD mixed – a bit like me - June 5, 2018

- What is the market focused on ? Over to you trader. - May 29, 2018